You’re watching smart terrain designers ditch traditional loans and tap Revenue-Based FinancingFinancing where investors receive a percentage of future gro to scale route empires.

They’re using RBF’s quick 48-hour approval to snap up high-density neighborhoods, then reinvesting that predictable subscription revenue into equipment and crews.

The result is route density jumps 40%, travel times plummet, and profits skyrocket.

Nine companies already proved that this works, and their playbook’s waiting for you.

Key Takeaways

- RBF enables landscapers to acquire multiple high-density routes rapidly, reducing travel time by 40% and increasing crew utilization significantly.

- Revenue-based financingFinancing where investors receive a percentage of future gro approves within 48 hours based on monthly contracts, allowing faster competitive route acquisition than traditional 60-90 day SBA loans.

- Subscription maintenance models create predictable recurring revenue; 10% route density increases yield 25% profit gains through operational efficiencies.

- RBF funds equipment purchases, crew expansion, and winter snow removal capabilities without depleting business savings or personal guarantees.

- Digital data from FSM software strengthens RBF applications, improving lender transparency and enabling seasonal repayment flexibility aligned with revenue cycles.

The Route-Based Advantage: Why Landscaping Is A Recurring Goldmine

You’re not selling mowed lawns anymore, you’re selling a subscription to a beautiful home, and that shift is everything.

When you own 50 maintenance contracts secured for the year, you’ve got predictable revenue that banks used to ignore but lenders now chase, because route density is where the real profit hides.

Here’s the math: a 10% jump in how tightly you pack your routes into one zip code can bump your net profit by 25%, and that’s before you factor in the fuel savings and crew efficiency gains you’ll reveal.

Leveraging a working capital credit lineA flexible loan allowing a borrower to access funds up to a as a liquidityThe ease with which assets can be converted into cash. safety net can help you manage cash flowThe net amount of cash moving in and out of a business. and seize opportunities without financial strain.

The Shift From One-Off Projects To “Subscription” Maintenance

predictable cash flowThe net amount of cash moving in and out of a business. equals quicker growth, more trucks, more crews, and market dominance.

Why Route Density Is The Only Metric That Matters For Profit

So you’ve locked in your maintenance contracts and now your cash flowThe net amount of cash moving in and out of a business.‘s actually predictable—that’s the win. But here’s what separates the empires from the one-truck operators: route density.

It’s not about how many clients you have; it’s about how tightly you’ve packed them geographically. When your routes cluster in the same zip codes, you’re slashing fuel costs and maximizing crew efficiency.

That’s where landscaping route financing and revenue-based financingFinancing where investors receive a percentage of future gro for lawn care become transformative. Lenders now value your landscaping business valuation based on route concentration, not just total revenue. A 10% increase in density can spike your net profit 25%.

With RBF, you’re leveraging tomorrow’s earnings to buy adjacent routes today, compressing your service area into a profit-generating machine that competitors can’t touch.

How Revenue Based Financing (RBF) Scales Landscaping Routes

You’ve got 500 maintenance contracts locked in, that’s basically a gold mine sitting in your Jobber dashboard, so why are you waiting 60 weeks for a bank to approve capital you’ve already earned?

RBF flips the script by letting your proven monthly revenue do the talking instead of requiring collateralAn asset pledged by a borrower to secure a loan, subject to or a perfect credit score, which means you can grab that competitor’s route or buy your third truck in 48 hours instead of watching someone else snatch the opportunity.

Unlike traditional SBA loans that treat you like a seasonal gamble, revenue-based financingFinancing where investors receive a percentage of future gro sees what you actually are: a recurring revenue machine that deserves the capital to scale right now.

This approach reduces the reliance on traditional collateralAn asset pledged by a borrower to secure a loan, subject to requirements, freeing up your business assets while accelerating growth opportunities.

Turning Your Recurring Contracts Into Immediate Growth Capital

While most gardeners are waiting for their bank to approve a loan, which takes months, by the way, their competitors are already buying routes with Revenue-Based FinancingFinancing where investors receive a percentage of future gro and claiming the best contracts in their zip code.

Your recurring contracts aren’t just work; they’re collateralAn asset pledged by a borrower to secure a loan, subject to. RBF lenders see your maintenance agreements as guaranteed income.

You’re not borrowing against equipment or real estate. You’re borrowing against tomorrow’s revenue, today.

This means scaling route businesses becomes possible in moments, not quarters. Non-dilutive landscaping loans let you keep ownership while fueling expansion.

Better yet, as you consolidate routes and elevate landscaping EBITDAEarnings Before Interest, Taxes, Depreciation, and Amortizat growth, you’re paying back the loan with the very revenue it helped generate.

- Access capital within 48 hours using proven contracts

- Keep 100% ownership while growing aggressively

- Lower repayment when revenue dips seasonally

- Reinvest savings into additional crew expansion

Why RBF Is Faster (And Fairer) Than SBA Acquisition Loans

The speed advantage we just talked about? That’s just the beginning. Here’s where RBF crushes traditional SBA acquisition loans: you’re not waiting 60 to 90 intervals for approval committees to debate your business plan. With RBF, landscaping acquisition capital flows in 48 hours because lenders aren’t obsessing over collateral—they’re analyzing your actual route revenue. Your recurring contracts are your golden key.

SBA loans demand personal guarantees and tie up your equipment as collateralAn asset pledged by a borrower to secure a loan, subject to. RBF? It’s non-dilutive. You keep ownership of everything while securing funding for landscaping trucks and crew expansion. The repayment scales with your revenue, so profitable months mean bigger payments, slower months mean breathing room. You’re not fighting bureaucracy; you’re partnering with lenders who actually understand how routes work.

9 Real-World Success Stories: How Landscapers Used RBF To Grow

You’re about to see how five different landscapers turned their route revenue into real growth, from buying out competitors who wanted to retire, for upgrading their entire fleet without taking on traditional debt.

Each story shows a different RBF play: rolling up nearby routes to dominate a zip code, scaling trucks when the bank wouldn’t budge, winning that juicy HOA contract you couldn’t afford to equip for, bridging the winter cash gap while prepping for snow season, and blitzing high-value neighborhoods with fresh equipment and crew capacity.

These aren’t hypothetical scenarios—they’re proof that your recurring contracts are your superpower. Leveraging revolving credit can provide the financial flexibility landscapers need to manage fluctuating costs and seize immediate growth opportunities.

Case 1: The “Roll-Up” Acquisition Of A Retiring Competitor’s Route

Every gardener faces a moment when a competitor suddenly decides they’re done, maybe they’re retiring, maybe they’re burnt out, or perhaps they just want to sell before the market shifts. That’s your golden opportunity. With RBF, you’re not waiting 60 moments for a bank to think about it. You’ve got capital in 48 hours to acquire that route outright.

Here’s what makes this function:

- Speed wins routes: Your competitor gets bought by someone else if you hesitate

- Route density explodes: You’re absorbing clients in the same zip code, cutting fuel costs dramatically

- Crews scale faster: You don’t need new trucks immediately, just more people working existing routes

- EBITDAEarnings Before Interest, Taxes, Depreciation, and Amortizat multiplies: One gardener tripled profits in six months after a single acquisition

That’s consolidation. That’s dominance.

Case 2: The Fleet Upgrade Scaling From 2 Trucks To 10 Without Liens

Most landscapers hit a wall around truck number three. You’ve got the routes, the crew, and the demand, but traditional banks want collateralAn asset pledged by a borrower to secure a loan, subject to you don’t have. That’s where RBF changes everything.

One Georgia-based operator had two trucks generating steady revenue. He saw the opportunity to dominate his market but needed ten trucks quickly.

RBF released $250k based on his proven route income, not his truck equity. He bought the fleet without liens, without diluting ownership, and without waiting months for bank approval.

Within eighteen months, his revenue tripled. Route density exploded. His fuel costs dropped because crews clustered geographically.

He went from surviving to scaling, all because his recurring contracts became his financing engine.

Case 3: The HOA Contract Win Requiring Upfront Equipment Investment

Landing a big HOA contract feels like winning the lottery, until you realize you need $120k in equipment before you can even start the initial job. You’ve got the contract signed, the crew ready, but your bank account? Empty. Here is where RBF changes the game. You’re not waiting 60 periods for a traditional loan, you’re getting capital in 48 hours based on that HOA contract alone.

Here’s what that looks like in action:

- Contract becomes collateralAn asset pledged by a borrower to secure a loan, subject to: Your signed agreement is proof you’ll generate revenue, not just a promise

- Equipment arrives rapidly: New mowers, trucks, and tools show up before your initial service date

- Crew expands right away: You hire and train people while paying for everything upfront

- Profit compounds: Higher-margin commercial work funds your next acquisition without touching savings

You’re not borrowing against hope anymore, you’re borrowing against certainty.

Case 4: The Winter Bridge For Snow Removal Prep And Payroll Stability

You’ve got a problem that most outdoor specialists won’t admit until November: your summer revenue disappears the moment the temperature drops, but your crews still need paychecks twelve months a year.

That’s where RBF changes the game. Instead of scrambling for cash for prep snow removal equipment and cover payroll gaps, you secure a revenue-based line from credit before winter hits.

You buy the plows, salt spreaders, and insurance coverage you need in September. Then, as snow contracts generate income, you repay the financing automatically. Your team stays employed year-round, your equipment’s ready, and your cash flowThe net amount of cash moving in and out of a business. stays smooth.

Winter becomes your profit season, not your survival test.

Case 5: The Route Density Blitz In High-Value Zip Codes

When a high-income neighborhood starts observing your truck in one street, they want you in the next three, and that’s where route density transforms into actual money.

You’re witnessing it happen: one client mentions another, then another. But you’re stuck because you don’t have the capital to seize that third route before your competitor does.

RBF changes that. You get $100k in 48 hours, not 60 periods. Suddenly, you’re acquiring routes in the same zip code, cutting fuel costs and doubling crew efficiency without needing new trucks.

Here’s what route density blitz actually signifies:

- Zip code domination reduces travel time between jobs by 40%

- Referral velocity skyrockets when neighbors see you everywhere

- Crew utilization climbs because routes cluster together naturally

- EBITDAEarnings Before Interest, Taxes, Depreciation, and Amortizat multiplies faster than your competition can react

You’re not just growing anymore, you’re consolidating your market.

Case 6: The Secondary Yard Expansion For Geographic Reach

The real ceiling isn’t your primary route—it’s your core yard. You’ve dominated your initial service area, but you’re maxed out. Here’s where RBF changes everything: you open a secondary yard in an adjacent zip code without draining your reserves.

One Georgia horticulturist did exactly this. She had 200 clients in her north territory, but growth was stalled.

Using RBF, she secured $120k for a south-side yard, equipment, and a new crew lead. Now she’s running two territories simultaneously.

The genius? Clients in zone two generate the same recurring revenue as zone one, but they don’t compete for your original resources. Your empire just doubled geographically. That’s not expansion—that’s intelligent multiplication. RBF made it happen in weeks, not years.

Case 7: The Labor Retention Play For Elite Field Technicians

Because your best crew lead just got a job offer from a bigger company with better pay, you’re facing a problem that no amount of equipment can solve. RBF changes this game entirely. You’re using revenue-based financingFinancing where investors receive a percentage of future gro to create competitive wages and ownership incentives that keep your elite technicians locked in, not with handcuffs, but with real opportunity.

Here’s how smart terrain managers are winning:

- Sign-on bonuses funded by RBF capital make your crew leads actual partners, not just employees

- Performance-based equity stakes give technicians skin in the game when you scale routes

- Equipment upgrades show them you’re reinvesting in their comfort and efficiency

- Career pathways prove there’s a future beyond the mower

Your route density means nothing if your best people walk. RBF lets you pay for loyalty before your competitor does.

Case 8: The Specialized Zero-Turn Upgrade For Faster Crew Billing

Most outdoor designers don’t realize that their crew’s equipment isn’t just a tool, it’s a billing machine. One Georgia landscaper faced this reality when his team spent hours at properties that should’ve taken half the time. His aging mowers were costing him thousands in lost billable hours each month.

He used RBF to finance three zero-turn radius mowers, $45,000 total. The payoff? His crews completed 40% more jobs weekly without hiring additional staff. Within four months, the equipment paid for itself through increased billing capacity alone.

You’re not buying quicker mowers, you’re buying quicker cash flowThe net amount of cash moving in and out of a business.. Route density skyrockets when your crews work smarter, not just harder. That’s how specialized equipment becomes your competitive advantage.

Case 9: The FSM Software Modernization For Optimized Route Logistics

While most landscapers can tell you their route list by heart, few realize that outdated scheduling software is silently eating into their profits. You’re running crews with spreadsheets and phone calls when modern Field Service Management (FSM) software could enhance every route in real-time.

One landscaper used RBF to fund a complete software modernization. Here’s what changed:

- Real-time GPS tracking cut travel time between jobs by 18%, freeing up hours for additional service calls

- Automated scheduling eliminated double-booking and crew downtime, elevating crew utilization to 92%

- Digital invoicing and payment accelerated cash collection by 11 days

- Predictive maintenance alerts prevented equipment breakdowns that would cost thousands

Within four months, his software investment paid for itself. He didn’t just save money, he reclaimed control of his operation. That’s route density alongside efficiency.

The ROI Of Route Density

When you pack your routes tighter into the same geographic zone, you’re not just mowing more lawns, you’re cutting fuel costs by as much as 15% because your crews aren’t burning gas driving between jobs.

That’s where RBF becomes your secret weapon: you borrow capital today in order to acquire those adjacent routes or hire sign-on bonuses for top crews, and the tighter route density pays back the loan through pure operational efficiency.

Using a short-term business line of credit can provide the fast, flexible funding needed to make these high-ROI investments without disrupting cash flowThe net amount of cash moving in and out of a business..

How Scaling Your Routes Lowers Fuel Costs And Increases Margins

You’ve probably noticed that your fuel bill doesn’t shrink when you’re running three scattered routes across town, it actually grows, because you’re burning gas just getting from one job towards the next. Route density flips that script entirely.

When your clients cluster in the same neighborhoods, you’re cutting travel time dramatically, which means fewer gallons pumped and more profit remaining in your pocket.

Here’s what route density actually delivers:

- Tighter geographic zones reduce windshield time and enhance crew productivity per hour

- Consolidated equipment stops mean one fuel-up instead of multiple tank fill-ups weekly

- Faster turnaround between jobs lets crews complete more stops daily without overtime costs

- Lower maintenance expenses on trucks that aren’t constantly grinding through unnecessary miles

The math is simple: denser routes equal efficient operations, fatter margins, and the competitive edge you’ve earned.

Using RBF To Fund Sign-On Bonuses For Elite Crews

The scenery creators who dominate their zip codes aren’t just running efficient routes: they’re attracting and keeping the best crews in town.

We want you here. A $5,000 bonus funded through revenue-based financingFinancing where investors receive a percentage of future gro costs you way less than replacing a crew member.

Better talent means quicker work, fewer callbacks, and happier clients who actually renew. When you’re consolidating routes, you need experienced hands ready right away.

RBF lets you allocate those bonuses rapidly, building a reputation as the employer crews actually want to join. Your routes stay full, your margins stay strong, and your team stays loyal. That’s how you win.

Comparing RBF To Traditional Equipment Leasing

You’ve probably noticed that traditional equipment leases lock you into fixed monthly payments whether you’re mowing in July or sitting idle in January, but here’s the thing: RBF lets your repayment breathe with your actual cash flowThe net amount of cash moving in and out of a business., meaning you’re not bleeding money during the slow season.

Unlike leases that tie up your balance sheetA financial statement summarizing a company's assets, liabil and limit your borrowing power for the next acquisition, unsecured revenue-based financingFinancing where investors receive a percentage of future gro keeps your assets clean and your credit lineA flexible loan allowing a borrower to access funds up to a ready to pounce upon that competitor’s route when it hits the market.

When you’re scaling through bolt-on acquisitions, that flexibility isn’t a luxury, it’s the difference between staying independent and getting swallowed by a national franchise.

Understanding the true cost of capital by comparing APR can help you avoid overpaying and make the most of flexible financing options like RBF.

Keeping Your Assets Clean: Why Unsecured Debt Is Better For Acquisitions

When most gardeners think about scaling, they visualize two paths: either save up cash for years, or lease equipment and trucks from a traditional lender.

Here’s the problem: leasing chains you to monthly payments without building equity. RBF works differently. You keep your balance sheetA financial statement summarizing a company's assets, liabil clean while accessing capital instantly. Your recurring routes become your collateralAn asset pledged by a borrower to secure a loan, subject to, not your trucks.

Why unsecured debt wins for acquisitions:

- You own your assets outright, no lender can repossess your mowers mid-season

- Flexibility to pivot, upgrade equipment without renegotiating lease terms

- Faster acquisitions, 48-hour funding beats 60-day bank approval

- Better margins, lower carrying costs mean higher EBITDAEarnings Before Interest, Taxes, Depreciation, and Amortizat growth

Your routes are the real asset. Let them work for you.

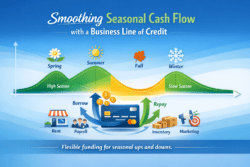

Repayments That “Breathe” With The Seasonal Grass Cycle

Most groundskeepers don’t think about cash flowThe net amount of cash moving in and out of a business. until March rolls around and the phone starts ringing, suddenly you’re scrambling to cover payroll for crews that’ll be slammed for four months straight, then ghosting come November.

Here’s where RBF flexes differently than traditional equipment leasing. With RBF, your repayment schedule actually moves with your revenue cycle. Spring boom? You pay more. Winter slowdown? Payments adjust downward.

Traditional leases? They’re rigid, the same payment hits your account every month, regardless whether you’re mowing five lawns or fifty. RBF lenders understand that landscaping isn’t year-round predictable. They’ve built flexibility into their model because they’re banking based your routes’ success, not just collecting fixed fees.

Your cash flowThe net amount of cash moving in and out of a business. breathes naturally.

How To Qualify Using Your Jobber Or LMN Data

Your Jobber or LMN dashboard is basically your financial resume now, lenders can see your route density, customer retention rates, and cash flowThe net amount of cash moving in and out of a business. patterns in real-time, which means you’re no longer fighting outdated bank assumptions about seasonal landscaping.

Instead of waiting weeks for approval based upon tax returns that don’t capture your actual recurring revenue, you can qualify for capital in moments because your software already proves you’ve got the customers and the cash flowThe net amount of cash moving in and out of a business. to pay it back.

When you’re ready to grab that competitor’s route down the street or add that fourth truck, you won’t be stuck waiting—your digital data‘s already doing the heavy lifting.

Building established relationships with lenders can further expedite your approval process and secure more favorable loan terms through relationship-based assessments.

Why Your Digital Route Map Is Your New Credit Score

Ever notice how traditional banks obsess over your credit score and tax returns, completely missing what’s actually sitting right in front of them, your route density data?

Your Jobber or LMN dashboard tells the real story. It shows your recurring contracts, customer retention rates, and predictable cash flowThe net amount of cash moving in and out of a business.. That’s way more precious than a credit score.

Here’s why lenders now see your digital route map as your financial fingerprint:

- Real-time revenue visibility proves you’ve got cash flowing in consistently

- Customer retention metrics demonstrate your routes are sticky and profitable

- Seasonal patterns become transparent, eliminating underwritingThe process of assessing risk and creditworthiness before ap guesswork

- Growth path shows lenders exactly how you scale without equity dilutionThe reduction in ownership percentage of existing shareholde

In 2026, your routes are your credit score. Your software doesn’t lie.

Preparing For Your Next Route Acquisition Today

The difference between the gardener who gets funded in 48 hours and the one who waits 60 moments? Data. Your Jobber or LMN dashboard isn’t just for scheduling—it’s your financial passport.

RBF lenders can now see your route density, contract values, and payment history in real-time. They’re reading your revenue like a bank reads your tax returns, except quicker.

Start cleaning up your records today. Confirm your client contracts are documented, your payment tracking is precise, and your route profitability is crystal clear.

When you’re ready to acquire that competitor’s route or buy your third truck, you’ll have the proof lenders need. Your software isn’t just managing crews—it’s building your next empire, one data point at a time.

The Landscaping Success Kit: Securing Your Empire One Yard At A Time

Ambition without a system is just a daydream, and you’re done daydreaming. You’ve got the routes, the crew, and the hunger to dominate your market. Now the moment has arrived to build the infrastructure that turns opportunity into empire.

Ambition without a system is just a daydream. Build your infrastructure now and turn opportunity into empire.

Your success kit isn’t fancy, it’s practical. You need three core elements working together:

- Route intelligence software that shows you exactly where density lives and where your next acquisition fits

- Cash access within 48 hours through RBF so you’re not watching competitors snatch retiring routes

- Crew scaling playbooks that let you add maintenance contracts without adding trucks immediately

- Consolidation strategy that targets zip codes you already service, maximizing efficiency before expansion

The groundskeepers winning right now aren’t waiting for perfection. They’re executing with what they’ve got, then upgrading as they grow. Your empire starts today. Revenue-based loans provide flexible repayments that align with fluctuating cash flowThe net amount of cash moving in and out of a business., letting you scale without fixed monthly payment pressure.

Frequently Asked Questions

What Happens to My RBF Repayment if a Major Client Cancels Their Contract?

Your RBF repayment adjusts depending upon your revenue decline. You’ll owe less because repayment’s tied with your actual cash flowThe net amount of cash moving in and out of a business., not fixed installments. You’re protected—that’s RBF’s innovation versus traditional debt.

Can I Use RBF to Acquire Routes in Adjacent Markets or Different States?

Yes, you can utilize RBF for out-of-state acquisitions, but you’ll face underwritingThe process of assessing risk and creditworthiness before ap scrutiny regarding new markets. Lenders will want proven revenue visibility and operational capacity before funding adjacent expansion. Begin locally initially.

How Quickly Can I Scale From 2 Trucks to 5 Trucks Using RBF Strategically?

You’re scaling from 2 to 5 trucks in 6-12 months with RBF. You’ll utilize your proven route revenue to fund bolt-on acquisitions, adding crews and equipment without diluting equity or waiting for traditional bank approvals.

What Percentage of My Monthly Route Revenue Goes Toward RBF Repayment Obligations?

Your RBF repayment typically runs 6-12% from monthly route revenue, depending upon your funding amount and term length. You’re reinvesting profits strategically—not sacrificing cash flowThe net amount of cash moving in and out of a business.. Most scaled operators maintain healthy margins while accelerating growth.

Does RBF Financing Impact My Ability to Secure Traditional Bank Loans Later?

You’ll actually strengthen your bank profile. RBF repayment history demonstrates revenue stability and disciplined cash management. Banks now view successful RBF usage as proof for your route density’s durability, making you a more attractive lending candidate.