In 2026, arr based loans have become the go-to way for serious SaaS and recurring revenue companies to turn predictable subscriptions into multi-million dollar, non-dilutive capital. Instead of being judged on EBITDAEarnings Before Interest, Taxes, Depreciation, and Amortizat or hard assets, lenders underwrite your Annual Recurring Revenue itself—typically advancing 0.5x to 1.5x ARR—so you can extend runwayThe amount of time a company can operate before running out, fund acquisitions, or scale your sales team without raising a down-round.

If you are a CFO or founder with $2M+ ARR and strong retention, this guide will show you exactly how institutional ARR facilities work, what metrics lenders care about, how to know if you qualify, and how to compare real term sheets. For a broader view of non-dilutive funding, you may also want to review our guides on SaaS revenue-based financing, alternatives to traditional business loans, and business loans and lines of credit so you can choose the right tool for your capital stack.

🎯 ARR Loan Qualification Self-Assessment

Check all that apply to see your qualification likelihood in 30 seconds

📥 Free Download: ARR Loan Readiness Checklist

Want a simple one-page diagnostic you can review with your board or investors before talking to lenders?

Scroll below for the ARR Loan Readiness Checklist to see exactly which metrics you need dialed in—ARR scale, NRR, churn, runwayThe amount of time a company can operate before running out, and documentation—before applying.

Understanding ARR As Institutional Collateral

The core shift in 2026 lending markets is that Annual Recurring Revenue is now treated as institutional-grade collateralAn asset pledged by a borrower to secure a loan, subject to for subscription businesses. Instead of asking for buildings, equipment, or personal guarantees, ARR lenders underwrite the quality and durability of your contracted revenue stream. If this is your first time using revenue as collateralAn asset pledged by a borrower to secure a loan, subject to, it can help to contrast ARR loans with other structures like revenue-based financing for SaaS, where repayments flex with monthly sales rather than following a fixed amortization scheduleA table detailing each periodic payment on a loan, split by.

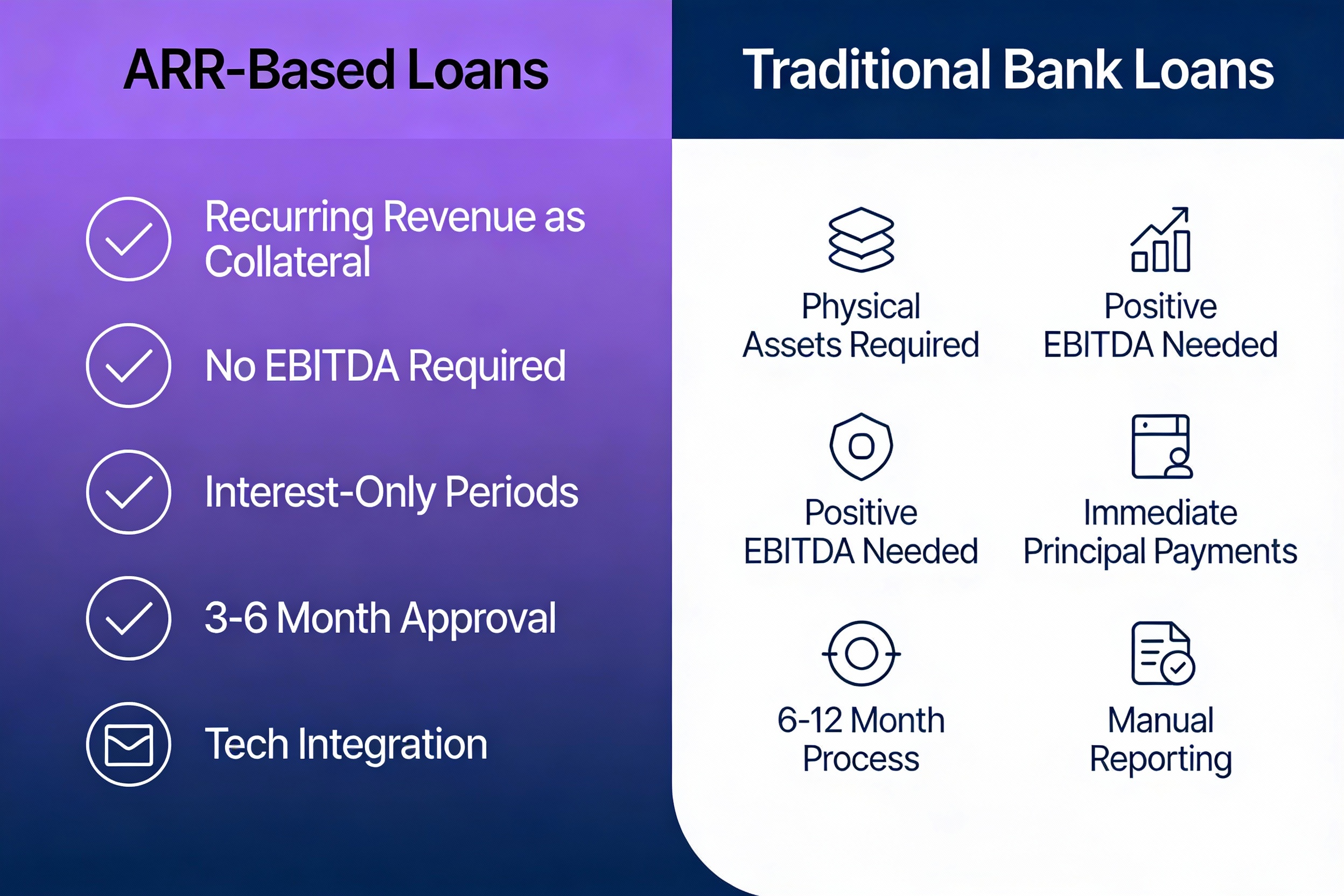

– Why Traditional EBITDA Lending Fails SaaS Companies

Traditional banks rely on positive EBITDAEarnings Before Interest, Taxes, Depreciation, and Amortizat and hard collateralAn asset pledged by a borrower to secure a loan, subject to, which penalizes growth-stage SaaS companies that reinvest heavily in customer acquisition. A business with $5M ARR, 95% NRR, and deliberate losses driven by CAC appears “too risky” in that framework despite having highly bankable contracted revenue. ARR lenders instead focus on metrics like LTV/CAC, payback period, and cohort retention curves—metrics that forecast future cash flows more accurately for subscription models.

If you are currently being told you are “too early” or “too unprofitable” for bank debt, it may be worth pairing this article with our guide on improving business loan eligibility so you can understand how different lenders frame risk and how ARR-based underwritingThe process of assessing risk and creditworthiness before ap changes that conversation.

How ARR Loan Underwriting Actually Works

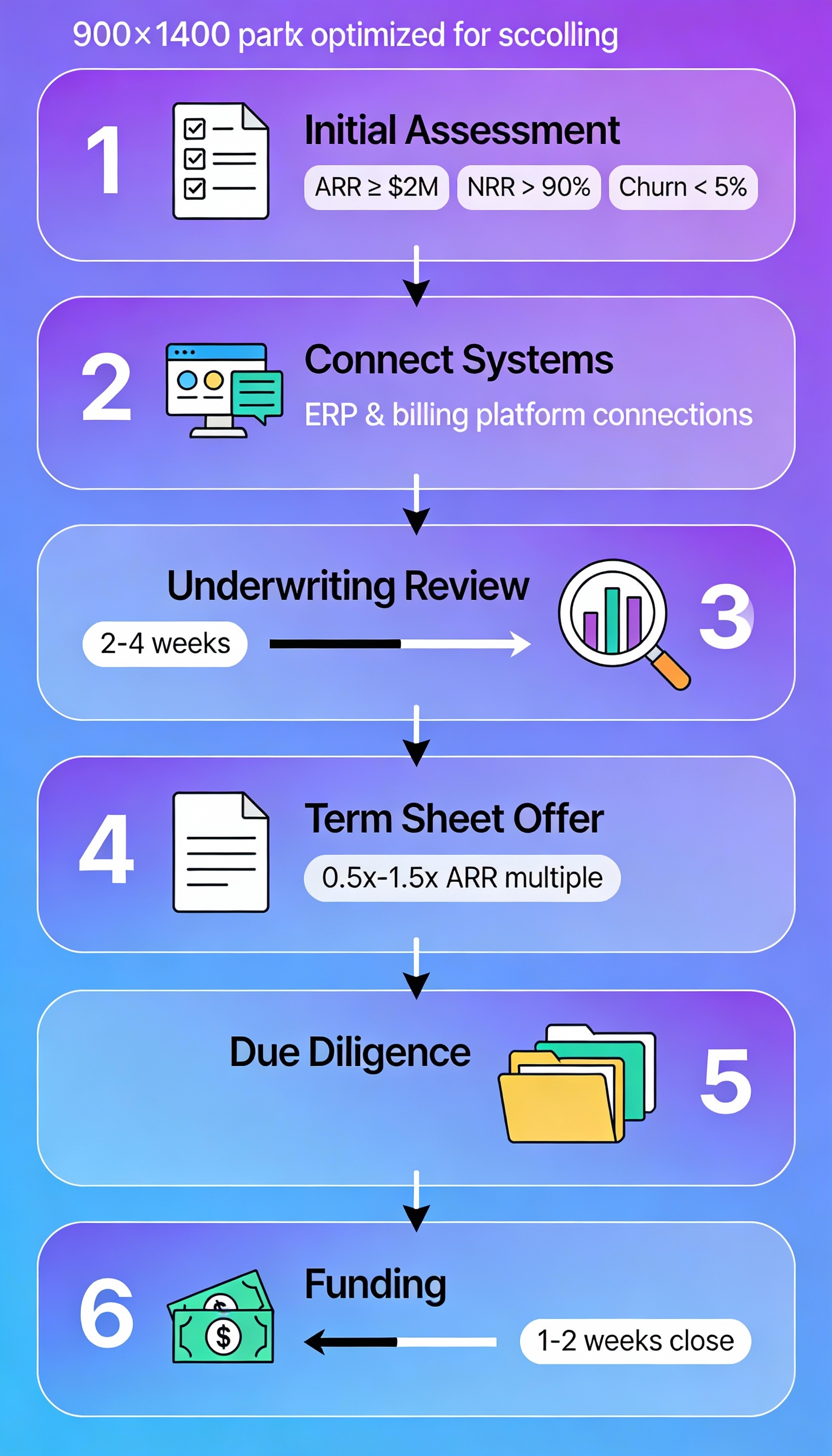

Modern ARR underwritingThe process of assessing risk and creditworthiness before ap has shifted from static data rooms to live system integrations. Lenders connect directly to your billing platform (Stripe, Zuora, Chargebee), your ERP, and your general ledger to monitor ARR, churn, collections, and cash in near real-time. This allows them to approve facilities in 3–6 weeks instead of the 6–12 month slog of traditional corporate credit.

– Revenue Benchmarks And Growth Requirements

Institutional ARR lenders typically begin serious conversations at $2M–$3M ARR, with more attractive pricing and structures at $5M+. Growth expectations cluster around 20%+ year-over-year, but lenders weigh that against unit economics—strong payback periods and improving cohort behavior can offset moderating growth. Below $2M ARR, many businesses instead lean on SaaS revenue-based financing or more general business lines of credit.

– The Critical Role Of Net Revenue Retention

Net Revenue Retention (NRR) is the underwritingThe process of assessing risk and creditworthiness before ap anchor. An NRR above 90% is often the baseline, with 100%+ and especially 110–120% opening the door to higher multiples and cleaner covenants. A company with 120% NRR effectively has “built-in” growth before new bookings, which dramatically de-risks a multi-year term loan from a lender’s perspective.

📊 Case Study: Strategic Acquisition Financing

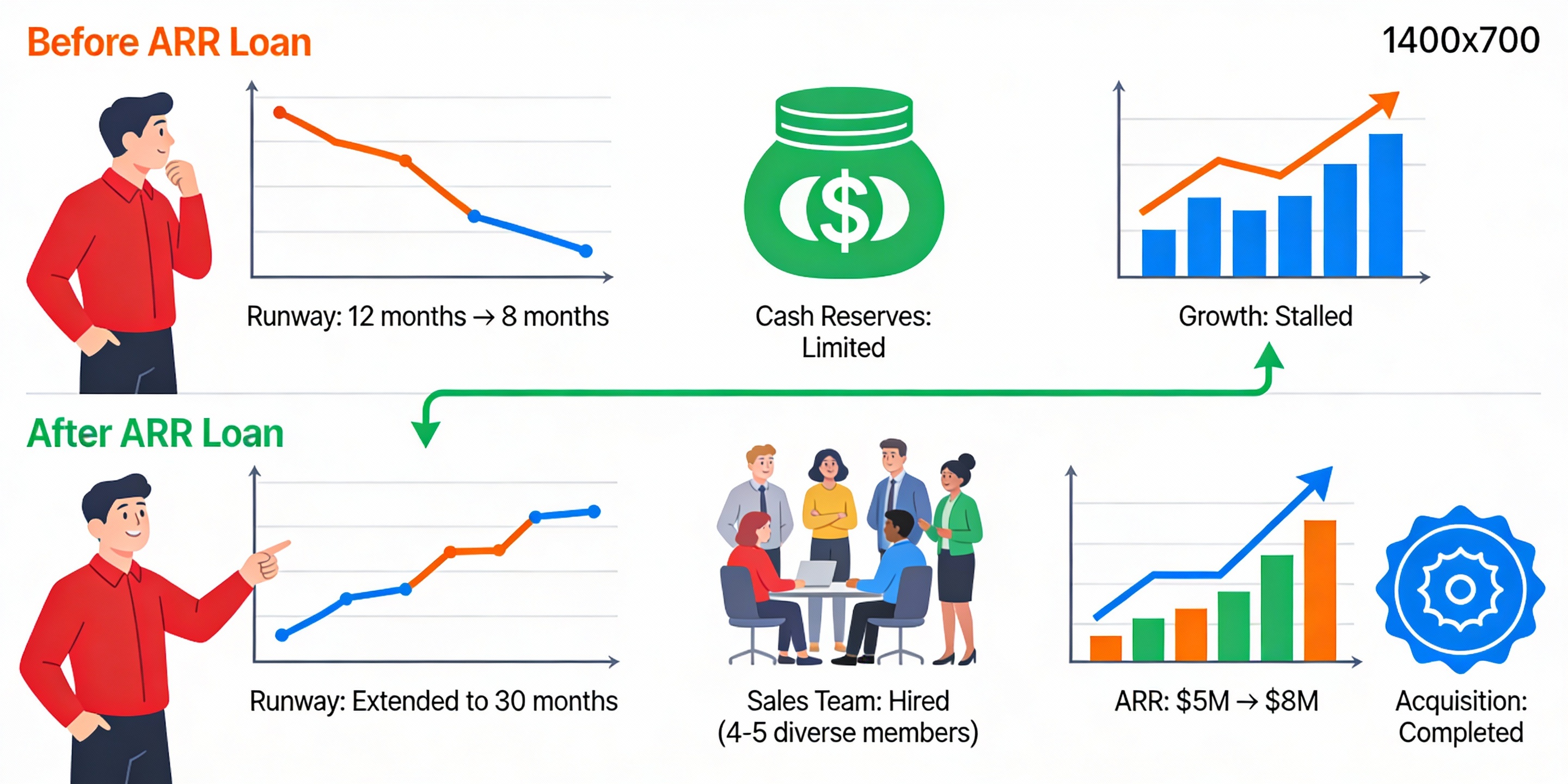

Profile: Mid-market SaaS company at $5M ARR, growing 50% YoY, 95% NRR, serving enterprise healthcare customers.

Problem: Targeted a $2.5M ARR competitor for acquisition. A Series B in a soft equity market would have required a down-round and 20–25% dilutionThe reduction in ownership percentage of existing shareholde.

Solution: Secured a $4M ARR-based facility at 12% + SOFR with a 12‑month interest-only period. Deployed $3M to acquire the competitor and $1M to fund integration and cross-sell campaigns.

Results: Combined ARR reached $8.2M within 12 months, NRR improved to 105%, and the company later raised a growth equity round at 3x the prior valuation—with no interim dilutionThe reduction in ownership percentage of existing shareholde. The ARR loan was refinanced on better terms using the stronger metrics.

ARR Loans Versus Revenue-Based Financing

ARR loans and revenue-based financingFinancing where investors receive a percentage of future gro are both powered by recurring revenue, but they behave very differently in your cash flowThe net amount of cash moving in and out of a business. and capital stack. Getting this distinction right is key before you sign anything long-term.

– Structured Term Loans Versus Flexible Revenue Sharing

ARR-based loans work like traditional term loans: fixed principalThe original sum of money borrowed or invested, excluding in amount, defined maturity (often 3–5 years), and a known interest rate, usually with a 12–24 month interest-only period. They are ideal when you need a large, one-time capital block for strategic moves like acquisitions, major product launches, or multi-quarter sales hiring.

Revenue-based financingFinancing where investors receive a percentage of future gro, by contrast, is repaid as a percentage of monthly revenue (commonly 3–8%), which makes payments flex with your performance but typically results in a higher effective cost of capital. For a deeper dive on that structure, see our dedicated guide on revenue-based financing for SaaS.

– When To Choose A Senior Secured Facility

Senior secured ARR facilities make sense when you have line of sight to material value creation over the loan term. If your plan is to double ARR, expand NRR, or complete an accretive roll-up, paying 10–15% + SOFR on debt can be dramatically cheaper than giving up 15–25% of the cap tableA table detailing the ownership percentages and equity dilut. If, instead, you are still testing markets or searching for product–market fit, shorter-duration, more flexible tools may be safer.

The Strategic Mathematics Of Non-Dilutive Debt

The core math is simple: debt is a fixed, contractual cost; equity is a permanent claim on your upside. For high-growth, high-retention SaaS, that difference compounds massively over 3–7 years. A $3M equity round at a $15M post-money valuationThe estimated value of a company after it has received outsi costs 20% of everything you ever build. A $3M ARR loan at 12% over the same period might cost roughly $1M–$1.2M in interest.

– Calculating The Trade-Off Between Interest And Dilution

Imagine you use $3M to accelerate growth from $5M to $15M ARR and exit at a 5x multiple ($75M). The 20% equity sold for $3M is now worth $15M at exit. In contrast, the lender receives interest and principalThe original sum of money borrowed or invested, excluding in but no equity. Even if you pay $1.5M in total finance costs, you have still preserved over $10M in value that would otherwise have been ceded to investors.

This is why many CFOs now view ARR loans as “bridge capital to a better round,” particularly when combined with other tools like flexible business lines of credit for working capital swings.

– Using ARR Multiples To Forecast Funding Capacity

With typical advance rates at 0.5x–1.5x ARR, it becomes straightforward to map ARR growth to future debt capacity. At $3M ARR and a 0.8x multiple, you might access $2.4M. At $6M ARR with the same multiple, that becomes $4.8M. Many lenders also structure accordion options that automatically increase your facility once you hit predefined ARR thresholds.

Navigating Covenants And Terms In Modern Debt Agreements

Covenants are where sophisticated borrowers separate themselves. The interest rate on the term sheetA document outlining the material terms and conditions of a is the headline; the covenants are the fine print that dictates how much flexibility you actually have during turbulence.

– Common Liquidity Buffers And Retention Requirements

Expect to see minimum cash covenants (3–6 months of runwayThe amount of time a company can operate before running out), minimum NRR (85–90%+), and maximum gross churn thresholds. Your job is to negotiate realistic cushions relative to your actual operating volatility. Running at 92% NRR and agreeing to a 90% floor leaves almost no room for a bad quarter; agreeing to an 85% covenantA condition or restriction placed on a borrower by a lender is far safer.

– The Strategic Benefits Of Interest-Only Periods

Interest-only periods are what make ARR loans truly growth-friendly. An 18‑month interest-only window at 12% on a $4M facility implies monthly payments around $40K while leaving the full $4M free to deploy into growth. Used wisely, this gives your customer acquisition engine time to turn borrowed dollars into durable ARR before amortizationSpreading loan payments or the cost of an intangible asset o kicks in.

📊 Case Study: Extending Runway To “Default Alive”

Profile: Early-stage SaaS at $3M ARR, 80% YoY growth, 14 months of runwayThe amount of time a company can operate before running out, 100% NRR.

Problem: Needed another 18 months to reach cash-flow breakeven but wanted to avoid a down-round in a weak equity market.

Solution: Closed a $2M ARR facility at 13.5% + SOFR with an 18‑month interest-only period and conservative covenants (85% NRR, 3 months cash minimum).

Results: RunwayThe amount of time a company can operate before running out extended to 32 months. CAC improved by 35%, payback went from 18 to 11 months, and the business achieved breakeven at $5.2M ARR. Management came back to market later with significantly more leverageUsing borrowed capital to finance assets and increase the po in equity negotiations.

Top ARR Loan Providers And Clickable Offers

The providers below are examples of the types of lenders active in the ARR and recurring revenue space. Always verify current terms and whether they operate in your geography and vertical.

| Lender | Min ARR | Typical Multiple | Interest Range | Key Features |

|---|---|---|---|---|

| SaaS Capital | $3M+ | 4–8x MRR | 10–13% + SOFR | Pioneered ARR lending; flexible lines, SaaS-only focus |

| Customers Bank | $2M+ | 0.5–1.5x ARR | 11–14% + SOFR | Full-service bank with dedicated ARR/MRR programs |

| Lighter Capital | $200K+ | Varies (up to $4M) | 12–20% effective | Hybrid term and revenue-based products; no equity or PGs |

| Arc | $1M+ | Custom | 10–15% | Banking plus non-dilutive advances against SaaS contracts |

| Novel Capital | $2M+ | 0.8–1.2x ARR | 11–14% | SaaS-exclusive, quick underwritingThe process of assessing risk and creditworthiness before ap, flexible structures |

| River SaaS Capital | $3M+ | 1–1.5x ARR | 10–13% + SOFR | Growth debt for recurring revenue businesses; hands-on support |

– Evaluating Beyond Rate Shopping

While interest rate matters, covenantA condition or restriction placed on a borrower by a lender strictness, prepayment penalties, warrant coverage, and flexibility in downturns often matter more. Ask how lenders behaved with portfolio companies during 2020–2022 or other volatile periods—that tells you more than any marketing deck.

As you compare options, keep an eye on how these facilities will sit alongside other tools like revolving business lines of credit and working capital LOCs. Your goal is a resilient, layered capital stack—not a single, oversized bet on one facility.

Key Takeaways

- ARR based loans can provide 0.5x–1.5x ARR as non-dilutive capital for companies with strong recurring revenue and retention

- Approval timelines are typically 3–6 weeks when lenders connect directly to your billing and ERP systems

- NRR, churn, and runwayThe amount of time a company can operate before running out matter more than GAAP profitability for ARR underwritingThe process of assessing risk and creditworthiness before ap

- Interest-only periods make ARR loans particularly powerful for SaaS-style CAC payback dynamics

- CovenantA condition or restriction placed on a borrower by a lender headroom is as important as the headline interest rate—negotiate realistic cushions

- Use ARR loans to bridge to a better equity round or fund M&A, not to paper over unclear product–market fit

- Combining ARR debt with lines of credit and revenue-based financingFinancing where investors receive a percentage of future gro can create a more flexible overall capital stack

Frequently Asked Questions

Ready To See Your ARR Loan Options?

If your self-assessment score suggests you may qualify, the next step is to see real terms based on your ARR, retention, and runwayThe amount of time a company can operate before running out.

Start A No-Obligation Application Schedule A 1:1 Capital Strategy CallAre You Really Ready for an ARR-Based Loan?

Tick the boxes that are true for your business and see how attractive you look to institutional ARR lenders right now.

- Check off what’s true today.

- Use the gaps as your short list for improving metrics before you borrow.