Hard money loans have become an increasingly popular financing option for real estate investors, entrepreneurs, and business owners looking to fund projects or opportunities that don’t qualify for traditional bank financing.

But what exactly are hard money business lenders, and could they be the right solution for your capital needs?

Key Takeaways:

- Hard money loans from alternative lenders provide faster, more flexible financing than traditional banks.

- Speed and access to capital make them ideal for real estate investments and time-sensitive business opportunities.

- The focus is on equity in the underlying collateral rather than borrower credit scores.

- Higher interest rates compensate lenders for increased risk with hard money loans.

- Thoroughly researching lenders’ reputations and loan terms is crucial to getting the best financing deal.

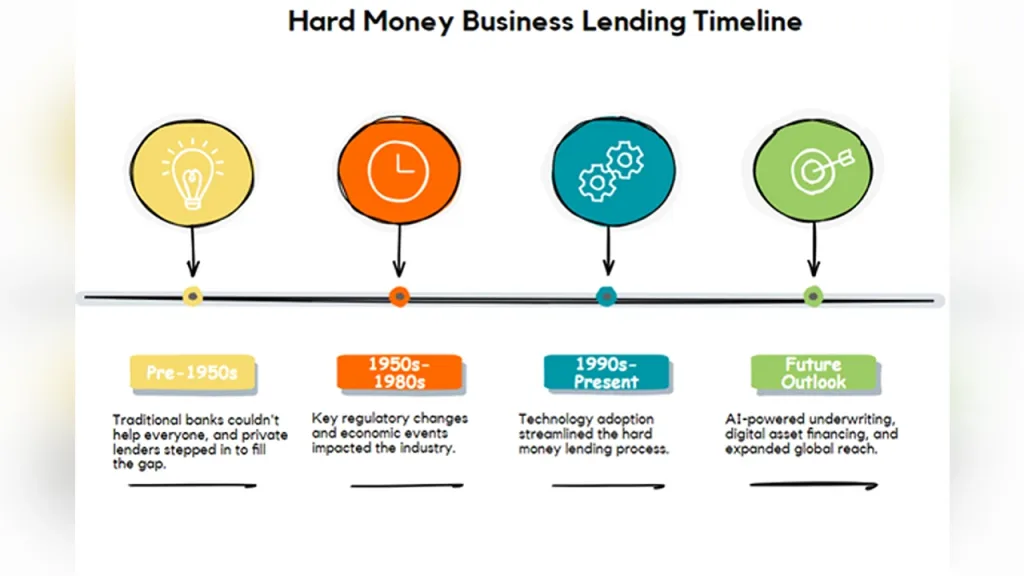

What is Hard Money Business Lending?

Hard money loans are a type of asset-based lending collateralized by real estate.

Unlike traditional bank loans, hard money lenders focus primarily on the value of the underlying asset rather than the borrower’s credit score or income.

Some key characteristics of hard money loans include:

- Higher interest rates – Typically ranging from 7% to 15%, compared to 4-6% for conventional loans. The higher rate compensates lenders for the increased risk.

- Shorter terms – Hard money loans usually have terms of 6 months to 3 years. This provides faster payoff and minimizes lenders’ exposure.

- Fast funding – Borrowers can often access funds in as little as a few days, compared to weeks or months with banks. Speed and flexibility are the hallmarks of hard money loans.

- Collateral-based – Hard money lenders focus on the market value and equity in the property rather than the borrower’s creditworthiness.

While hard money loans fill an important niche, the higher costs mean they are best utilized for short-term projects where speed and flexibility are critical.

They can serve as a bridge to longer-term, lower-cost financing.

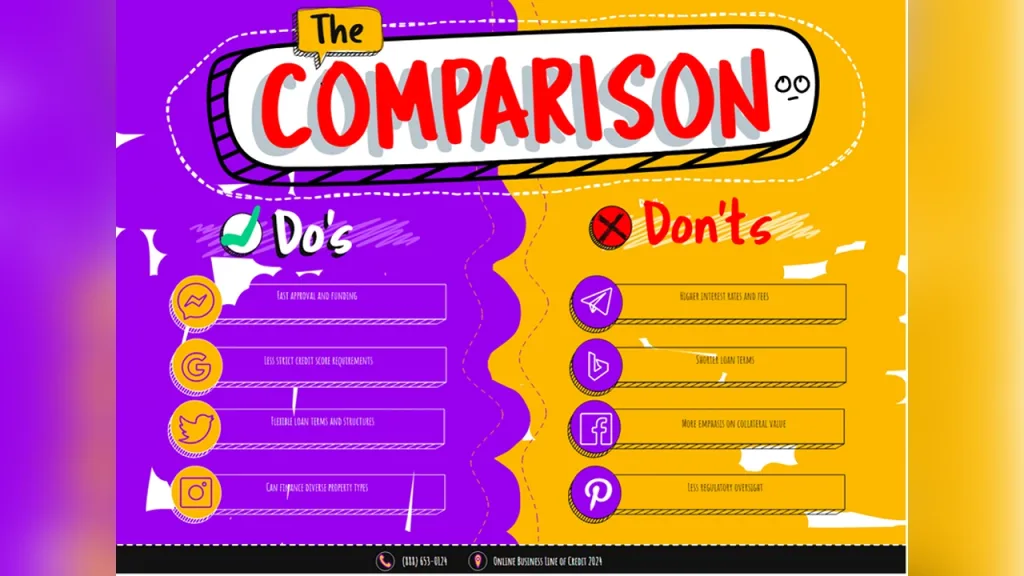

Hard Money vs Traditional Lending

| Hard Money Loans | Traditional Bank Loans |

|---|---|

| Focus on collateral value | Focus on borrower’s income and credit |

| Short terms of 0-3 years | Long terms of 15-30 years |

| Fast funding in days | Slower approval takes weeks/months |

| Higher interest rates | Lower interest rates |

| Fewer loan qualifying requirements | Stricter income and credit requirements |

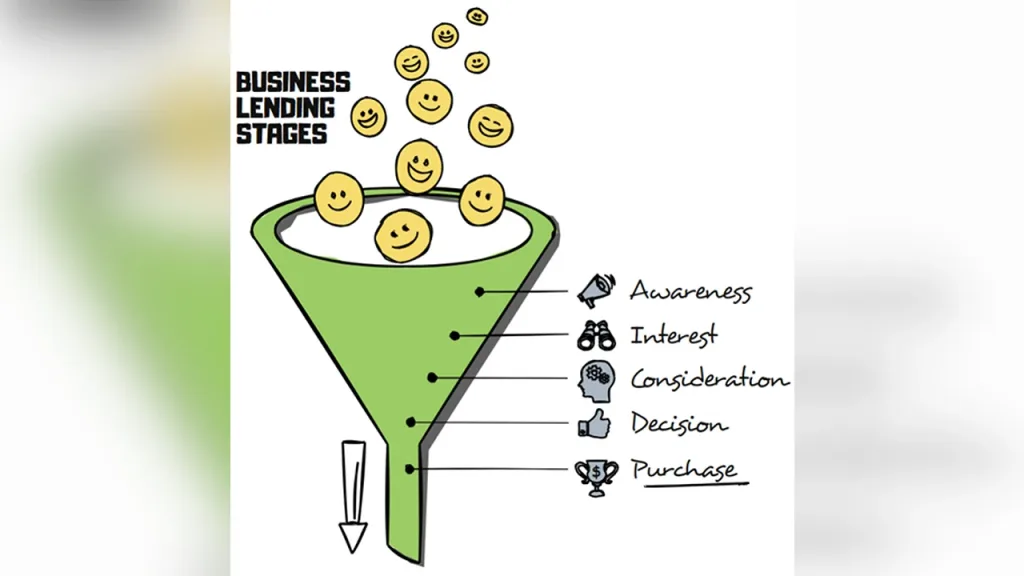

When Do Businesses Use Hard Money Loans?

There are several common scenarios where securing a hard money loan can be advantageous for business owners and real estate investors:

Bridge Financing

Hard money loans are often used as short-term bridge financing while waiting for an approved loan from a traditional lender or other longer-term funding.

The flexibility and fast access to capital allow borrowers to seize time-sensitive opportunities.

Property Rehab Projects

For real estate investors financing rehab projects or fix-and-flip properties, hard money loans provide the capital to fund repairs and renovations quickly so the property can be resold for a profit.

Purchase Short Sales/Foreclosures

Hard money lenders will fund the purchase of distressed properties, enabling investors to buy short sales and foreclosures at a discount and get them income-producing more rapidly.

Emergency Business Funding

Startups or existing businesses can use hard money loans to access quick capital for growth opportunities, expansions, equipment purchases, inventory, payroll, or other urgent needs.

Credit Challenges

Business owners with past credit issues who don’t qualify for traditional financing may still be approved for a hard money loan based on the strength of their collateral.

In all of these scenarios, the speed and flexibility of hard money loans provide an advantage over conventional lending.

As long as there is sufficient equity in the collateral, borrowers can gain access to capital quickly.

Key Criteria Hard Money Lenders Evaluate

While approval is primarily based on collateral value, lenders still carefully assess the overall risk factors involved:

Loan to Value Ratio (LTV)

The loan amount is a percentage of total property value. Most lenders require an LTV of 65-75%. A lower LTV means lower risk.

Experience

The skill and track record of the sponsor/borrower. Experienced real estate investors are preferred.

Exit Strategy

A realistic payoff plan for the loan like selling or refinancing within the term. The viability of the exit strategy is crucial.

Business Plan

For business funding requests, lenders examine financial projections, use of funds, and growth opportunities. Strong plans get approved.

In addition to collateral value, hard money lenders want to see experienced sponsors and well-conceived business plans that ensure loans will perform.

Common Hard Money Loan Structures

Hard money loans can be structured in different ways depending on the specific project and the lender. Two primary types are:

Single Close Loans

The lender provides the full amount borrowed upfront in a single disbursement. Simple but fewer funds available.

Two Close Loans

A portion is disbursed initially, and the rest after repairs are completed per an inspection. More due diligence but more capital.

Creative lenders work with borrowers to customize loans to fit their needs. Communicating your unique situation is key.

Case Study: Hard Money Success for Real Estate Investors

James is a real estate investor looking to purchase and renovate a small apartment building. After being denied for traditional financing due to a recent foreclosure, he turned to a private hard money lender.

The lender approved James for 75% of the $400,000 purchase price of the property. The 30% down payment requirement and James’ previous experience with similar projects satisfied the lender’s loan criteria.

The hard money loan had a 12% interest rate with an 18-month term. This provided ample time for James to renovate the apartments and either sell or refinance the building after rents increased.

In the end, James successfully renovated and sold the property for a $200,000 profit after paying back the loan. The fast funding and flexibility of the hard money loan enabled him to take advantage of this lucrative real estate opportunity.

Types of Properties Funded by Hard Money Loans

While commercial and residential real estate are most common, hard money lenders also provide financing for more specialized property types:

- Retail buildings – Grocery stores, shopping centers, restaurants

- Industrial properties – Warehouses, manufacturing facilities, self-storage

- Healthcare buildings – Doctor’s offices, dental clinics, urgent care centers

- Mixed-use developments – Combine commercial and residential

- Land development – Raw land, subdivision sites, infill parcels

Experienced hard money lenders are available that specialize in funding these niche real estate assets.

They understand the unique aspects and risks involved.

Finding and Vetting Hard Money Lenders

With hundreds of active hard money lenders, you must do your due diligence to find an ethical, experienced provider.

Here are key considerations in choosing a lender:

- Track record – Look for years in business and low default rates

- Competitive rates – Shop and compare interest rates and fees between lenders

- Industry expertise – Select a lender familiar with your type of project

- Strong communication – Ensure openness and transparency throughout the process

- No prepayment penalties – Avoid lenders charging hefty penalties for early payoffs

Take the time to research lender reputations, better terms could save tens of thousands in interest costs.

Leverage hard money loan brokers to compare multiple loan options.

Can Hard Money Loans Benefit Your Business?

For business owners and real estate investors who value speed, flexibility, and access to fast financing, hard money loans can provide the capital needed to maximize opportunities and grow your company.

Just be sure to plan your exit strategy, vet lenders thoroughly, and only utilize these higher-cost loans for their intended short-term purpose.

With the right planning, hard money can be the gateway to creating true financial success.

Navigating the Ethical Landscape of Hard Money Lending

While hard money loans serve an important role for underserved borrowers, the industry has also faced criticism around potentially predatory lending tactics.

Responsible borrowing and ethical lending practices are essential to provide affordable financing options without exploiting vulnerable borrowers.

Avoiding Predatory Lending Practices

Reputable hard money lenders aim to steer clear of predatory practices, but borrowers should watch for potential red flags like:

- Excessively high-interest rates and fees well above industry norms

- Misleading marketing or understating rates, costs, and conditions

- Encouraging borrowers to repeatedly refinance and incur more fees

- Charging excessive prepayment penalties that trap borrowers

- Overvaluing collateral to make loans appear less risky

Avoid lenders engaging in deception or manipulating unsophisticated borrowers into unaffordable loan terms.

Seek out transparent lenders who deal in good faith.

Promoting Ethical Standards

Industry groups promote stronger oversight and standards for hard money lending:

- The National Association of Private Lenders (NAPL) advocates for ethical practices through its code of ethics. Members must offer clear loan disclosures and reasonable rates.

- The American Association of Private Lenders (AAPL) provides resources and education to improve lending practices. Their ethical guidelines prohibit misleading marketing and excessive fees.

These groups provide certifications and continuing education to help lenders operate responsibly. Look for affiliated lenders.

Community Impact of Hard Money Lending

Hard money lending has complex effects on local communities:

Potential Benefits:

- Revitalizes neglected neighborhoods by funding rehabilitation projects ignored by banks

- Provides access to credit for new businesses to stimulate economic growth

- Allows property owners to tap equity to avoid foreclosure and stay in their homes

Potential Drawbacks:

- Can facilitate predatory real estate speculation and practices like house flipping

- Risks expanding a “bubble” if excess leverage promotes unsustainable price growth

- Higher costs may make loans unaffordable for lower-income borrowers

Ultimately, hard money lending requires conscientious oversight to promote sustainable community development rather than heightened speculation and risk.

Technology and Innovation in Hard Money Lending

Hard money lenders are leveraging new technologies to improve processes and expand access:

- Online marketplaces like ROK Financial allow borrowers to compare loan options from multiple lenders. This increases transparency.

- Automated valuation models analyze property data to quickly assign collateral values to speed underwriting.

- Blockchain applications securely store loan documents and payments, reducing costs.

- Big data analytics help assess risks and determine appropriate pricing based on past performance.

- Digital closings provide faster, more convenient document signing and funding 24/7.

These innovations provide borrowers with more financing options through lower costs and added convenience.

They help responsible lenders scale while still managing risks.

Regulations and Compliance Considerations for Hard Money Lending

While hard money lending is less regulated than banking, important regulations still apply around disclosure, reporting, and licensing.

Key Federal Regulations

- Truth in Lending Act (TILA) – Requires lenders to disclose APR, payment terms, and total costs. Ensures transparency.

- Equal Credit Opportunity Act – Prohibits discrimination in lending based on race, gender, and other protected categories.

- Dodd-Frank Act – Requires lenders to verify borrowers’ ability to repay mortgages. Aimed at curbing abusive practices.

State-Level Regulations

- Licensing – Most states require lenders to obtain licenses proving they meet standards. Unlicensed lending may be illegal.

- Maximum rates and fees – Many states set caps on interest rates and origination fees lenders can charge.

- Disclosure rules – Some states dictate upfront disclosures lenders must provide to borrowers outlining rates/terms.

Borrowers should research their state’s specific regulations and only work with properly licensed lenders.

Risks of Non-Compliance

Failure to comply with applicable laws and regulations entails serious risks for both lenders and borrowers:

- Lawsuits, fines, and license revocation for non-compliant lenders

- Voided loans and unenforceable loan terms

- Criminal penalties for unlicensed lending activity

Reputable hard money lenders make compliance a top priority to avoid litigation and ensure loans withstand legal scrutiny. Do your due diligence on licensing.

A Valuable Financing Tool When Used Responsibly

Hard money business lenders provide critical fast financing to underserved borrowers, sparking economic and community growth.

But higher costs also pose risks without prudent controls.

By fostering transparency, upholding standards, using technology responsibly, and promoting ethical conduct, the hard money lending industry can provide faster access to capital while avoiding predatory practices.

With strategic diligence, hard money loans unlock opportunities often stalled by traditional financing. Far from a last resort, they offer sensible funding for productivity and prosperity.

Hard Money Business Lenders Poll

We want to learn more about your financing needs and experience with hard money loans.

Question 1

What types of projects do you need financing for?

Question 2

How much are you looking to borrow?

Thank you for completing the poll!

Want to learn more about your hard money lending options?

Schedule a free consultation