When cash flowThe net amount of cash moving in and out of a business. hits a wall, bridge loans are your speedboat—not a rowboat. You’ll get approval and funding within 24 hours, which means you can cover payroll, restock inventory, and handle those urgent expenses without watching your business slow down. Yes, interest rates run higher than traditional banks, typically 2-4% monthly, but the quick capital infusion often beats the alternative for missing deadlines. Stick around to reveal exactly what qualifications you’ll need and whether this funding route actually makes sense for your situation.

Key Takeaways

- Bridge loans offer quick 24-hour approval with minimal credit analysis, enabling rapid working capital access for businesses facing cash flowThe net amount of cash moving in and out of a business. gaps.

- Monthly interest rates typically range from 2-4%, requiring a solid exit strategyA plan for an investor or owner to sell their stake in a com to manage accumulating costs and avoid expensive extension fees.

- Businesses must demonstrate 1-2 years of operation history, solid credit, and a debt-to-income ratio ideally at or below 50% for qualification.

- Bridge financingInterim financing used to bridge a gap until a specific futu covers immediate operational needs including payroll, supplier payments, seasonal inventory, and urgent expenses without lengthy traditional bank approval processes.

- Streamlined applications require basic documentation and proof of assets, enabling swift capital disbursement to support business continuity during financial challenges.

What Are Bridge Business Loans and How Do They Work?

A bridge business loan is fundamentally a financial pit stop—short-term funding that keeps your business moving forward while you’re waiting for a more permanent financing solution or a major cash influx to arrive. Think of it as a strategic pause button that prevents your operations from stalling.

Here’s how it works: you’re basically borrowing against future income or assets you’re anticipating. When that larger loan closes or your revenue kicks in, you’ll repay the bridge loanShort-term financing used to bridge the gap until permanent. This business bridge loanShort-term financing used to bridge the gap until permanent structure makes sense for companies facing seasonal gaps, acquisition delays, or temporary cash flowThe net amount of cash moving in and out of a business. hiccups.

A bridge loanShort-term financing used to bridge the gap until permanent for business typically comes with quicker approval—sometimes 24 hours—because lenders focus less on lengthy credit analysis. Instead, they prioritize your exit strategyA plan for an investor or owner to sell their stake in a com and available collateralAn asset pledged by a borrower to secure a loan, subject to. It’s innovation meets pragmatism. Bridge loans usually have higher interest rates compared to traditional financing due to their short-term nature.

Key Benefits of Fast Approval and Quick Disbursement

When you get approved for a bridge loanShort-term financing used to bridge the gap until permanent in 24 hours, you’re not just getting money quickly—you’re keeping your business moving forward without those agonizing delays that can derail your plans. The minimal documentation required means you’re spending less time shuffling paperwork and more time focusing upon what actually matters, like seizing that opportunity or covering your cash gap before it becomes a real headache. Having that capital available swiftly takes a huge weight off your shoulders because you’re no longer scrambling to figure out how you’ll make payroll or handle unexpected expenses. Additionally, these loans can provide short-term funding that bridges capital gaps while you secure longer-term financing.

Speed Enables Business Continuity

Because business emergencies don’t wait for the traditional lending cycle, bridge loans offer you a lifeline that keeps your operations moving ahead. When you’re facing a cash flowThe net amount of cash moving in and out of a business. crunch, a bridge loanShort-term financing used to bridge the gap until permanent for small business delivers capital when you need it most—sometimes within 24 hours. This swiftness matters because your payroll doesn’t pause, suppliers expect payment, and opportunities vanish quickly. Business bridge loanShort-term financing used to bridge the gap until permanent lenders understand that timing is everything. By securing funds swiftly, you’ll maintain momentum without interrupting daily operations. You can cover immediate expenses, seize growth opportunities, or steer through seasonal gaps without grinding to a halt. Quick approval means you’re not stuck waiting around while competitors move ahead. Your business stays competitive and resilient.

Minimal Documentation Streamlines Process

Unlike traditional banks that’ll bury you in paperwork for weeks, bridge lenders keep things simple and straightforward. You’ll submit basic financial documents—typically your recent tax returns and bank statements—without jumping through endless hoops. Instead of dealing with mountains of forms, you’re providing exactly what lenders need to assess your situation promptly. This optimized approach means you’re not waiting around for underwriters to review unnecessary paperwork. Bridge lenders focus on your assets and exit strategyA plan for an investor or owner to sell their stake in a com rather than obsessing over every detail. That efficiency translates directly into quicker decisions. You’re talking about hours, not months, because the process cuts through the noise. This no-nonsense documentation strategy keeps momentum in your favor when time matters most for your business.

Capital Availability Reduces Financial Stress

Getting capital into your account in 24 hours isn’t just convenient—it’s a game-changing factor for your cash flowThe net amount of cash moving in and out of a business. situation. When you’re facing payroll deadlines or unexpected expenses, that rapid funding becomes your financial lifeline. You won’t spend sleepless nights worrying about whether your business can survive the next week. Instead, you’re free to focus around what actually matters—growing your company and seizing opportunities. Quick access to capital eliminates the stress of juggling creditors or delaying important purchases. Your team stays motivated because you can meet their needs in due time. Equipment breakdowns don’t derail your operations. Seasonal lulls become manageable challenges rather than existential crises. That peace of mind? It’s priceless for any business owner dealing with unpredictable cash flowThe net amount of cash moving in and out of a business. challenges.

Typical Loan Terms and Repayment Schedules

When you’re considering a bridge loanShort-term financing used to bridge the gap until permanent, understanding how you’ll actually pay that back is just as crucial as knowing how quickly you can get the money. Bridge loans typically come with shorter timeframes than traditional financing—usually six months through two years—and they’re designed to be temporary solutions while you’re waiting for a more permanent funding source or exit event. These loans often have high interest rates compared to traditional loans due to their short-term and flexible nature.

| Loan Feature | Typical Range |

|---|---|

| Loan Duration | 6 months through 2 years |

| Interest Rates | 2-4% monthly |

| Extension Fees | 0.5-2% from balance |

You’ll encounter monthly interest payments rather than quarterly or annual ones, which means your costs add up quickly if timelines shift. That’s why having a solid exit strategyA plan for an investor or owner to sell their stake in a com isn’t just smart—it’s vital for avoiding those nasty extension fees that can blindside your budget.

Understanding Interest Rates and Associated Fees

Bridge loans come with a price tag that goes way beyond just the interest rate, and that’s what trips up a lot of borrowers who aren’t paying heed. You’re looking at origination fees, extension fees, and monthly interest that can stack up rapidly. For example, a $250,000 loan at 2% monthly interest with a 3% origination fee hits you with an effective annual rate around 28-30%. If you need an extension, that’s another 0.5-2% fee in addition to more monthly interest. Extension costs add thousands—literally $18,750 regarding that same loan with a three-month extension. Smart borrowers calculate total financing costs upfront, not just the headline rate. Understanding these fees helps you plan your exit strategyA plan for an investor or owner to sell their stake in a com and avoid costly surprises. Additionally, being aware of hidden risks in commercial bridge financingInterim financing used to bridge a gap until a specific futu can prevent unexpected financial burdens.

Qualification Requirements and Eligibility Criteria

In order to qualify for a bridge loanShort-term financing used to bridge the gap until permanent, you’ll need to meet some pretty straightforward criteria that lenders use to assess whether you’re a good fit for quick funding. Your business age and revenue history matter because lenders want to see you’ve got some track record, while your credit score signals how responsibly you’ve handled past debt obligations. The good news is that bridge lenders are often more flexible than traditional banks regarding these requirements, which means you’ve got a real shot at approval even if your numbers aren’t perfect. Many specialized lenders focus on commercial bridge loans, tailoring their offerings to meet specific business funding needs quickly.

Business Age and Revenue

Since lenders want to guarantee your business has staying power, they’ll typically look at how long you’ve been operating and what kind of revenue you’re generating. Most bridge lenders prefer businesses that’ve been around for at least one to two years, though some’ll work with newer ventures if you’ve got solid financials. Your revenue matters too—lenders want evidence you’re actually making money and can handle loan payments. They’re basically asking, “Can this business survive?” Think about it like proving you’re not a flash-in-the-pan startup. Even if you’re newer, showing consistent monthly revenue growth can strengthen your case. The stronger your revenue track record, the quicker you’ll likely move through approval.

Credit Score Requirements

Your credit score is basically your financial report card, and most bridge lenders will take a hard look at that before handing over the cash. Here’s what you’re typically up against:

- Minimum score expectations – While requirements vary by lender, you’ll generally need solid credit to qualify for quicker approval

- Debt-to-income ratio – Lenders typically feel comfortable approving loans when your DTI stays around 50% or lower

- Overall financial view – Your credit score works alongside other factors like cash flowThe net amount of cash moving in and out of a business. and business performance

The truth is, bridge lenders aren’t looking for perfection. They’re evaluating risk, and your credit history tells them whether you’ve handled money responsibly. Think about it as proving you’re trustworthy enough to handle their capital swiftly.

The Streamlined Application and Approval Process

One thing that sets bridge business loans apart from traditional financing is how swiftly lenders can move you from application into funding—we’re talking 24 hours in many cases. Unlike banks that require stacks of paperwork and weeks of waiting, bridge lenders optimize everything. You’ll submit your basic documentation, proof of assets, and exit strategyA plan for an investor or owner to sell their stake in a com, and that’s all. Lenders focus upon your collateralAn asset pledged by a borrower to secure a loan, subject to quality rather than obsessing over your credit score alone. This means less red tape and quicker decisions. Many direct lenders and alternative funding sources have already pre-approved their underwritingThe process of assessing risk and creditworthiness before ap processes, so they’re ready to act rapidly. When your business needs capital urgently, that speed becomes your competitive advantage. Additionally, some lenders specialize in providing cross-border bridge financingInterim financing used to bridge a gap until a specific futu to support businesses operating internationally.

Common Working Capital Uses for Bridge Financing

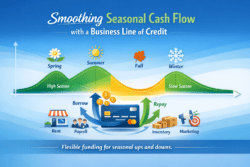

When you’re waiting for a bigger financial event for closure, bridge financingInterim financing used to bridge a gap until a specific futu covers the working capital gaps that could otherwise derail your operations—whether that’s making payroll when cash flow’s tight, stocking up during seasonal inventory before demand hits, or handling those surprise operational expenses that won’t wait. You’ve got bills for payment and customers for service, so a bridge loanShort-term financing used to bridge the gap until permanent steps in to keep your business running smoothly until your primary funding arrives. This represents your financial safety net during the in-between moments when you require liquidityThe ease with which assets can be converted into cash. now, not later. As many borrowers look toward shorter-term debt options amid current market conditions, bridge loans become a crucial tool for maintaining financial stability.

Payroll Continuity During Delays

Because cash flowThe net amount of cash moving in and out of a business. hiccups can turn into full-blown payroll disasters more quickly than you’d like, bridge loans offer a practical lifeline when you’re caught between a revenue timing gap and your employees’ expectations.

When delayed payments threaten your payroll schedule, bridge financingInterim financing used to bridge a gap until a specific futu keeps your team motivated and employed. Here’s how you can utilize this strategy:

- Cover immediate payroll obligations without tapping personal savings or defaulting on employee commitments

- Maintain workforce stability during seasonal slowdowns or pending invoice collections

- Avoid costly penalties that come with late wages or missed payment dates

The best part? You’ll repay your bridge loanShort-term financing used to bridge the gap until permanent once customer payments hit your account, converting a stressful situation into a manageable cash flowThe net amount of cash moving in and out of a business. solution. Your employees stay happy, and your business keeps running smoothly.

Seasonal Inventory Stock Building

Building up inventory before your busy season hits is a lot like stocking your pantry before a big storm—you’ve got to have the goods at hand before customers come knocking. A bridge loanShort-term financing used to bridge the gap until permanent gives you rapid access to capital without waiting months for traditional bank approval. You can stock shelves, secure popular items, and position yourself ahead of competitors when demand peaks. The swift funding—sometimes within 24 hours—means you’re not scrambling at the last minute or missing sales opportunities. Your inventory becomes collateralAn asset pledged by a borrower to secure a loan, subject to, and lenders typically offer solid advance rates regarding stock. This strategic move alters seasonal gaps into growth opportunities, letting you capture market demand when it matters most.

Urgent Operational Expense Coverage

Beyond seasonal inventory sits another reality that every business owner knows too well: unexpected expenses don’t wait for your next remuneration. When critical operational needs emerge, bridge loans deliver the swift capital you need.

Your business might face:

- Emergency payroll gaps when cash flowThe net amount of cash moving in and out of a business. stutters mid-cycle, keeping your team paid without missing a beat

- Urgent equipment repairs that halt production if you don’t address them immediately

- Supplier obligations requiring immediate payment to maintain relationships and inventory access

Bridge financingInterim financing used to bridge a gap until a specific futu closes these gaps quickly—sometimes within 24 hours. Rather than scrambling for traditional loans with lengthy approval processes, you’re accessing funds when timing matters most. This innovative approach keeps your operations humming smoothly, letting you handle surprises without derailing your momentum or straining relationships with vendors and employees.

Collateral Options and Asset-Based Lending

When you’re pursuing a bridge loanShort-term financing used to bridge the gap until permanent, your collateralAn asset pledged by a borrower to secure a loan, subject to is basically your ticket for the dance—it’s what convinces lenders you’re serious about repaying the money and what protects them if things don’t go according to plan. You’ve got solid options here. Accounts receivable typically snag the highest advance rates, ranging from 70-90%, making them an attractive choice. Real estate, equipment, and inventory all work too, though they’ll pull lower rates depending on their quality and how swiftly lenders can convert them into cash. The better your assets look in writing, the more quickly you’ll secure approval. Think strategically about what you’re putting up—choose collateralAn asset pledged by a borrower to secure a loan, subject to that’s liquid and useful, not the dusty stuff gathering cobwebs in your warehouse.

Risks, Challenges, and Important Considerations

While bridge loans can feel like a lifeline when you’re in a tight situation, they’re not without their thorns—and you’ll want to understand them before you sign at the dotted line.

Here’s what keeps savvy borrowers up at night:

- Exit StrategyA plan for an investor or owner to sell their stake in a com Delays – If your planned exit event stalls, you’re looking at extension fees (typically 0.5-2% of your balance) along with ongoing monthly interest, which can quickly balloon your costs.

- Sky-High Effective Rates – A $250,000 loan at 2% monthly interest with origination fees hits you with an effective annual rate around 28-30%. That’s not chump change.

- CollateralAn asset pledged by a borrower to secure a loan, subject to Pressure – You’ll need quality assets backing the loan, and lenders won’t necessarily appraise them generously.

Understanding these realities helps you make smarter decisions.

Alternatives to Bridge Loans for Business Funding

If bridge loans feel like they’re carrying too much baggage—the steep rates, the extension fees, the pressure for nailing your exit strategy—you’ve got other options worth investigating.

| Funding Option | Best For |

|---|---|

| Term loans | Stable cash flowThe net amount of cash moving in and out of a business. needs |

| Lines of credit | Flexible, ongoing access |

| Equipment financingA loan or lease specifically used to purchase business machi | Asset-based purchases |

Traditional term loans offer predictable payments without the clock ticking down. Lines of credit give you flexibility—you’re only paying interest on what you actually use. Equipment financingA loan or lease specifically used to purchase business machi lets you spread costs over time while keeping your working capital intact.

Real estate investors might investigate commercial loans, while inventory-heavy businesses could tap into asset-based lendingA loan secured by business assets like inventory, accounts r. Credit unions sometimes offer more forgiving terms than banks. The key? Match your funding source to your actual timeline and needs. You don’t always need the speed; sometimes you just need the right fit.