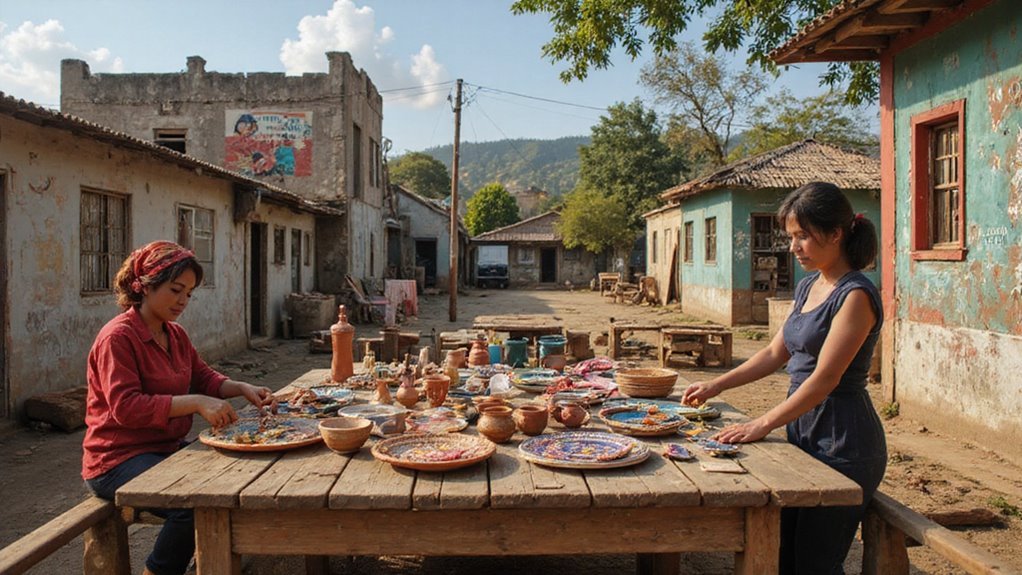

If you’re a rural artisan, locating credit lines can feel like trying to squeeze water from a stone—traditional banks want collateral you probably don’t have. Luckily, microfinance institutions and local cooperatives offer loans without the usual hoop-jumping, often trusting communities over paperwork. Additionally, government programs may provide low-interest options if you fit certain income and business criteria. Need to enhance your chances? A smart business plan and some financial know-how go a long way. Keep going, and you’ll uncover how tech and supportive policies make it easier than ever.

Key Takeaways

- Rural artisan credit lines provide collateral-free loans with flexible repayment tailored to artisans’ irregular income patterns via microfinance institutions.

- Government programs offer low-interest loans, easing eligibility with income limits and focus on notified minority communities for rural artisans.

- Local cooperatives and community-based models emphasize trust over collateral, enhancing artisans’ access to funding and economic growth.

- A comprehensive business plan with financial training citations boosts artisans’ loan eligibility and supports risk assessment.

- FinTech innovations like digital lending platforms and peer-to-peer models accelerate loan access and improve credit evaluation transparency for artisans.

The Financial Gap Stifling Rural Communities and Handmade Goods

You probably know that traditional banks love collateral, but when you’re an artisan with skills instead of land deeds, that wall feels pretty high—and pretty unfair. From a banker’s perspective, small-scale artisan businesses seem risky and hard to gauge, making them tough for them to get the assistance they need. Yet, such underfunding doesn’t just hold back individuals; it slows down entire rural economies and dims the bright future of handmade goods you and your neighbors work hard to create.

The Collateral Barrier: Why Traditional Banks Exclude Artisans

While traditional banks claim in support of small businesses, they often shut the door at rural artisans before they even step inside. Their rigid eligibility criteria and demand for collateral—something you likely don’t have—make access to financing nearly impossible. That’s where rural artisan credit lines shine. Offered by microfinance institutions and backed by government support, these collateral-free loans rethink risk assessment. They trust your expertise and community rather than land deeds or bank statements. Without them, artisans remain sidelined investors in their own talent.

Here’s why traditional banks create barriers:

- Require extensive documentation

- Demand physical collateral

- Label uncertain income as “high risk”

- Overlook community-based trust models

- Lack personalized government-supported programs

It’s time for smarter lending—your artistry deserves a fighting chance.

A Banker’s View: The Perceived Risk of Funding a Small-Scale Enterprise

Even though banks are supposed to support small businesses, they often see rural artisans as too risky for funding. When artisans apply for loans to grow their handmade goods enterprises, banks assess credit risk based heavily on collateral concerns and formal documentation—things that artisans usually don’t possess. This leaves many talented creators stuck. But here’s the silver lining: microfinance institutions offer financing customized for these unique realities, often providing low-interest financing options. Programs like the credit guarantee scheme help banks feel safer by covering part of the risk, making it easier to fund small-scale enterprises. Sustainable financing strengthens communities by turning skills into thriving businesses. So, while banks still hesitate, the rise of innovative lending models is changing the game for you and fellow artisans.

The Macro View: How Underfunding the Craft Sector Slows Economic Development

Small loans from microfinance institutions may be a lifeline for many artisans, but when you look at the bigger visual, the trade sector still faces a major money squeeze. Rural communities remain trapped by insufficient funding and limited market access, which stalls economic development and income generation. Sure, artisan credit lines offer attractive interest rates, but the cap and rigid criteria restrict their impact and financial integration for rural populations. This bottleneck can keep talented creators stuck in the shadows instead of scaling up.

Consider these obstacles holding back progress:

- Maximum loan caps too low for growth

- Eligibility rules excluding near-poor artisans

- Lack of awareness about loan schemes

- Inconsistent income complicating repayments

- Limited channels for selling handcrafted goods

Without broader support, the financial gap will keep rural trades from truly thriving.

The Architecture of Artisan Financing: Lenders and Mechanisms

You might be wondering who actually puts money into the hands of rural artisans and how that whole process works. Well, this is a mix of microfinance institutions that often use group lending, governments and development banks offering low-interest loans, and local cooperatives stepping up with grassroots funding. Understanding these players and their methods isn’t just important—it’s the secret sauce that helps skilled hands keep creating and growing their businesses.

Microfinance Institutions (MFIs): A Look at Individual and Group Lending

Microfinance Institutions, or MFIs for short, are like the friendly neighborhood helpers from the financial world, especially when they concern artisans in rural areas who don’t fit the traditional banking mold. They offer accessible credit through individual or group lending, turning your trade into a thriving business. Group lending, in particular, lets you and your fellow artisans guarantee each other’s loans, easing repayment worries and enhancing community development. With flexible repayment terms, microfinance enables you not just with money but with stability and economic enhancement.

Here’s why MFIs rock for artisans like you:

- No need for fancy collateral

- Group lending builds trust and lowers risk

- Credit access fuels growth

- Repayment terms fit your cash flow

- Sparks community-driven success and enhancement

Governments and Development Banks: The Source of Low-Interest Financing

While banks often seem like great places for obtaining loans, they’re usually not our initial choice when referring to rural artisans needing affordable credit. Government loans for rural artisans, especially through development banks, offer low-interest rates around 5% and flexible, accessible loan terms designed just for you. The eligibility criteria for artisan credit lines focus on your family income, making sure help reaches those who truly need assistance. The application process is straightforward, with minimal or no collateral requirements—think self-guarantees and simple trusts rather than complicated paperwork. These artisan credit lines aren’t just about money; they spark the economic empowerment of artisans, allowing you to invest in tools and materials without bank obstacles. So, if you want finance that understands your handiwork, look to these government-backed programs initially.

Grassroots Capital: How Local Cooperatives Provide Accessible Funding

Because local cooperatives are rooted right in your community, they offer an invigorating alternative for the cold, formal world from big banks. They use the community banking model to pool resources and provide accessible funding through micro loans customized for artisan initiatives. With joint responsibility at their core, these community credit enterprises enhance accountability while nurturing trust among members. Additionally, partnerships with micro-financing institutions mean more capital flows your way to grow your craft. Here’s why local cooperatives shine:

- They require little to no collateral, focusing on community trust.

- Micro loans enable you to invest in essential materials and tools.

- Group lending reduces fear and shares financial risk.

- Collaboration sparks innovation and expands market access.

- They build your credit history, revealing bigger opportunities.

Ready to tap into grassroots capital? These cooperatives make it possible.

A Practical Guide to Securing Capital for Your Craft Business

Acquiring a loan might sound like filling out endless paperwork and decoding secret banker language, but it’s actually simpler than you think once you know what is expected. Initially, you’ll want to check if you meet the eligibility rules and gather the right documents—no crystal ball needed. Then, by sharing a clear business plan and understanding how repayments work, you’ll dodge surprises and keep your trade business growing without sweating the interest rates. Additionally, exploring credit lines designed for rural and sustainable businesses can provide capital tailored specifically to your needs.

Decoding Eligibility Criteria and Documentation Needs

Wondering what that truly entails for a rural artisan credit line? To get started, you’ll need to meet specific eligibility criteria and gather the right documentation, which might feel like a mini-adventure in paperwork. For artisan credit lines, here’s the nutshell: you must belong to a notified Minority community, keep your annual family income below Rs. 98,000 (rural), and show you don’t already have government loans. Additionally, having a solid business plan enhances your chances. Smaller loans up to Rs. 1,00,000 often need just a self-guarantee and post-dated cheques; bigger ones may require collateral.

Remember these key points:

- Confirm Minority community status and income limits

- Provide proof of no existing government loans

- Present a feasible business plan

- Understand self-guarantee vs. collateral needs

- Highlight your participation in Hunar Haat exhibitions

This document dance is your ticket for sustainable livelihood creation!

Navigating the Risk Assessment with a Strong Business Plan

While creating a business plan might sound like a chore, that is actually your secret weapon when applying for a rural artisan credit line. It shows lenders you’re serious about your small-scale business and helps nail down your loan eligibility. Lay out your craft’s market potential, financial needs, and how you’ll use the funds—whether for materials or equipment. Don’t forget to explain your repayment plan, including that handy 6-month moratorium and five-year schedule. That kind of transparency eases lenders’ worries about risk. Furthermore, if you’ve attended any financial training, mention it—it amps up your credibility. Think of your business plan as a roadmap, proving your artisanship isn’t just passion, but a sustainable venture ready to grow. Who knew paperwork could be such a source of empowerment?

Understanding Repayment Terms and Managing Interest Rates

Before you plunge into borrowing, the situation assists in truly understanding how repayment terms and interest rates function—because recognizing that can signify the difference between smooth sailing and financial headaches. When artisans create handmade products, knowing your microfinance loan’s affordability is key. Government loans for rural artisans usually offer attractive interest rates, like 5% simple interest annually, with women even getting a 1% discount. Additionally, a 6-month moratorium gives you breathing room before repayments. Keep these in mind:

- Maximum loan up Rs. 10 lakhs with 90% funding

- Repay over 5 years in easy quarterly installments

- Loans under Rs. 1 lakh need minimal security

- Repayment deadlines fall last day Mar, Jun, Sep, Dec

- Late payments mean penalties—so stay sharp!

Master these terms, and your credit line won’t create surprises—just opportunities.

Beyond Money: The Non-Financial Support That Ensures Success

Getting a loan is just the initial step—you also need the know-how to apply that money for your benefit. Learning business skills and understanding how to reach new customers can turn your trade from a hobby into a thriving enterprise. After all, even the best potter needs a little marketing magic to get their pots off the shelf!

The Value of Financial Literacy and Business Skills Training

Because having money in hand is just part within the puzzle, understanding how to manage it wisely makes all the difference when you take out a credit line. Financial literacy and business skills training enable you to turn a loan into lasting success. These tools amplify repayment rates and strengthen your entrepreneurship development, ensuring income generation that actually sticks. When artisans like you learn budgeting, pricing, and market knowledge, your credit lines become more than just borrowed money—they’re launchpads for growth.

Here’s what smart training can do for you:

- Sharpen budgeting and financial management

- Improve loan repayment confidence

- Enhance market access via customer understanding

- Develop negotiation and inventory skills

- Build a foundation for lasting business growth

Master these, and you’re not just creating goods—you’re shaping your future.

Forging Pathways to Broader Market Access

While having a loan in hand gives you the fuel to start your engine, steering your way into bigger markets is what really sets your trade along the path toward success. Lenders provide credit to artisans not just to fund small businesses but to strengthen community-focused growth. You might wonder, “Where can I find financing for my creation business that also enhances market access?” The answer goes beyond cash—think training, joint marketing through cooperatives, and shared production spaces. These support traditional crafts and skills while helping you manage risk-mitigation by connecting you with steady buyers. When you blend credit lines with real-world market access, you’re not just selling a product—you’re forging a pathway to lasting success with a community backing your every step.

Measuring the Real Impact of Artisan Credit Lines

You might think that handing out loans is the whole story, but the real impact shows up when those loans enhance incomes and build stronger communities. When you see artisans not just earning more but feeling genuinely strengthened, that’s when credit lines earn their keep. Let’s investigate how these numbers and stories connect to real change within the community.

Data Focus: The Link Between Financing and Income Generation

When artisans gain access to specially designed credit lines, their potential for enhancing income doesn’t just improve—it often leaps forward in surprising ways. Thanks to governments supporting rural development and affordable artisan credit lines with low interest rates, financing becomes a real transformative factor. These loans help artisans buy better tools and materials, sparking tangible income generation and uplifting community development.

Here’s what you can expect from these enabling credit lines:

- Loans up to Rs. 10 lakhs elevate production capacity.

- Preference for Hunar Haat participants connects artisans directly to markets.

- Simple 5% interest rates keep repayments manageable.

- Strict income caps guarantee targeted support for those who need it most.

- Increased income stability helps artisans plan for growth.

This is innovation you can see in action—proof that affordable financing creates real impact.

The Empowerment Effect: Financial Inclusion and Community-Focused Development

Although financial access might sound like a buzzword, this actually opens up real opportunities for rural artisans who’ve long been left out from traditional banking. Artisan credit lines with low interest rates—like those supporting Self Help Groups—are overcoming obstacles, making financial integration more than just a catchphrase. You see, these artisan loans don’t just provide money; they ignite community development by enabling women and rural communities to grow together. Imagine a group of weavers pooling resources, enhancing their skill without worrying about hefty collateral. That’s women empowerment—and it’s real. These credit lines create a circle of support that helps artisans innovate, scale, and thrive. So, next time you hear about artisan loans, think about the ripple effect: stronger communities and brighter futures fueled by accessible finance.

The Future of Artisan Financing: Technology and Innovation

You’re about to see how technology is shaking up artisan financing, making loans easier to obtain in even the most remote villages. FinTech solutions aren’t just flashy apps—they’re opening doors with smart, collateral-free lending designed to fit your schedule and needs. Additionally, there’s a growing push from policies that actually want to help keep your trade alive and kicking, not just talk about it.

FinTech Solutions Expanding Accessibility for Rural Populations

Since rural artisans often face roadblocks with traditional banks, FinTech is stepping in like a savvy sidekick to shake things up. You no longer have to wonder how to get a loan for a rural artisan business because digital lending platforms use mobile technology to offer rapid, hassle-free access to customized financial products. Additionally, peer-to-peer lending connects you directly with local investors, fueling community development. Blockchain technology builds trust by keeping everything transparent, while smart data analysis enhances your creditworthiness, even without a formal credit history. Here’s why FinTech’s a game changer:

- Instant approvals and fund transfers via mobile apps

- Customized loan terms matching your business cycle

- Community-backed lending models

- Transparent, fraud-resistant blockchain smart contracts

- Alternative data evaluating your creditworthiness beyond paperwork

FinTech’s here to turn your creation into a sustainable business with a high-tech twist.

The Growth of Sustainable, Collateral-Free Lending

Technology is shaking up the manner rural artisans obtain credit, making that easier for them to borrow without requiring mountains of paperwork or piles of collateral. Thanks to sustainable, collateral-free lending models, artisans like you can now tap into microfinance customized to your skills and cash flow cycles. These innovative approaches, powered by technology, use community trust and peer guarantees instead of traditional bank demands, enhancing financial participation where it’s needed most. Mobile apps and digital platforms optimize loan management, cutting out red tape and headaches. As a result, artisan businesses gain economic stability and the freedom to grow without risking land or assets they don’t have. It’s about turning your artistry into a thriving enterprise—without the scary loan fine print that usually scares everyone off.

Policy Blueprints for Supporting Traditional Crafts and Skills

When one thinks of keeping traditional creations alive and thriving, smart policies can make all the difference, and you’re about to see why. Government loans and artisan credit lines customized for rural artisans offer low interest rates—sometimes as low as 5%, with cozy discounts for women. These policies ease eligibility criteria, using community development as a backbone rather than collateral. Additionally, microfinance loans now come with digital tools making application and repayment a breeze.

Here’s what these blueprints emphasize:

- Fair, transparent eligibility criteria

- Affordable, subsidized interest rates

- Moratoriums for better income planning

- Platforms like Hunar Haat for market access

- Tech-enabled loan processes enhancing financial access

Smart policy isn’t just paperwork; it’s a transformative factor for your trade’s future.

Frequently Asked Questions

How Do Group Guarantees Affect Individual Credit Scores?

Group guarantees can enhance your credit score when everyone repays in a timely manner, demonstrating trustworthiness. But if a member defaults, this can hurt your individual score as well. So, your group’s collective responsibility directly impacts your credit health.

Can Rural Artisans Refinance Loans if They Face Repayment Issues?

Yes, you can refinance loans if repayment becomes challenging. Many lenders provide flexible terms or restructuring alternatives, assisting you manage cash flow innovatively and evade default while sustaining your creditworthiness for future opportunities.

What Legal Protections Do Artisans Have if Loans Become Unaffordable?

When debt storms hit, you’re shielded by consumer protection laws that cap interest rates and forbid unfair practices. Know your rights—innovative advocacy groups also monitor lenders, ensuring you won’t face legal whirlwinds alone.

Are There Special Loan Programs for Seasonal Artisan Income Fluctuations?

Yes, you can find special loan programs customized for seasonal income fluctuations. These flexible loans offer adjusted repayment schedules aligned with your cash flow, helping you manage slow seasons while fueling growth during busy periods without added stress.

How Do Credit Lines Impact Artisans’ Eligibility for Government Subsidies?

Think of credit lines as your key that opens government subsidy doors. By showing reliable repayment, you enhance your eligibility, making innovation-funded opportunities more accessible and helping your artisan venture grow stronger and more sustainable.