Managing Seasonal Cash Flow With a Business Line of Credit

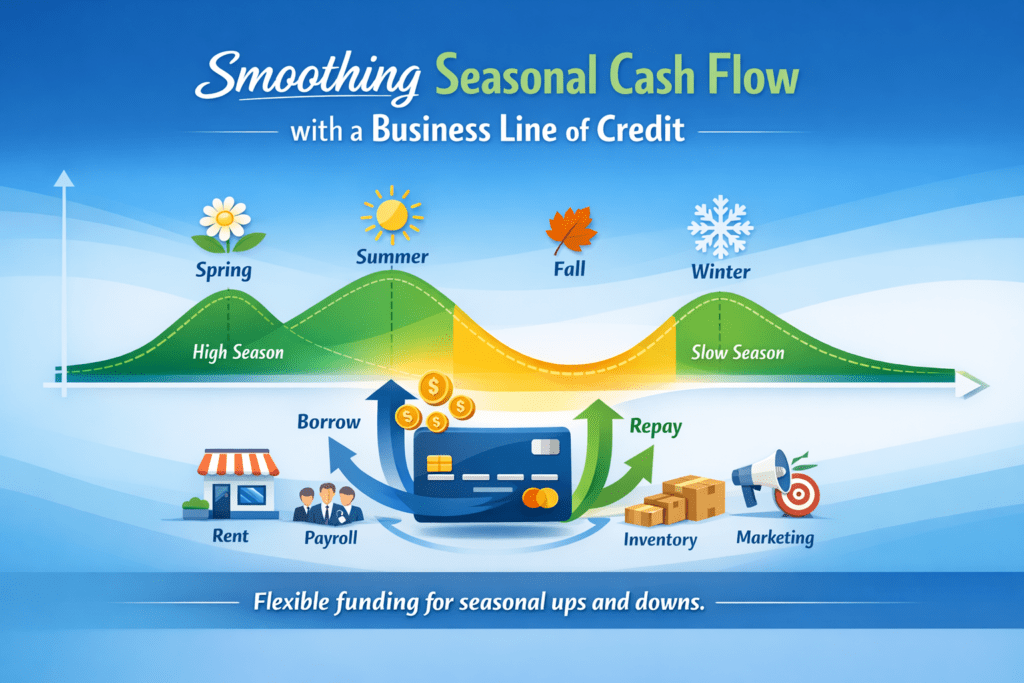

Managing seasonal cash flowThe net amount of cash moving in and out of a business. is one of the biggest challenges for real estate investors, contractors, e‑commerce brands, and small business owners. Revenue rises and falls throughout the year — but payroll, inventory, materials, and operating expenses don’t wait.

A business line of credit gives you flexible, on‑demand capital to smooth out these fluctuations so you can operate confidently during slow seasons and scale aggressively during busy ones.

What Is Seasonal Cash Flow?

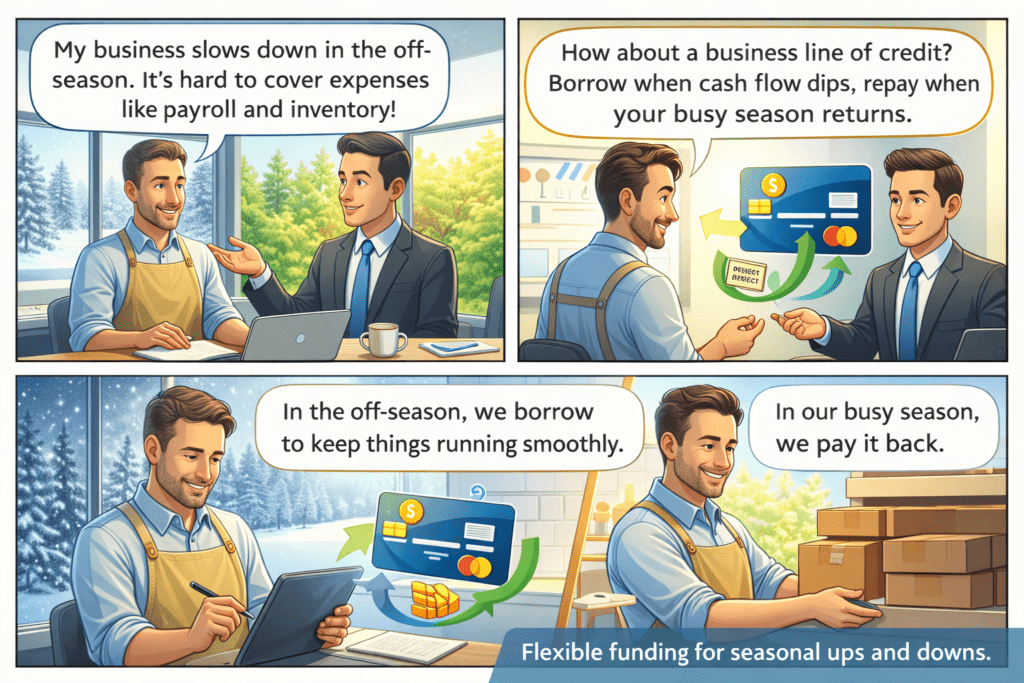

Seasonal cash flowThe net amount of cash moving in and out of a business. refers to predictable ups and downs in your revenue and expenses throughout the year. These patterns can be tied to weather, holidays, market cycles, or industry‑specific busy and slow periods. The challenge isn’t that the seasonality is unexpected — it’s that the timing of cash inflows rarely matches when you need to pay for inventory, labor, or materials.

When the slow months arrive, many businesses end up relying on high‑interest credit cards, vendor extensions, or simply delaying opportunities. A business line of credit is designed to bridge those gaps more strategically.

What Causes Seasonal Cash Flow Problems?

Seasonal cash flowThe net amount of cash moving in and out of a business. issues typically come from predictable patterns in revenue, expenses, or customer demand. The most common triggers include:

- Slow winter or summer months that reduce customer traffic

- Holiday‑driven spikes followed by sharp drop‑offs in orders

- Inventory cycles that require large upfront purchases

- Project‑based revenue with long payment timelines

- Weather‑dependent industries such as landscaping, HVAC, or roofing

- Market‑driven seasonality in tourism, retail, or real estate

None of these patterns are unusual — but without a plan to finance them, they can put pressure on your cash, slow growth, and create stress during the parts of the year that should be most productive.

Ready to Put a Business Line of Credit to Work?

If you’re actively doing deals and want flexible, repeatable funding, a quick conversation can clarify your ideal line size, structure, and next steps. No scripts, no call centers—just a strategy call focused on your pipeline.

- Discuss your current and upcoming projects

- See if a business line of credit fits your model

- Get a ballpark on potential limits and terms

Speak with a funding specialist:

Call Now: 888‑653‑0124

Typical call length: 10–15 minutes.

Ideal for investors already doing or planning multiple deals per year.

How a Business Line of Credit Helps You Manage Seasonal Cash Flow

A business line of credit acts as a flexible safety net that fills temporary cash flowThe net amount of cash moving in and out of a business. gaps without forcing you to take on long‑term debt. You can:

- Cover payroll during slow months

- Purchase inventory before peak season

- Fund materials for upcoming projects

- Bridge long invoice cycles

- Take advantage of seasonal opportunities

- Avoid high‑interest credit cards or merchant cash advances

You borrow only what you need — and only pay interest on what you use.

Business Line of Credit vs Hard Money Loan

Experienced investors often use both tools, but for different reasons. This comparison helps you see where a flexible business line of credit fits alongside deal‑specific hard money, especially when you’re trying to smooth seasonal cash flowThe net amount of cash moving in and out of a business. and keep multiple projects moving.

| Feature | Business Line of Credit | Hard Money LoanA short-term, asset-based loan usually secured by real estat |

|---|---|---|

| Speed to Funding | Once approved, you can draw funds quickly whenever you need them. | Fast per deal, but each property usually requires its own approval and underwritingThe process of assessing risk and creditworthiness before ap. |

| Flexibility of Use | Highly flexible: acquisitions, rehab, marketing, payroll, or general working capital. | Primarily tied to a specific property, purchase, or rehab budget. |

| Interest Structure | You pay interest only on the amount you draw, not on the full approved limit. | Interest typically accrues on the full loan amount from day one, often at a higher rate. |

| Best Use Case | Smoothing seasonal cash flowThe net amount of cash moving in and out of a business., funding multiple projects, and handling timing gaps between inflows and outflows. | Short‑term, high‑margin deals where you need to close quickly on a specific property. |

| Risk Profile | Can be structured to limit personal exposure and keep leverageUsing borrowed capital to finance assets and increase the po manageable across your portfolio. | Often higher cost and higher leverageUsing borrowed capital to finance assets and increase the po on a single deal; missed exits can compress margins quickly. |

| Impact on Personal Credit | When set up correctly as a business facility, it can help separate business use from personal credit. | Some lenders may still look at personal credit; late payments can impact your profile. |

| Scalability Across Projects | Designed to be reused across multiple projects and seasons without re‑applying each time. | Generally scaled deal‑by‑deal; each new project requires a new loan and closing process. |

Want a Line of Credit That Works With Your Deals?

If you’re already using hard money or other financing tools, a business line of credit can sit alongside them and smooth out the seasonal ups and downs. One short conversation can help you see whether this is a fit for your current pipeline and cash flowThe net amount of cash moving in and out of a business..

Call 888‑653‑0124 Prefer to talk later? Ask about timing your line around your next project.Seasonal Cash Flow Examples by Business Type

Real Estate Investors

- Cover renovation costs before resale

- Bridge gaps between closings

- Fund multiple projects simultaneously

E‑Commerce Brands

- Buy inventory before Q4

- Smooth out post‑holiday slowdowns

- Manage supplier lead times

Contractors

- Purchase materials upfront

- Handle weather‑driven slow seasons

- Keep crews paid during project delays

Small Business Owners

- Manage payroll

- Handle utility spikes

- Prepare for seasonal demand shifts

Seasonal Cash Flow Gap Calculator

Estimate how much flexible capital you may need during slow months.

Managing Inventory With Ease

Imagine turning your seasonal inventory challenges into a smooth sail, with ease. You can easily manage inventory for better seasonal cash flowThe net amount of cash moving in and out of a business. and management of uneven cash flows.

Flexible inventory systems allow you to adjust to demand without much stress. Track inventory in real time and mechanize tasks for stress-free management.

With a business line of credit, draw funds as needed for purchasing inventory. Enjoy the flexibility in drawing funds to cover what you require, when you need them.

Scale your operations, whether up or down, without breaking a sweat.

By having a reliable source of working capital, you can optimize your inventory management and improve cash flowThe net amount of cash moving in and out of a business. with working capital lines of credit.

Is a Business Line of Credit Right for Seasonal Cash Flow?

Pros

- Only pay interest on what you use

- Perfect for seasonal ups and downs

- Fast access to working capital

- Revolving credit you can reuse

Cons

- Requires revenue verification

- Lower limits than term loans

- Not ideal for long-term financing

Covering Fluctuating Staffing Costs

Now that you’ve handled those inventory hiccups, let’s turn our focus toward staffing, another beast in its own right, especially during the ups and downs throughout the season.

You can rely upon short-term borrowing, business lines of credit, to manage fluctuating staffing costs. Seasonal demand variations require flexibility, and businesses have cash flowThe net amount of cash moving in and out of a business. that comes and goes.

Using locs, you can steer through these fluctuations smoothly. Hiring extra staff during peak times needs cash, and off-season can create a cash crunch.

But don’t sweat it; with locs, you can borrow what you need, ensuring staff is never skimpy. Locs manage fluctuations, giving you the breathing room needed to thrive.

By maintaining a cash reserve, Mastering Seasonal Revenue becomes more achievable, as it allows you to make timely payments and invest in growth opportunities during peak seasons.

ROK Financial vs Bank of America

ROK Financial and Bank of America both offer funding options for small businesses, but they serve very different needs. This comparison highlights how each lender performs when speed, flexibility, and accessibility matter — especially for owners managing seasonal cash flowThe net amount of cash moving in and out of a business. or rapid growth cycles.

| Feature | ROK Financial | Bank of America |

|---|---|---|

| Speed to Funding | Fast approvals; funding often available within days depending on product. | Slower underwritingThe process of assessing risk and creditworthiness before ap; traditional bank timelines can take weeks. |

| Flexibility of Programs | Wide range of alternative lending options tailored to business needs. | More rigid product set with stricter qualification requirements. |

| Qualification Requirements | More accessible for newer businesses or those with variable cash flowThe net amount of cash moving in and out of a business.. | Higher credit, revenue, and documentation requirements. |

| Interest & Cost Structure | Costs vary by product; prioritizes speed and access over lowest rates. | Lower rates but limited flexibility; approvals can be restrictive. |

| Best Use Case | Businesses needing fast capital, seasonal support, or alternative options. | Established businesses with strong financials seeking traditional financing. |

| Scalability | Can scale quickly with business needs through multiple lending partners. | Scales slowly; requires re‑qualification and deeper financial review. |

Want a Line of Credit That Works on Your Timeline?

Whether you’re comparing ROK Financial, Bank of America, or other lenders, a business line of credit can give you the flexibility to handle seasonal dips, project timing gaps, and growth opportunities without waiting on slow underwritingThe process of assessing risk and creditworthiness before ap cycles.

Call 888‑653‑0124 Ask how a revolving line can support your next busy season.Funding Strategic Marketing Efforts

Given how well you’ve managed those inventory and staffing ups and downs, let’s shift towards the next big player: your marketing game. As seasons affect cash flowThe net amount of cash moving in and out of a business., consider these tips to fund your strategic marketing efforts: Be mindful of the true costs of business credit lines, including hidden fees, when allocating funds for marketing.

| Strategy | When | Why |

|---|---|---|

| Enhance Budget | Start of High-Growth | Capitalize on customer interest |

| Flexible Tools | Throughout Year | Adjust spending easily |

| Anticipation | Quiet Months | Prep for peak times |

Use lines of credit wisely, preparing ad placements ahead of time for peak times. Remember, the goal is to refine ROI by aligning marketing efforts with periods of high customer interest. It’s time to convert that interest into sales.

Handling Unforeseen Expenses Gracefully

Sometimes, no matter how well you plan, surprises pop up and throw a wrench in your finances. You could have a small but costly emergency, like an unexpected machinery repair.

To handle these effortlessly, build an emergency fund by setting aside part from your revenue monthly. Keep your checking accounts organized with sub-accounts for different expenses.

If unexpected costs pop up, open a dedicated credit card for emergencies and apply for a business line from credit. Use that wisely to manage payroll or purchase extra inventory without straining your regular cash flowThe net amount of cash moving in and out of a business..

Keep your warranties and insurance current, and consider negotiating better payment terms with suppliers. You’ll sleep better knowing you’re ready for whatever comes next. Having a Business Equity Line of Credit in place can provide an additional layer of financial flexibility during these times.

Effective Planning for Cash Flow

Analyze your seasonal cash flowThe net amount of cash moving in and out of a business. patterns in order to predict peaks and valleys effectively.

Regularly monitor credit lineA flexible loan allowing a borrower to access funds up to a usage to avoid unnecessary debt.

Prioritize your repayment strategy in order to maximize savings and handle off-peak demands.

Establish a cash reserve to mitigate the impact of cash flowThe net amount of cash moving in and out of a business. gaps and ensure a steady flow of funds during slow periods.

Analyze Seasonal Patterns

To get a firm grip on your cash flowThe net amount of cash moving in and out of a business. through the seasons, it’s crucial that we investigate some serious pattern recognition.

- Dig into past financial data. Check those numbers to see revenue and expense highs and lows.

- Recognize external trends. If your own data’s lacking, look at the industry trends for clues.

- Spot specific triggers. Figure out what exactly causes those ebbs and flows.

- Forecast like a pro. Use data and trends to predict future cash coming in and going out.

You’re now seeing the patterns in cash flowThe net amount of cash moving in and out of a business., not just the random cash dance.

Monitor Usage Regularly

Kickstart effective cash flowThe net amount of cash moving in and out of a business. planning by regularly monitoring your business’s cash flowThe net amount of cash moving in and out of a business. needs. Identify those tricky high and low periods through past data and trends.

Use cash flowThe net amount of cash moving in and out of a business. monitoring tools to generate reports, showing where your money comes and goes. It’s like having a financial detective, helping you identify irregularities early.

Control costs wisely to build reserves for the tough times. Don’t just hope for the best with payables; negotiate smart terms with suppliers.

Stay vigilant against financial risks, ensuring your business stays afloat. It’s all about turning chaos into calendar-driven confidence.

Prioritize Repayment Strategy

Effective planning can keep your cash flowThe net amount of cash moving in and out of a business. moving smoothly.

Here’s how to prioritize repayment strategy:

- Align repayment with cash flowThe net amount of cash moving in and out of a business.; set aside some profits during busy times.

- Budget realistically; forecast incomes using past data and trends.

- Focus upon smart borrowing; use the line of credit for big-impact needs, not everything.

- Repay smartly; don’t get stuck in slow periods by borrowing too much.

You’ve got that! Keep your finances in check and ride the waves of seasonal cash flowThe net amount of cash moving in and out of a business.!

Monitoring Credit Usage and Repayments

Monitoring credit use isn’t just about keeping tabs; it’s your business’s radar for potential pitfalls. Regular monitoring helps you catch errors and unauthorized activities before they spiral out of control. It’s like checking your rearview mirror before making a turn.

Don’t let incorrect data steer your business off-course. Align your credit moves with your seasonal cash flowThe net amount of cash moving in and out of a business. to avoid bumps along the road. You’ll keep your business stable through every season that way.

Ultimately, use tools that alert you regarding changes or suspicious activity, so you can stay ahead of any trouble. Monitoring ain’t just boring; it’s smart business. Effective credit management, including cash flowThe net amount of cash moving in and out of a business. forecasting, is crucial to maintaining a healthy business line of credit.

Prioritizing Debt Management With Seasonal Income

When seasonal cash flow’s as fickle as a cat in a sunbeam, managing debts can feel like you’re walking a tightrope.

- Assess debts: Identify interest rates and repayment terms.

- Prioritize high-interest debts: Pay them off initially to minimize interest paid.

- Boost payments during peak times: Use profits from high earnings to pay down debt.

- Reserve during off-peak: Set aside funds during slow seasons to cover debts.

Effective debt management requires a clear understanding of the Debt-to-Equity RatioA ratio comparing a company's total liabilities to its share, which can help businesses make informed decisions about their credit utilization.

Integrating With Broader Financial Strategies

You’re juggling bills and budgets, so aligning your credit lineA flexible loan allowing a borrower to access funds up to a with overall financial strategies makes sense.

Consider how your credit usage impacts cash reserves and daily operations.

Think about the combined benefits from credit, cash flowThe net amount of cash moving in and out of a business., and reserves for a resilient financial plan.

Having a business line of credit can provide a financial cushion during seasonal fluctuations, ensuring that you can meet your financial obligations on time.

Budgeting and Credit

Combining your credit lineA flexible loan allowing a borrower to access funds up to a with broader budgeting is where the magic happens.

Initially, recognize the value in blending these tools:

- Set goals grounded in seasonal peaks.

- Align repayments with your cash flowThe net amount of cash moving in and out of a business. patterns.

- Balance your credit use with other financial goals.

- Prepare for unexpected expenses.

Imagine keeping your business steady like a tightrope walker, using credit wisely during your lean months.

You’ll be prepared and in sync, no matter the season.

Credit and Cashflow

Integrating credit and cash flowThe net amount of cash moving in and out of a business. requires a strategy that keeps your business breathing smoothly. Use lines of credit wisely to steer through seasonal fluctuations. Here are key points in a table:

| Factor | Strategy |

|---|---|

| Flexible Financing | Access credit during peak and off-peak seasons |

| Cash FlowThe net amount of cash moving in and out of a business. Alignment | Match repayment with cash flowThe net amount of cash moving in and out of a business. peaks |

| Inventory & Staffing | Adjust with your fluctuating needs |

Optimize your credit and cash flowThe net amount of cash moving in and out of a business. for a balanced approach in financial health.

Adjusting to Market Trends and Historical Patterns

Modifying for market trends and historical patterns can be a bit like trying to predict the weather in a place with four seasons all in one day.

- Identify peaks and valleys: Know when you’ll be swimming in cash and when you’ll be treading water.

- Look back for clarity: Analyzing past data provides understanding into what lies ahead.

- Don’t ignore industry trends: Different seasons bring different needs and opportunities.

- Beware of regulatory constraints: Sometimes, you can’t do what you want, when you want.

You’ve got to plan and remain versatile to stay afloat. Having a business line of credit in place can help you navigate these fluctuations by providing flexible access to capital when you need it most.

Frequently Asked Questions

What Is the Typical Interest Rate for a Business Line of Credit?

What’s the usual interest rate for a business line for credit? This ranges from 8% through 9.15%, influenced by credit score, repayment history, and economic conditions. Higher rates apply for online loans.

How Quickly Can a Line of Credit Be Accessed?

You can access a line for credit swiftly, typically within 24 until 48 hours from approval. Some lenders, like American Express and OnDeck, make funds available instantly or the same day. Quick access aids in managing immediate financial needs effectively.

Can a Business Line of Credit Be Extended?

Can a business line of credit be extended? Yes, this can be expanded depending on creditworthiness and terms. Most lenders review your performance and can renegotiate terms. It’s essential to maintain good payment history and discuss needs with your provider.

What Credit Score Is Needed to Qualify?

In order qualify for a new credit lineA flexible loan allowing a borrower to access funds up to a, you’ll need a good credit score. Traditional lenders often require a minimum of 680. Online lenders may accept lower scores; you’ll need at least 600. Your credit score directly impacts approval and loan terms.

Are There Any Fees for Unused Credit?

Don’t forget, unused credit can cost you up to 0.75% annually! Are there any fees for unused credit? Yes, and you’ll pay them unless you fully employ your line. Fees vary from 0.10% to 0.75% for the idle portion.