Category: Revenue Based Financing | By: Gerry Stewart of Online Business Line of Credit | Updated for 2026

I. Revenue Based Business Loan Ultimate Guide 2026: Scale Without Equity Dilution

In the hyper-competitive market of 2026, cash is not just fuel—it is a tactical weapon. Traditional financing remains stuck in the 1990s, forcing founders into a binary trap: beg banks for loans they will probably deny, or sell meaningful equity to investors for capital that comes with control strings attached.

A revenue based business loan offers a third way. Instead of fixed payments that ignore your cash flowThe net amount of cash moving in and out of a business. or giving up ownership, you secure growth capital today and repay it as a small, agreed-upon percentage of future gross revenue. Your sales history becomes your collateralAn asset pledged by a borrower to secure a loan, subject to, and your repayment schedule automatically flexes with your business performance.

In 30 seconds, discover if your business qualifies and calculate your estimated funding amount ↓

Revenue Based Business Loan Calculator: Self-Assess First

Why self-assess? Banks reject 80% of SMB applications. This calculator uses your real revenue data to estimate your qualification and funding range before you apply—helping you avoid wasting time on products that won’t approve you.

| Input | Your Data |

|---|---|

| Average Monthly Revenue ($) | |

| Months in Business | |

| Desired Funding Amount ($) |

What Is A Revenue Based Business Loan

A revenue based business loan provides a lump sum of growth capital in exchange for a fixed percentage of your future gross revenue—typically between 5% and 20%—until a predefined repayment cap is reached. Unlike a traditional term loan, there is no fixed monthly payment; your payment rises and falls automatically with your sales.

Instead of charging interest, lenders use a factor rateA decimal figure used to calculate the total repayment amoun or cap multiple. If you borrow $100,000 with a 1.2x factor rateA decimal figure used to calculate the total repayment amoun, you owe $120,000 in total repayment. Payments continue until that amount is collected, with high-revenue months accelerating payoff and slow months extending the timeline without triggering defaultFailure to repay a debt according to the terms of the loan a.

– How Revenue Based Financing Differs From Traditional Debt

Traditional small business term loans are underwritten primarily on credit scores, collateralAn asset pledged by a borrower to secure a loan, subject to, and tax returns, and they repay through fixed monthly installments. If your revenue dips, your payment does not, which can create severe cash flowThe net amount of cash moving in and out of a business. strain. Approval is often slow, and rejection rates for young or asset-light businesses can approach 80%.

A revenue based business loan instead focuses on your sales performance. Lenders plug into systems like Stripe, Shopify, or your accounting software, evaluate your gross receipts and cash flowThe net amount of cash moving in and out of a business. trends, and qualify you based on revenue consistency rather than real estate or equipment. The result is faster decisions, less emphasis on personal guarantees, and zero equity dilutionThe reduction in ownership percentage of existing shareholde.

– The Mechanics Of Sales Linked Repayments

In practice, your lender debits a set percentage of your sales on a daily, weekly, or monthly basis. If your agreement sets a 10% share and you generate $200,000 in a month, your payment is $20,000. If the next month you only generate $100,000, the payment falls to $10,000.

This sales-linked structure is especially attractive if your revenue is seasonal or cyclical. A $0 revenue month typically leads to a $0 payment—there is no fixed installment waiting to crush your cash flowThe net amount of cash moving in and out of a business. when you can least afford it.

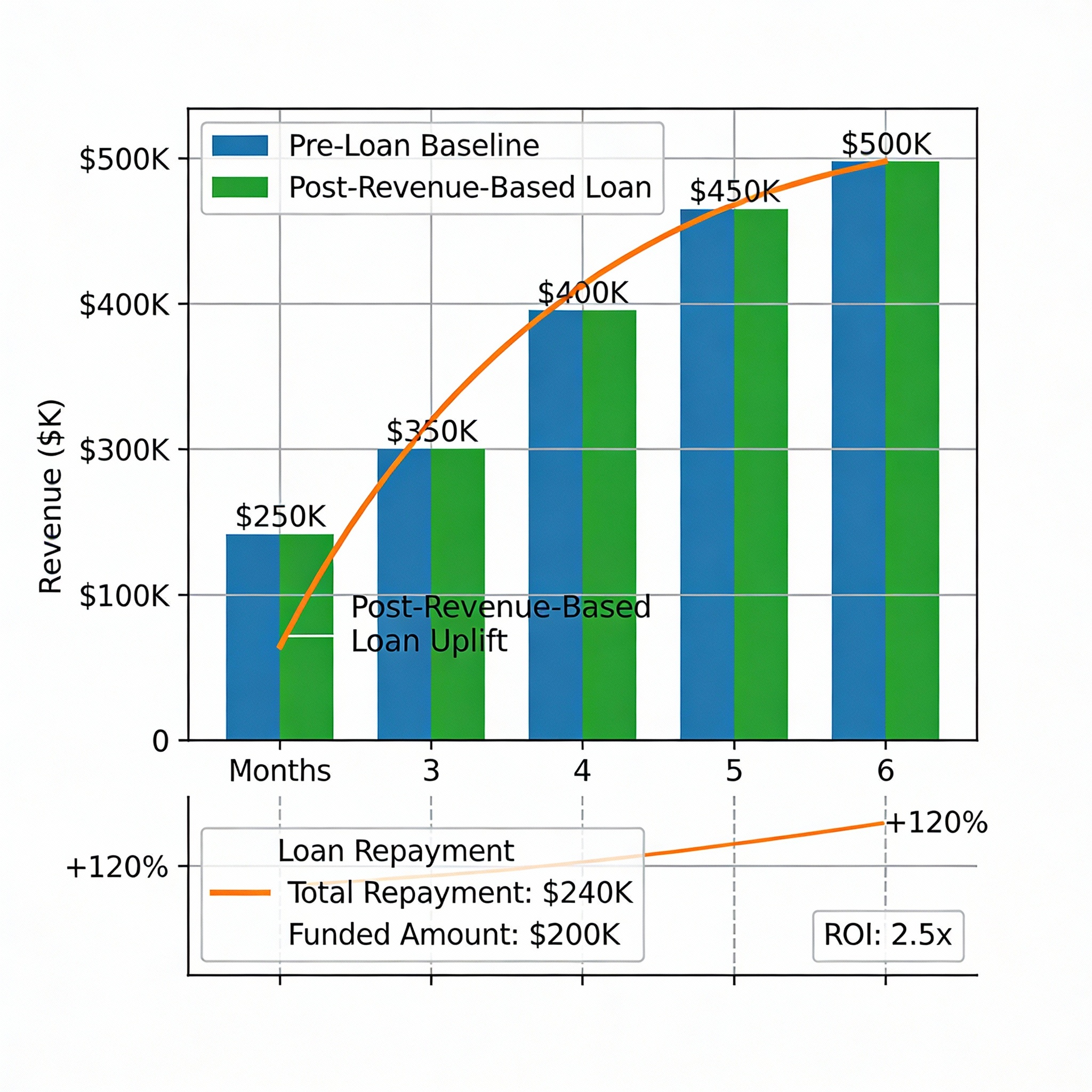

CASE STUDY 1: E-Commerce Brand Scaling Holiday Inventory

Profile: A direct-to-consumer apparel brand in Atlanta averaging $250,000 in monthly revenue with strong Q4 seasonality and chronic stockouts during peak months.

Problem: The founder needed $200,000 to front-load holiday inventory. Banks demanded real estate collateralAn asset pledged by a borrower to secure a loan, subject to and projected a 60–90 day approval timeline. Equity investors wanted 10% of the company for a similar check—equity the founder believed could be worth millions later.

Solution: The company secured a $200,000 revenue based business loan at a 1.2x factor rateA decimal figure used to calculate the total repayment amoun with a 10% share of monthly gross receipts. UnderwritingThe process of assessing risk and creditworthiness before ap was based on Shopify and payment processor data, with funds deposited within 72 hours.

Results: The brand doubled its peak-season revenue to $500,000 per month for four consecutive months, cleared the $240,000 repayment cap in under five months, and retained 100% ownership. The founder noted: “I paid a premium on the capital, but I didn’t sell a single share—I’d make that trade every time.”

Why Modern Founders Are Choosing Non Dilutive Capital

Founders increasingly view equity as their most expensive currency. Industry surveys suggest that well over half of founders regret how much equity they parted with in early rounds once their business scales, especially when that capital was used for short-term working capital needs rather than long-term strategic bets.

At the same time, the revenue-based financingFinancing where investors receive a percentage of future gro market has grown from a niche experiment into a multibillion-dollar global segment as platforms and lenders compete to fund recurring-revenue and high-growth businesses quickly and flexibly. For companies that are “revenue rich but cash poor,” non-dilutive capital is often the only practical way to keep pace with demand.

– Avoiding The Trap Of Early Stage Equity Loss

Giving up 10% of your company for $200,000 might feel acceptable when you are fighting for survival. If that same company later reaches a $20 million valuation, that stake is suddenly worth $2 million. That is effectively a 10x “interest cost” on what was really growth working capital.

A revenue based business loan reframes that trade. Instead of permanent equity, you commit to a capped, contractual repayment that ends once the factor rateA decimal figure used to calculate the total repayment amoun is satisfied. You preserve full upside, control, and decision-making authority while still funding inventory, hires, and marketing.

– The Flexibility Of Variable Monthly Payments

Many SMB owners describe their cash flowThe net amount of cash moving in and out of a business. as a roller coaster. Fixed loan payments from banks or equipment lenders do not care if this was your slowest month of the year. The payment hits anyway, often forcing painful tradeoffs between payroll, inventory, and tax obligations.

Because a revenue based business loan is linked to sales, your effective “debt service” rises in strong months and shrinks in lean periods. This flexibility is particularly valuable for seasonal businesses, agencies that rely on project-based work, and subscription companies still refining churn and retention.

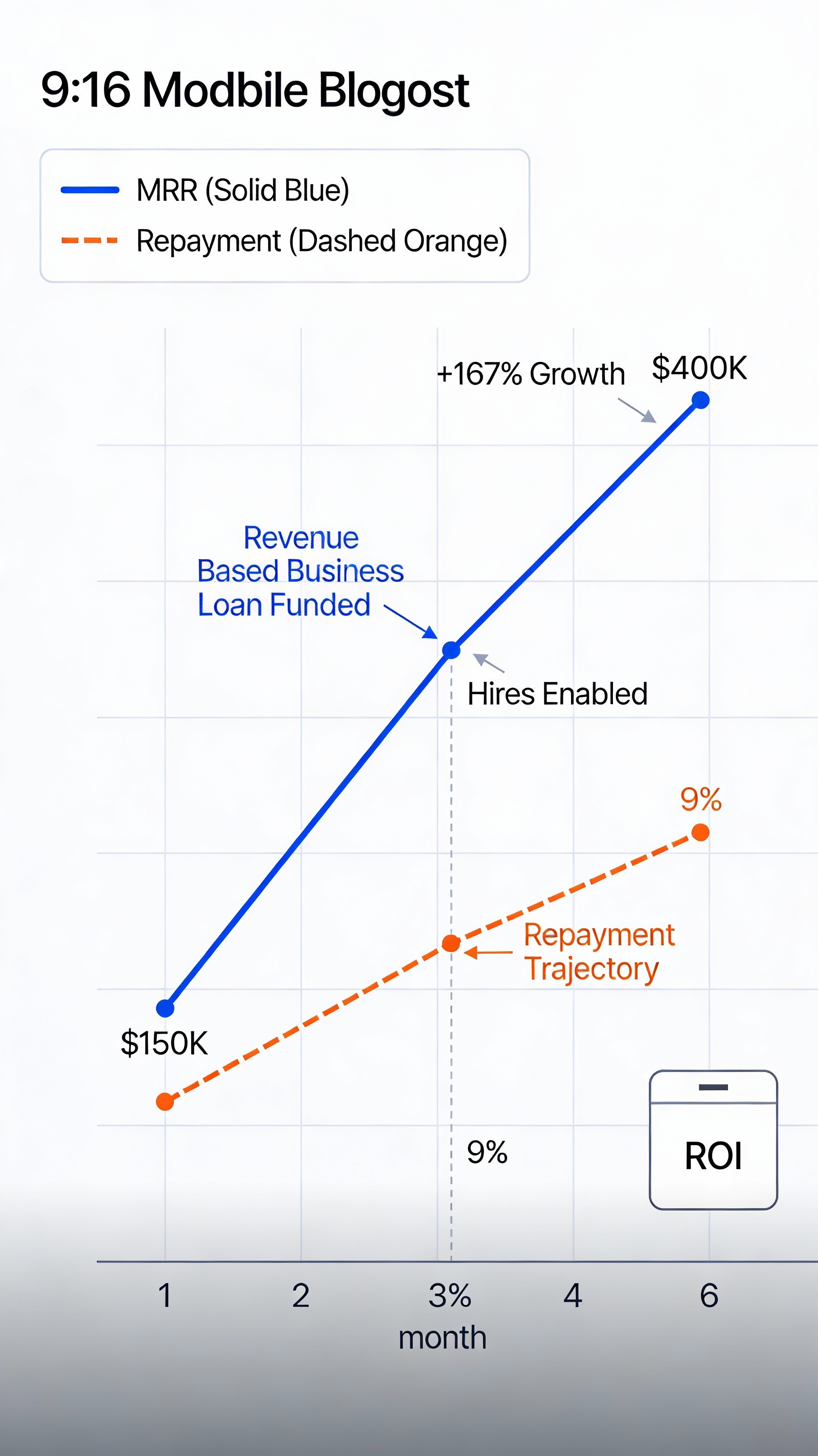

CASE STUDY 2: SaaS Startup Funding Sales Hires

Profile: A B2B SaaS company at $150,000 in monthly recurring revenue with low churn and strong net dollar retention, but constrained by a thin sales team.

Problem: The founder wanted to add five account executives to accelerate growth, but each hire required 4–6 months of ramp time before becoming cash-flow positive. Banks were focused on collateralAn asset pledged by a borrower to secure a loan, subject to and tax returns and offered only small credit lines with personal guarantees.

Solution: The company closed a $300,000 revenue based business loan at a 1.15x cap, tied to a 7% share of monthly revenue. UnderwritingThe process of assessing risk and creditworthiness before ap leaned on recurring revenue metrics and cohort retention instead of hard assets.

Results: Within eight months, MRR climbed from $150,000 to $400,000, the cap was substantially paid down, and the business retained full ownership and board control. The CEO explained: “It felt less like taking on debt and more like renting capital at a fixed, known cost while we captured the upside.”

The Cost Of Capital And Factor Rates Explained

Revenue based business loan pricing is built around a factor rateA decimal figure used to calculate the total repayment amoun or “cap multiple.” Typical caps range from about 1.1x to 1.6x of the capital advanced, depending on risk profile, revenue volatility, and lender. That means a $100,000 advance might require total repayment of $110,000 to $160,000 over time.

The effective annual cost depends heavily on how quickly you repay. If your business pays off a 1.2x cap in six months, the implied annualized cost is much higher than if you take two or three years. For fast-growing businesses that can deploy the capital into high-ROI opportunities, this tradeoff is often still attractive compared to alternative financing options.

– Understanding The 1.1x To 1.3x Factor Range

Lower caps (1.1x–1.3x) are generally reserved for businesses with relatively predictable recurring revenue, diversified customer bases, and strong margins. Riskier or more volatile revenue models may see caps pushing toward the higher end of the range or smaller approved amounts.

Compared with bank term loans, the sticker price is higher. However, compared with many merchant cash advances, high-fee lines, or short-term working capital products, revenue based business loans often sit in the middle of the cost spectrum—with far more alignment between timing of repayments and actual cash inflows.

– Calculating The ROI Of Your Funding

To decide whether the cost is worth it, shift the conversation from “What is the APR?” to “What is the ROI of this capital?” If a $50,000 advance with a 1.2x cap costs you $10,000 in total financing but enables $100,000 in profitable revenue you could not otherwise capture, the effective return on that capital is compelling.

This is why revenue based business loans are best thought of as scaling tools rather than emergency lifelines. They work best when you have a clear, data-backed plan for turning every dollar of capital into multiple dollars of predictable gross profitProfit remaining after deducting the direct costs of produci.

Qualification Requirements For Revenue Financing

Instead of asking “Do you have collateralAn asset pledged by a borrower to secure a loan, subject to?” most revenue-based lenders ask “Do you have consistent revenue?” In general, businesses are strongest candidates when they have at least six to twelve months of history and a minimum revenue threshold—often around $10,000 to $20,000 per month, with higher levels required for larger advances.

UnderwritingThe process of assessing risk and creditworthiness before ap leans heavily on live data feeds. You may be asked to connect your payment processor, e-commerce platform, or accounting system so the lender can analyze gross receipts, seasonality, churn, and concentration risk in near real time.

– Minimum Revenue Benchmarks For 2026

While each lender sets its own cutoffs, many revenue based business loan providers in 2026 look for:

- Consistent monthly revenue of at least $10,000–$50,000, depending on product size

- Six or more months of operating history, ideally with an upward trend

- Reasonable gross margins so repayments do not crush cash flowThe net amount of cash moving in and out of a business.

- Diversified customer base to reduce concentration risk

Some will also review your personal credit, but they often treat it as a secondary factor rather than the core decision driver—especially compared to traditional banks that prioritize FICO scores and credit building strategies.

– Why Your Cash Flow Is Your New Credit Score

Where a bank might focus on your personal tax returns, debt-to-income ratios, and collateralAn asset pledged by a borrower to secure a loan, subject to, a revenue-based lender primarily cares about how your business actually performs. Healthy cash flowThe net amount of cash moving in and out of a business., growing gross sales, and diversified customers effectively become your “new credit score.”

This can be transformative for digital-first or asset-light businesses that have historically been excluded from bank lending despite strong sales and loyal customer bases. Companies in e-commerce, SaaS, professional services, and tech-enabled services benefit most from this shift.

CASE STUDY 3: Marketing Agency With Seasonal Cash Flow

Profile: A boutique marketing agency generating around $80,000 per month on average but swinging between $50,000 in slow months and $130,000 in peak periods.

Problem: A fixed bank loan payment was eating into cash reserves during down months. The founder needed capital for additional staff and ad spend but did not want to pledge a home as collateralAn asset pledged by a borrower to secure a loan, subject to or accept an inflexible amortization scheduleA table detailing each periodic payment on a loan, split by.

Solution: The agency secured a $150,000 revenue based business loan with a 1.25x cap, repaid via 12% of monthly gross revenue. Lender underwritingThe process of assessing risk and creditworthiness before ap focused on client retention, invoice history, and seasonality rather than hard assets.

Results: The agency invested in sales and fulfillment capacity, increasing average monthly revenue to roughly $200,000 within a year. Because repayments flexed with revenue, cash flowThe net amount of cash moving in and out of a business. stayed manageable even in shoulder seasons. The founder noted: “For the first time, my payment schedule actually moved with the business instead of against it.”

Step By Step Process To Secure Funding In 48 Hours

Because revenue based business loans are built on live performance data, the path from application to funding is typically far faster than a traditional bank loan. Many providers advertise decisions within 24 hours and funding in as little as two to three business days once documentation is complete.

– Connecting Your Digital Sales Platforms

The first step usually involves a short online application covering your business, revenue range, and capital needs. After that, you will connect your revenue sources—such as Stripe, PayPal, Shopify, or your accounting system—through secure, read-only integrations.

The lender analyzes your transaction history to understand how much revenue you bring in, how stable it is, how seasonal your business might be, and whether a given repayment percentage is sustainable. This replaces weeks of document uploads and back-and-forth emails with a largely automated review.

– Reviewing Your Funding Offer And Terms

Once underwritingThe process of assessing risk and creditworthiness before ap is complete, you receive a term sheetA document outlining the material terms and conditions of a outlining the amount of capital offered, the factor rateA decimal figure used to calculate the total repayment amoun or cap, the percentage of revenue allocated to repayment, and estimated repayment timeline based on current revenue.

Before accepting, model how the repayment percentage would affect your cash flowThe net amount of cash moving in and out of a business. in both strong and weak months. Ensure you understand how zero or low revenue periods are handled and whether there are any fees beyond the cap itself. Compare with working capital alternatives to ensure you are choosing the right structure.

After e-signing the agreement and completing any remaining KYC or bank verification steps, funds are typically deposited to your business bank account within one to two business days.

Is A Revenue Based Business Loan Right For Your Business

A revenue based business loan is usually a strong fit if you are in the “revenue-rich but cash-poor” scenario—strong demand, proven sales, and clear opportunities to scale, but not enough working capital to seize them. It is especially compelling if your primary constraint is inventory, advertising spend, or short-term hiring runwayThe amount of time a company can operate before running out.

It may be less appropriate if your unit economics are not yet positive, your revenue is highly unpredictable, or lower-cost bank financing is readily available and fast enough for your needs.

– Best Use Cases For Inventory And Marketing

Inventory purchases ahead of a predictable sales spike are one of the cleanest use cases. E-commerce brands and retailers frequently use revenue based business loans to stock up before peak seasons, pay vendors early for discounts, or expand into new product lines while demand is hot.

Funding high-ROI marketing campaigns is another strong application. If your data shows that every dollar of ad spend reliably produces multiple dollars of gross profitProfit remaining after deducting the direct costs of produci, using a revenue based loan to front-load those campaigns can generate returns that comfortably exceed the cost of capital.

– When To Choose A Line Of Credit Instead

If your need for capital is ongoing and unpredictable—covering delayed invoices, occasional payroll gaps, or irregular expenses—a revolving business line of credit may serve you better than a one-time revenue based business loan.

Lines of credit let you draw, repay, and redraw as needed, and interest is only paid on what you actually use. Many sophisticated SMBs combine both approaches: a flexible line of credit for everyday liquidityThe ease with which assets can be converted into cash. management, and revenue based financing for large, discrete growth initiatives like inventory builds or aggressive customer acquisition campaigns.

Top Revenue Based Business Loan Providers Comparison

| Provider Type | Repayment Structure | Typical Cost | Speed | Best For |

|---|---|---|---|---|

| Revenue Based Business Loan | % of monthly revenue until cap repaid | Cap ~1.1x–1.6x principalThe original sum of money borrowed or invested, excluding in | 24–72 hours | High-growth, revenue-generating SMBs |

| Business Line Of Credit | Flexible draws & interest-only payments | Variable interest, often lower than RBF | Days to weeks | Ongoing, unpredictable cash needs |

| Bank Term Loan | Fixed monthly payment over set term | Lower APR, strict underwritingThe process of assessing risk and creditworthiness before ap | Weeks to months | Asset-backed, well-established firms |

| Equity FinancingRaising capital by selling shares of ownership in the compan | Permanent ownership stake | No repayment, but dilutionThe reduction in ownership percentage of existing shareholde | Months | Big, long-term bets and R&D |

For detailed provider comparisons and application strategies, explore our guides on debt financing options and cash flow based lending.

Key Takeaways: Revenue Based Business Loan Essentials

- Non-Dilutive Growth Capital: Repay through a percentage of revenue instead of giving up equity or pledging assets

- Flexible Repayment: Payments automatically adjust with your sales—high months accelerate payoff, slow months reduce strain

- Speed Advantage: Most providers fund within 24-72 hours using automated revenue verification via Stripe, Shopify, or accounting platforms

- Factor RateA decimal figure used to calculate the total repayment amoun Pricing: Total repayment capped at 1.1x-1.6x of principalThe original sum of money borrowed or invested, excluding in, with no compound interestInterest calculated on the initial principal and also on the or hidden fees

- Qualification Focus: $10K+ monthly revenue and 6+ months history matter more than collateralAn asset pledged by a borrower to secure a loan, subject to or perfect credit scores

- Best Use Cases: Inventory purchases, high-ROI marketing campaigns, and hiring initiatives with clear payback timelines

- Strategic Fit: Ideal for “revenue-rich, cash-poor” businesses; consider lines of credit for ongoing, unpredictable needs

Ready To See If A Revenue Based Business Loan Fits Your Growth Plan?

Use your real revenue data to explore non-dilutive funding options in as little as 48 hours.

Bonus: Download the Business Credit Building Checklist ($27 value) to position your company for better offers and lower caps.

Get Your Free Funding Assessment →Revenue Based Business Loan FAQ

How much equity do I lose with a revenue-based loan?

None. A revenue based business loan is structured as debt tied to your future revenue, not as an equity investment, so you keep 100% of your shares and control.

What happens if I have a $0 revenue month?

Because payments are a fixed percentage of revenue, a true $0 revenue month typically yields a $0 payment. Check your contract for any minimum payment clauses, but many providers align fully with your sales.

Are the costs higher than a traditional bank loan?

Yes, the effective cost is usually higher than a secured bank loan. In exchange, you gain speed (24-72 hours vs weeks), reduced collateralAn asset pledged by a borrower to secure a loan, subject to requirements, no personal guarantees, and a repayment schedule that flexes with your revenue instead of fighting it.

How fast can I get funded?

Once your revenue data is connected and your application is complete, many revenue based financing providers can fund within one to three business days.

Can this help build my business credit?

Many, but not all, lenders report to business credit bureaus. Ask explicitly before signing; when they do report, on-time repayment can help strengthen your business credit profile over time.

What types of businesses qualify for revenue based loans?

E-commerce stores, SaaS companies, subscription businesses, professional services firms, and agencies with consistent monthly revenue typically qualify. Asset-heavy industries like manufacturing may find better rates with equipment financingA loan or lease specifically used to purchase business machi.

Can I pay off a revenue based business loan early?

Most revenue based business loans have no prepayment penalties. If you pay off the cap early, you save time but not money, since the total repayment is fixed by the factor rateA decimal figure used to calculate the total repayment amoun regardless of timeline.

References & Further Reading

- Allied Market Research – “Revenue-Based Financing Market” (market size and growth projections)

- SoFi – “Revenue-Based Business Loans: What Are They?”

- OnDeck – “Revenue-Based Financing for Small Business: How it Works”

- Swoop Funding – “Revenue-based financing: What is it and how does it work?”

- Innovative Finance Playbook – “Revenue Based Loans”