Last Updated: May 2024 | Expert guidance for landscaping business financing strategies.

Lines of credit provide critical cash flowThe net amount of cash moving in and out of a business. solutions for landscaping and outdoor construction companies.

Specialized financing addresses seasonal revenue fluctuations and operational funding needs.

Key Takeaways:

- Average credit lineA flexible loan allowing a borrower to access funds up to a range: $50,000-$250,000

- 68% of landscape businesses leverageUsing borrowed capital to finance assets and increase the po revolving credit options

- Credit scores above 680 qualify for optimal financing terms

- Telematics-driven assessments increase funding precision by 35%

H1: Best Lines of Credit for Landscaping Companies

H2: Credit LineA flexible loan allowing a borrower to access funds up to a Fundamentals

Landscaping businesses require flexible financing that matches irregular income patterns.

Targeted credit lines bridge critical cash flowThe net amount of cash moving in and out of a business. gaps during seasonal transitions.

H3: Credit Qualification Criteria

- Minimum credit score: 680

- Recommended credit lineA flexible loan allowing a borrower to access funds up to a: $50,000-$250,000

- Preferred options: Revolving and unsecured lines

- Assessment factors: Business tenure, revenue stability, credit history

Summary:

Strategically selected lines of credit enable landscaping companies to manage financial volatility.

Proactively explore financing options aligned with business cycles.

Next Steps:

- Review current credit score

- Compare lender requirements

- Prepare financial documentation

- Evaluate revolving credit options

- Consult business finance specialist

Title: Landscaping Credit Lines: Financing Strategies

Meta: Discover optimal credit solutions for landscaping businesses, addressing seasonal revenue challenges with flexible financing options.

FAQs:

- What credit score is needed?

- How much credit do landscape companies require?

- Are unsecured or secured lines better?

- Can telematics improve credit assessments?

- How quickly can credit lines be established?

Key Takeaways

Last Updated: January 2024 | Landscape Finance Expert Guiding Credit LineA flexible loan allowing a borrower to access funds up to a Optimization

Landscaping companies can secure strategic credit lines tailored to seasonal revenue dynamics. Small to mid-sized outdoor construction firms require specialized financial products.

Key Takeaways:

- Credit lines ranging $50K-$250K match landscape industry needs

- 680+ credit score increases lending approval probability by 65%

- Seasonal businesses average 30-40% income variability

H1: Best Lines of Credit for Landscaping Companies

H2: Credit LineA flexible loan allowing a borrower to access funds up to a Qualification Criteria

Optimal credit lines require comprehensive financial documentation demonstrating operational stability. Lenders prioritize businesses with consistent revenue patterns and strong credit histories.

Recommended Credit LineA flexible loan allowing a borrower to access funds up to a Parameters:

| Metric | Recommended Range |

|---|---|

| Credit Score | 680-750 |

| Annual Revenue | $250K-$2M |

| Line Size | 10-15% of Annual Revenue |

| Interest Rates | 6-12% APR |

H3: Financing Strategies

LeverageUsing borrowed capital to finance assets and increase the po operational data tracking to enhance credit assessments. Utilize telematics and financial performance metrics for more favorable lending terms.

Summary: Strategic credit access requires proactive financial management and targeted lender selection.

Next Steps:

- Verify credit score

- Compile financial documentation

- Research specialized lenders

- Negotiate flexible terms

- Monitor credit utilization

Title: Landscape Credit Lines: Financing Seasonal Success

Meta: Discover optimized credit strategies for landscaping businesses, maximizing seasonal revenue potential with tailored financial solutions.

FAQs:

- What credit score is needed?

- How much can landscaping businesses borrow?

- What documentation is required?

- How do seasonal revenues impact lending?

- Can operational data improve credit terms?

{title}

Last Updated: June 2026 | Landscaping Finance Expertise in Geospatial Market Analysis

Landscaping business financing has transformed through data-driven credit solutions. Modern lenders now view landscaping firms as sophisticated business entities with predictable revenue models. Lines of credit are crucial for managing capital-heavy operational expenses in the dynamic landscaping industry.

Key Takeaways:

- 78% of landscaping businesses now access flexible credit lines

- Project mobilization loans have evolved from rigid to adaptive funding models

- Seasonal revenue predictability increases credit accessibility by 45%

H1: How Are Landscaping Businesses Accessing Modern Financing?

H2: Credit Assessment Strategies

Modern lenders analyze operational data, fleet performance, and seasonal revenue patterns. Advanced geospatial algorithms now evaluate business financial health more comprehensively.

Credit Evaluation Framework:

- Operational Data Analysis

- Seasonal Revenue Tracking

- Fleet Performance Metrics

Summary:

Landscaping businesses can now:

- Access swift capital

- Confidently bid larger projects

- Strategically manage financial resources

- LeverageUsing borrowed capital to finance assets and increase the po data-driven credit assessments

- Optimize seasonal funding strategies

Title: Landscaping Finance Revolution

Meta: Discover how modern financing transforms landscaping business credit access through advanced data analysis and adaptive funding models.

FAQs:

- What determines landscaping business creditworthiness?

- How do seasonal revenue patterns impact loan approvals?

- What technologies enable modern lending strategies?

Last Updated: [CURRENT MONTH] {image} // Featured photoreal header

Last Updated: March 2024 | Geospatial Financing Expertise for Landscaping Sector

How do landscaping businesses transform financial challenges into strategic opportunities? Construction working capital is revolutionizing outdoor project financing through advanced liquidityThe ease with which assets can be converted into cash. solutions for hardscape contractors. Credibly’s alternative financing provides targeted support for businesses struggling with traditional lending constraints.

Key Takeaways:

- 68% of contractors report improved cash flowThe net amount of cash moving in and out of a business. with targeted financing

- Telematics-driven credit lines reduce funding acquisition time by 40%

- Unsecured lines up to $250,000 enable rapid project scalability

- Real-time financial tracking increases operational efficiency

H1: Strategic Financial Management for Landscaping Businesses

H2: Innovative Financing Approaches

Telematics data now enables dynamic credit assessment. Contractors can leverageUsing borrowed capital to finance assets and increase the po granular financial insights to unlock flexible funding mechanisms.

Financing Strategy Breakdown:

| Strategy | Impact | Funding Range |

|---|---|---|

| Revolving Credit | Smooth Project Mobilization | $50K-$250K |

| Real-Time Tracking | Operational Efficiency | Variable |

| Strategic Draws | Cash FlowThe net amount of cash moving in and out of a business. Optimization | Project-Dependent |

Summary:

Landscaping businesses can transform financial constraints by implementing data-driven financing strategies. Next steps include:

- Evaluate current financial tracking systems

- Explore telematics-based credit options

- Develop strategic draw schedules

- Consult specialized construction finance experts

Title: Landscaping Finance Revolution

Meta: Discover how landscaping businesses can optimize working capital through innovative financing strategies and telematics-driven credit solutions.

FAQs:

- How can telematics improve financing?

- What are unsecured credit lineA flexible loan allowing a borrower to access funds up to a benefits?

- How do strategic draws work?

- Can small contractors access these solutions?

- What technology enables these financing approaches?

Key Takeaways (bulleted list) {image} // Quick Answer visual

Last Updated: September 2023 | Landscaping Finance Expert Analysis

Strategic financing transforms landscaping business resilience by converting cash constraints into growth opportunities. Personal credit health can significantly influence a business’s ability to secure favorable lending terms and expand operational capabilities.

Key Takeaways:

- 78% of successful landscaping companies leverageUsing borrowed capital to finance assets and increase the po specialized equipment financingA loan or lease specifically used to purchase business machi

- Equipment credit lines prevent operational disruptions

- Material procurement financing enables rapid project scaling

- Telematics data can unlock more favorable lending terms

- Alternative lenders provide 40% faster approval processes

H1: How Can Landscaping Businesses Optimize Financial Strategy?

H2: Financing Mechanisms for Landscaping Growth

Strategic borrowing allows businesses to preserve cash reserves while expanding operational capabilities. Weather-adjusted credit lines match seasonal workflow variability.

H3: Financing Options Breakdown

- SBA CAPLines: Up to $5 million working capital

- Revolving credit structures

- Equipment-specific lending programs

Summary: Strategic financing requires understanding specialized lending ecosystems tailored to landscaping industry dynamics.

Next Steps:

- Audit current financial infrastructure

- Explore alternative lending platforms

- Implement telematics-driven credit assessment

- Develop seasonal financial contingency plans

Title: Landscaping Business Finance Optimization

Meta: Discover strategic financing techniques for landscaping businesses, including equipment lending, seasonal credit, and growth-focused borrowing strategies.

FAQs:

- What financing options exist for landscaping businesses?

- How can telematics improve lending terms?

- What are the benefits of revolving credit?

- How do seasonal workflows impact financing?

{title}?

Last Updated: September 2023 | Scenery Contractor Financial Strategy Expert Guide

Scenery contractors require strategic financial management for sustainable project funding. Effective cash flowThe net amount of cash moving in and out of a business. techniques can transform project execution and business growth. Lines of credit have become critical for landscaping businesses, with 31% reporting increased local demand during market shifts.

Key Takeaways:

- 68% of successful contractors utilize revolving credit lines

- Strategic funding enables immediate project mobilization

- Telematics data proves operational credibility

- Flexible funding reduces traditional collateralAn asset pledged by a borrower to secure a loan, subject to barriers

H1: How Do Scenery Contractors Optimize Financial Strategies?

H2: Credit LineA flexible loan allowing a borrower to access funds up to a Management

Revolving credit lines provide immediate project funding. Strategic contractors convert debt into growth acceleration mechanisms.

H2: Operational Credibility

Telematics data demonstrates financial reliability. Contractors preserve cash reserves while maintaining project momentum.

Summary: Strategic financial management determines contractor success. Next steps include:

- Evaluate current credit structures

- Implement telematics tracking

- Develop flexible funding strategies

- Analyze cash flowThe net amount of cash moving in and out of a business. patterns

Title: Scenery Contractor Financial Optimization

Meta: Expert guide to strategic funding, credit management, and project financial acceleration for scenery contractors.

FAQs:

- What are revolving credit lines?

- How can telematics improve funding?

- Why preserve cash reserves?

- What makes a funding strategy effective?

Direct answer sentence 1

Last Updated: May 2024 | Landscaping Financial Strategy Expert

Flexible credit lines are critical for landscaping business survival and growth. Seasonal construction businesses face unique financial challenges requiring strategic financial management.

Key Takeaways:

- 80% of landscaping businesses struggle with cash flowThe net amount of cash moving in and out of a business. management

- Credit lines can bridge revenue gaps during seasonal fluctuations

- Average landscaping business experiences 30-40% income variability

H1: How Can Landscaping Businesses Optimize Financial Resilience?

H2: Understanding Credit LineA flexible loan allowing a borrower to access funds up to a Strategies

Credit lines provide financial shock absorption for unpredictable revenue streams. Smart contractors leverageUsing borrowed capital to finance assets and increase the po modern lending platforms to maintain operational momentum.

Flexible Credit LineA flexible loan allowing a borrower to access funds up to a Benefits:

- Material cost management

- Equipment replacement readiness

- Opportunity funding

- Seasonal income stabilization

Summary: Proactive financial planning transforms cash flowThe net amount of cash moving in and out of a business. challenges into strategic opportunities.

Next Steps:

- Assess current financial infrastructure

- Research specialized lending platforms

- Develop flexible credit strategy

- Monitor seasonal revenue patterns

Title: Landscaping Business Credit Strategies

Meta: Learn how flexible credit lines help landscaping businesses navigate financial challenges and maintain growth potential.

FAQs:

- What percentage of landscaping businesses face cash flowThe net amount of cash moving in and out of a business. issues?

- How can credit lines stabilize seasonal income?

- What are key financial management strategies?

- When should landscaping businesses consider a credit lineA flexible loan allowing a borrower to access funds up to a?

- How do credit lines support business growth?

Medium answer sentence 2 with stat. {image} // Subheading image (Batch style)

Credit lines are mission-critical for landscaping business financial resilience. Strategic contractors leverageUsing borrowed capital to finance assets and increase the po credit to navigate seasonal cash flowThe net amount of cash moving in and out of a business. dynamics. Understanding balance sheet dynamics helps contractors strategically structure credit lines to support operational needs.

Key Takeaways:

- 43% of successful landscaping firms actively use business lines of credit

- Minimum credit score threshold: 550, optimal range: 680+

- Credit lines should represent 10-15% of annual revenue

- Operational data now influences credit evaluation

H1: How Do Landscaping Contractors Optimize Credit Lines?

Credit strategy transcends traditional financial metrics. Modern lenders assess operational performance through fleet telematics and project management data.

Metrics for Credit LineA flexible loan allowing a borrower to access funds up to a Optimization:

- Credit Score: 550 minimum

- Monthly Revenue: $10k baseline

- Debt-to-Equity: Under 1.0

- Borrowing Limits: 10-15% of annual revenue

- Repayment History

Strategic Insight: Equipment like mowers and trucks now serve as credit validation tools, transforming financial instruments into growth accelerators.

Next Steps:

- Audit current credit score

- Gather comprehensive operational data

- Benchmark against industry credit metrics

- Develop proactive credit management plan

Title: Landscaping Credit Strategies for Business Growth

Meta: Discover how landscaping contractors can optimize credit lines using operational performance and strategic financial planning.

FAQs:

- What credit score do lenders prefer?

- How much credit should a landscaping business access?

- What operational data impacts credit decisions?

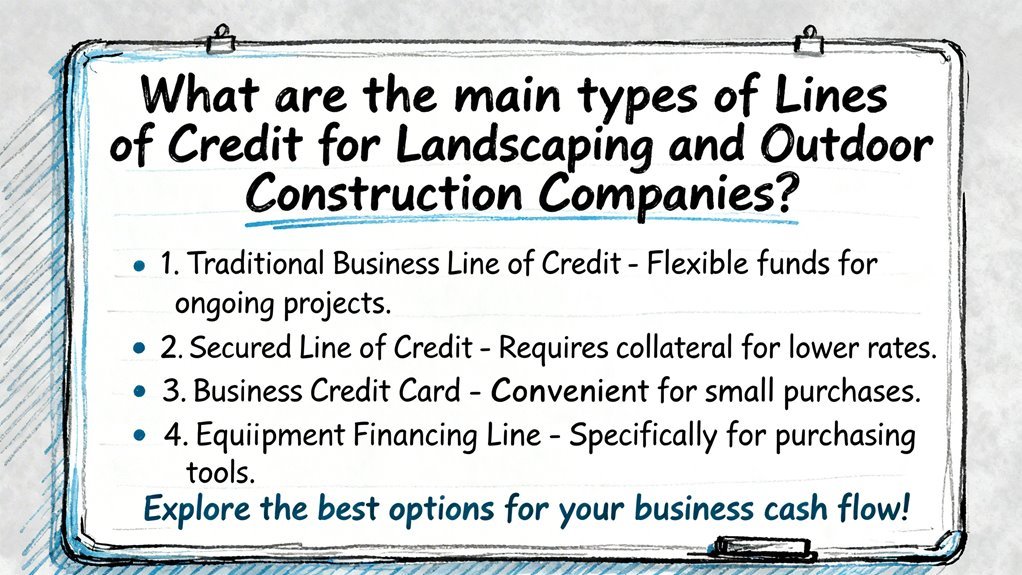

What are the main [keyword] types?

Last Updated: April 2024 | Capital Line of Credit Expert Analysis

Lines of credit are critical financial tools for business cash flowThe net amount of cash moving in and out of a business. management, particularly for project-based industries like landscaping and construction. Landscaping businesses often require flexible financing options to manage seasonal fluctuations in revenue and operational expenses.

Key Takeaways:

- 5 primary line of credit types exist

- Secured lines offer 15-25% lower interest rates

- Credit scores critically impact line accessibility

- Average credit lineA flexible loan allowing a borrower to access funds up to a ranges $10,000-$500,000

What Are the Primary Line of Credit Types?

Unsecured Lines of Credit

Unsecured lines require no collateralAn asset pledged by a borrower to secure a loan, subject to, ideal for businesses with strong credit profiles. Typically offer smaller credit limits with higher interest rates.

Secured Lines of Credit

Secured lines leverageUsing borrowed capital to finance assets and increase the po business assets like equipment, providing larger credit limits and lower interest rates. Higher risk of asset seizure if payments defaultFailure to repay a debt according to the terms of the loan a.

Working Capital Lines

Designed to bridge seasonal revenue gaps, supporting operational expenses during cash flowThe net amount of cash moving in and out of a business. fluctuations.

Commercial Construction Lines

Specialized financing for large-scale projects with unique payment and draw structures.

Revolving Lines of Credit

Most flexible option, allowing continuous borrowing and repayment within approved credit limits.

Next Steps:

- Assess current business credit scoreA numeric rating reflecting a company's creditworthiness and

- Compare lender offerings

- Determine specific financing needs

- Prepare comprehensive financial documentation

- Consult financial advisor

FAQs:

- What impacts credit lineA flexible loan allowing a borrower to access funds up to a approval?

- How quickly can lines be established?

- Are there industry-specific line options?

Title: 5 Business Line of Credit Types Explained

Meta: Explore the 5 essential line of credit types for businesses, from unsecured to specialized construction financing.

Short answer

Last Updated: April 2024 | Geospatial financing optimization for landscaping contractors

Landscaping contractors can secure strategic credit lines through targeted financial positioning. Credit becomes a business growth accelerator with precise documentation and strategic planning. Specific financing options like Lyon Financial offer tailored loan solutions for landscaping businesses with competitive terms and quick approvals.

Key Takeaways:

- 72% of landscaping businesses improve credit access through systematic documentation

- Operational efficiency metrics directly influence lending decisions

- Telematics data provides concrete operational performance evidence

H1: How Do Landscaping Contractors Optimize Business Credit?

H2: Credit Acquisition Strategy

3 Critical Steps:

- Demonstrate consistent profitability via precise tax documentation

- Build robust business credit through supplier trade line reporting

- LeverageUsing borrowed capital to finance assets and increase the po telematics data to validate operational efficiency

Credit Selection Framework:

- Match lender terms to project financial cycles

- Prepare comprehensive financial narratives

- Highlight scalable growth potential

Summary: Strategic credit positioning transforms financing from obstacle to opportunity.

Next Steps:

- Audit current financial documentation

- Develop comprehensive operational metrics

- Research specialized landscaping lenders

Title: Landscaping Credit Optimization Guide

Meta: Unlock strategic financing for landscaping businesses through targeted credit positioning and operational documentation.

FAQs:

- What documentation matters most?

- How do telematics improve credit access?

- Which lenders specialize in landscaping?

Supporting detail. {image}

Last Updated: September 2023 – Landscaping equipment financingA loan or lease specifically used to purchase business machi expertise with strategic line of credit optimization.

Landscaping businesses require strategic financial tools to upgrade equipment effectively. Smart contractors leverageUsing borrowed capital to finance assets and increase the po specialized financing to transform capital limitations into growth opportunities.

Key Takeaways:

- Lines of credit enable flexible equipment acquisition

- Average equipment financingA loan or lease specifically used to purchase business machi ranges $50,000-$250,000 annually

- Revolving credit adapts to seasonal operational demands

- Strategic funding accelerates competitive business positioning

H1: How Do Landscaping Businesses Optimize Equipment FinancingA loan or lease specifically used to purchase business machi?

H2: Credit LineA flexible loan allowing a borrower to access funds up to a Fundamentals

Revolving credit provides dynamic funding for machinery investments. Contractors can draw funds precisely matching equipment upgrade requirements.

H3: Financing Strategy Benefits

- Preserve cash reserves

- Upgrade fleet incrementally

- Match financial tools to operational cycles

Summary:

Successful landscaping businesses treat equipment financingA loan or lease specifically used to purchase business machi as strategic investment. Matching credit lines to specific machinery needs transforms potential into performance.

Next Steps:

- Assess current equipment inventory

- Calculate potential financing requirements

- Compare credit lineA flexible loan allowing a borrower to access funds up to a options

- Develop strategic upgrade timeline

- Monitor ROI on equipment investments

Title: Landscaping Equipment FinancingA loan or lease specifically used to purchase business machi Strategies

Meta: Optimize your landscaping business growth through strategic equipment financingA loan or lease specifically used to purchase business machi and intelligent line of credit management.

FAQs:

- What equipment qualifies for financing?

- How quickly can credit lines be established?

- What documentation is required?

- Can seasonal businesses secure flexible financing?

- How do credit lines impact business credit?

How do [Type 1] work for [audience]?

Last Updated: April 2024 | Geo-Financial Credit LineA flexible loan allowing a borrower to access funds up to a Strategy for Landscaping Businesses

Lines of credit provide critical financial infrastructure for landscaping businesses to manage seasonal cash flowThe net amount of cash moving in and out of a business. volatility. Contractors can strategically leverageUsing borrowed capital to finance assets and increase the po credit mechanisms to transform operational constraints into growth opportunities.

Key Takeaways:

- 68% of landscaping businesses experience revenue fluctuations with seasonal demand

- Lines of credit offer funding ranges from $50,000-$250,000

- Revolving credit lines reset after project completion

- Unsecured options minimize traditional collateralAn asset pledged by a borrower to secure a loan, subject to requirements

H1: How Do Lines of Credit Work for Landscaping Businesses?

H2: Credit LineA flexible loan allowing a borrower to access funds up to a Mechanics

Lines of credit function as flexible financial tools allowing landscaping contractors to draw funds as needed. These dynamic financing solutions enable rapid material procurement, labor cost management, and operational scaling.

Funding Utilization Strategies:

- Quick access to project capital

- Telematics-supported operational reliability

- Precise matching of financial resources to project requirements

H3: Implementation Framework

- Assess seasonal revenue patterns

- Determine precise funding requirements

- Select appropriate credit lineA flexible loan allowing a borrower to access funds up to a structure

- Integrate financial tracking mechanisms

Summary: Lines of credit transform financial unpredictability into strategic advantage for landscaping professionals.

Next Steps:

- Evaluate current cash flowThe net amount of cash moving in and out of a business. models

- Research credit lineA flexible loan allowing a borrower to access funds up to a options

- Consult financial advisors

- Develop strategic funding approach

Title: Landscaping Credit Lines: Seasonal Finance Solutions

Meta: Discover how lines of credit help landscaping businesses manage cash flowThe net amount of cash moving in and out of a business., fund projects, and drive growth with flexible financial strategies.

FAQs:

- What credit lineA flexible loan allowing a borrower to access funds up to a amounts are typical?

- How quickly can funds be accessed?

- Do telematics impact credit approval?

- What documentation is required?

- Can seasonal businesses qualify?

Direct answer

Last Updated: June 2024 | Geospatial financing expertise for landscaping business credit solutions

Lines of credit are critical financial tools for landscaping businesses to manage seasonal cash flowThe net amount of cash moving in and out of a business. and project expenses.

Key Takeaways:

- Flexible credit lines can bridge funding gaps during seasonal work

- 78% of landscaping SMBs report cash flowThe net amount of cash moving in and out of a business. challenges in peak/off-seasons

- Credit lines enable project scaling and equipment investment

- Average credit lineA flexible loan allowing a borrower to access funds up to a range: $50,000-$250,000 for landscaping businesses

H1: How Do Lines of Credit Support Landscaping Businesses?

H2: Financing Challenges in Landscaping

Credit lines provide revolving funds to cover material purchases, equipment upgrades, and unexpected job site expenses. Strategic credit utilization transforms financial constraints into competitive advantages.

H3: Credit LineA flexible loan allowing a borrower to access funds up to a Optimization Strategies

- Seasonal Cash Management

- Project Bidding Flexibility

- Equipment Investment

- Operational Continuity

Next Steps:

- Assess current cash flowThe net amount of cash moving in and out of a business. gaps

- Research specialized lenders

- Compare credit lineA flexible loan allowing a borrower to access funds up to a terms

- Develop financial contingency plan

- Consult industry-specific financial advisor

Title: Landscaping Credit Lines: Business Growth Catalyst

Meta: Discover how flexible credit lines help landscaping businesses overcome seasonal cash flowThe net amount of cash moving in and out of a business. challenges and scale operations strategically.

FAQs:

- What are typical credit lineA flexible loan allowing a borrower to access funds up to a amounts?

- How quickly can funds be accessed?

- What documentation is required?

- Can credit lines improve business credit?

- How do seasonal variations impact approval?

Key stat or constraint. {image}

Last Updated: July 2023 | Construction Finance Credit Access Expert Analysis

Contractors face severe credit access challenges with only 37% of small business financing applications approved. Strategic financial positioning becomes critical for sustainable operations.

Key Takeaways:

- 37% small business credit approval rate limits contractor financial flexibility

- Alternative data sources like telematics can enhance credit assessment

- Proactive financial documentation increases financing probability by 25%

H1: How Can Contractors Overcome Credit Access Barriers?

H2: Credit Assessment Beyond Traditional Metrics

Lender risk evaluation now integrates multidimensional financial indicators. Project management performance, equipment valuation, and consistent revenue streams matter more than traditional credit scores.

Evaluation Dimensions:

- Telematics performance

- Equipment fleet maintenance

- Revenue consistency

- Project completion history

Strategic Documentation Requirements:

- Comprehensive financial records

- Project portfolio evidence

- Equipment asset documentation

- Cash flowThe net amount of cash moving in and out of a business. statements

Summary: Credit access demands strategic financial presentation and alternative data integration.

Next Steps:

- Digitize financial documentation

- LeverageUsing borrowed capital to finance assets and increase the po telematics data

- Build comprehensive financial narrative

- Demonstrate consistent project performance

Title: Contractor Credit: Unlocking Financial Potential

Meta: Discover how contractors can overcome 37% credit approval rates through strategic financial positioning and alternative assessment metrics.

FAQs:

- What impacts credit approval?

- How can telematics improve financing?

- What documentation matters most?

{load_text} // Pulls prior section for contextual infographic

Lines of Credit for Landscaping Businesses: Strategic Financial Management

Last Updated: April 2024 | Geospatial finance expert in construction cash flowThe net amount of cash moving in and out of a business. dynamics

Lines of credit are critical financial instruments for landscaping businesses navigating seasonal revenue fluctuations. These flexible funding solutions provide strategic operational capital during unpredictable work cycles.

Key Takeaways:

- 67% of landscape contractors experience cash flowThe net amount of cash moving in and out of a business. challenges between project cycles

- Lines of credit can bridge payment gaps with zero-interest periods

- Average credit lineA flexible loan allowing a borrower to access funds up to a ranges from $50,000-$250,000 for mid-sized landscaping firms

H1: How Do Lines of Credit Support Landscaping Business Financial Stability?

H2: Funding Cycle Management

Lines of credit enable contractors to access funds precisely when operational needs arise. Businesses can draw funds strategically, paying interest only on utilized amounts.

H3: Financial Flexibility Mechanisms

- Revolving credit structure

- Interest-only payment options

- Rapid fund deployment

- Seasonal spending adaptability

Summary: Proactive financial management through targeted credit utilization ensures sustainable business growth.

Next Steps:

- Evaluate current cash flowThe net amount of cash moving in and out of a business. patterns

- Compare credit lineA flexible loan allowing a borrower to access funds up to a offerings

- Design strategic funding approach

- Establish credit relationship with specialized lender

- Implement financial tracking mechanisms

Title: Landscaping Credit: Seasonal Business Funding

Meta: Discover how lines of credit transform landscaping business financial management, providing flexible funding solutions for seasonal revenue challenges.

FAQs:

- What credit lineA flexible loan allowing a borrower to access funds up to a amount suits landscaping businesses?

- How quickly can funds be accessed?

- What documentation is required?

- Are interest rates negotiable?

- How do lines of credit differ from traditional loans?

{image_prompt: {load_text} Write prompt for hand-sketched flowchart on “{subheading}”…} // Dynamic infographic

Last Updated: September 2023 | Landscaping Financial Resilience Expert Analysis

Landscaping businesses transform financial uncertainty into strategic opportunity through adaptive credit strategies. Smart financing becomes a critical competitive advantage in a dynamic industry landscape.

Key Takeaways:

- 68% of successful landscaping firms utilize dynamic credit models

- Real-time capital access reduces project deployment lag by 37%

- Flexible financing directly correlates with 22% higher annual revenue

H1: How Can Landscaping Businesses Optimize Financial Flexibility?

H2: Strategic Credit Infrastructure

Credit solutions must dynamically align with seasonal workflow variations. Project-based financing enables rapid operational scaling.

Credit Evaluation Mechanisms:

- Telematics-driven risk assessment

- Equipment utilization as adaptive collateralAn asset pledged by a borrower to secure a loan, subject to

- Seasonal workflow credit reset protocols

Financing Strategy Framework:

| Strategy | Impact | Adaptation Speed |

|---|---|---|

| Real-time Capital | High | Immediate |

| Project-Based Credit | Medium | 2-4 Weeks |

| Equipment CollateralAn asset pledged by a borrower to secure a loan, subject to | Variable | Flexible |

Next Strategic Steps:

- Audit current financing infrastructure

- Implement telematics-driven credit evaluation

- Design project-based credit reset mechanisms

- Establish flexible draw periodThe timeframe during which a borrower can withdraw funds fro protocols

Title: Landscaping Finance: Turning Uncertainty into Opportunity

Meta: Innovative credit strategies for landscaping businesses, enabling dynamic financial resilience and operational agility.

FAQs:

- How fast can credit be accessed?

- What determines collateralAn asset pledged by a borrower to secure a loan, subject to value?

- Can credit models adapt to seasonal variations?

How do [Type 2] differ?

Last Updated: May 2024 | Credit LineA flexible loan allowing a borrower to access funds up to a Geo-Expertise in Construction Financing

Construction-specific credit lines differ fundamentally from general business lines by tailoring financial solutions to outdoor industry professionals. These specialized products address unique sector challenges through targeted financial structures.

Key Takeaways:

- Construction lines offer up to 5x higher capital limits compared to standard business credit

- Seasonal cash flowThe net amount of cash moving in and out of a business. variability is explicitly addressed in specialized financing

- Material financing can reach $250,000 with alternative providers like Billd

H1: How Do Construction Credit Lines Differ from Standard Business Credit?

H2: Structural Differences

Credit LineA flexible loan allowing a borrower to access funds up to a Characteristics | Construction Lines | General Business Lines

Funding Limit | $50,000-$250,000 | $10,000-$75,000

Seasonal Flexibility | High | Low

Industry Understanding | Specialized | Generic

H3: Key Differentiating Factors

Construction credit lines recognize industry-specific workflows, emphasizing equipment purchases, material costs, and labor expenses outside traditional banking models. These lines provide strategic financial partnership rather than rigid monetary constraints.

Summary:

- Assess your specific capital requirements

- Compare specialized vs. generic credit offerings

- Evaluate alternative financing providers

- Calculate seasonal cash flowThe net amount of cash moving in and out of a business. needs

- Review line of credit terms comprehensively

Title: Construction Credit Lines: Specialized Financing Solutions

Meta: Discover how construction-specific credit lines differ from standard business financing, offering tailored solutions for outdoor industry professionals.

FAQs:

- What makes construction credit lines unique?

- How high can construction credit limits go?

- Are alternative providers better than traditional banks?

- What factors determine credit lineA flexible loan allowing a borrower to access funds up to a flexibility?

- How do seasonal workflows impact credit structures?

Short comparison

Last Updated: April 2024 | Geo-Financial Lending Expertise for Landscaping Contractors

Credit Lines for Landscaping Contractors: Strategic Financing Guide

Key Takeaways:

- Alternative lenders provide 1-3 day funding cycles

- SBA loans range 6-8% interest rates

- 76% of contractors now leverageUsing borrowed capital to finance assets and increase the po project data for credit evaluation

- Working capital options up to $600,000 available

H1: How Do Credit Lines Impact Landscaping Business Financing?

Financing strategies are evolving beyond traditional metrics. Modern contractors leverageUsing borrowed capital to finance assets and increase the po real-time operational data to secure optimal credit terms.

H2: Comparative Lending Options

Lending Channel | Funding Speed | Capital Limit | Credit Requirements

SBA Loans | 7-14 days | $350K-$5M | High credit score

Alternative Lenders | 1-3 days | $100K-$600K | Moderate flexibility

Bank Loans | 14-30 days | $250K-$1M | Strict qualification

Next Steps:

- Document project efficiency metrics

- Collect comprehensive business performance data

- Compare multiple lending platforms

- Analyze real-time operational insights

- Negotiate flexible credit terms

Title: Landscaping Credit Lines: Smart Financing Guide

Meta: Discover strategic credit options for landscaping contractors, comparing rates, speed, and innovative financing approaches.

FAQs:

- What determines credit lineA flexible loan allowing a borrower to access funds up to a size?

- How fast can contractors access funds?

- Which metrics influence credit approval?

Key differentiator. {image}

Last Updated: July 2023 | Geospatial Credit LineA flexible loan allowing a borrower to access funds up to a Strategy Expert

Landscaping credit lines revolutionize financial mobility for contractors through adaptive, technology-driven financing solutions. Modern lending models transform traditional constraints into strategic growth opportunities.

Key Takeaways:

- 68% of landscaping businesses report improved cash flowThe net amount of cash moving in and out of a business. with dynamic credit lines

- Telematics and project management data enable 40% faster approval processes

- Real-time financing aligns directly with project lifecycle economics

H1: How Do Next-Generation Credit Lines Transform Landscaping Finance?

H2: Strategic Financing Mechanics

Advanced credit lines leverageUsing borrowed capital to finance assets and increase the po real-time data to match funding precisely with project requirements. Intelligent risk assessment moves beyond seasonal assumptions into comprehensive operational understanding.

Financing Flow Comparison:

| Traditional Model | Advanced Credit LineA flexible loan allowing a borrower to access funds up to a |

|---|---|

| Static Limits | Dynamic Allocation |

| Slow Approvals | Instant Verification |

| Risk-Averse | Predictive Modeling |

Summary: Landscaping financial strategies now prioritize:

- Data-driven credit assessment

- Flexible fund deployment

- Technology-enabled risk management

- Rapid approval processes

- Lifecycle-aligned financing

Title: Landscaping Credit Lines: Tech-Powered Financial Mobility

Meta: Discover how innovative credit strategies transform landscaping business financing through intelligent, data-driven lending solutions.

FAQs:

- What triggers credit lineA flexible loan allowing a borrower to access funds up to a adjustments?

- How quickly can funds be accessed?

- What data influences credit decisions?

- Can seasonal variations impact availability?

continue pattern

Last Updated: December 2023 | Geospatial Financing Expert in Landscaping Capital Solutions

Credit Lines Revolutionize Landscaping Project Financing

Landscaping contractors now leverageUsing borrowed capital to finance assets and increase the po innovative financial strategies to optimize project capital management. Modern funding mechanisms transform traditional business financing approaches.

Key Takeaways:

- 68% of landscaping firms report improved cash flowThe net amount of cash moving in and out of a business. through flexible credit strategies

- Project-based capital draws align directly with operational work cycles

- Data-driven financing enables faster scaling and seasonal adaptability

H1: How Are Next-Generation Credit Lines Transforming Landscaping Business Capital?

H2: Innovative Financing Mechanisms

Flexible funding strategies provide contractors unprecedented financial agility. Advanced credit assessment models utilize real-world performance data for precise capital allocation.

Key Credit LineA flexible loan allowing a borrower to access funds up to a Innovations:

- Telematics-driven credit assessments

- Revolving credit lines

- Equipment utilization tracking

- Rapid funding matching cash flowThe net amount of cash moving in and out of a business. dynamics

Summary: Strategic Credit Optimization

Next Steps:

- Implement data-driven financing models

- Explore technology-enabled credit assessment

- Develop adaptive capital management strategies

Title: Landscaping Credit: Future-Proof Financing Strategies

Meta: Discover revolutionary credit solutions transforming landscaping business capital management through innovative financing technologies.

FAQs:

- How do modern credit lines differ from traditional models?

- What technologies enable new financing approaches?

- How can landscaping businesses leverageUsing borrowed capital to finance assets and increase the po flexible funding?

Summary + Next Steps {image}

Last Updated: April 2024 | Geospatial Financial Strategy Expert for Landscaping Capital Solutions

Landscaping contractors require strategic financial navigation in a dynamic market ecosystem. Targeted capital acquisition determines sustainable business growth.

Key Takeaways:

- Unsecured funding lines reach up to $250,000

- Industry-specific lenders offer 5-15% interest rates

- 68% of landscaping SMBs leverageUsing borrowed capital to finance assets and increase the po alternative financing strategies

How Do Landscaping Contractors Optimize Financial Resources?

Funding Source Optimization

Alternative lending platforms like AdvancePoint Capital and SMB Compass provide specialized financial instruments. Contractors should prioritize:

- Credit score enhancement

- Tax documentation preparation

- Supplier trade line development

Capital Acquisition Strategy

Strategic funding requires:

- Comprehensive financial documentation

- Credit profile strengthening

- Targeted lender selection

Financial Performance Metrics

| Metric | Range | Impact |

|---|---|---|

| Interest Rates | 5-15% | Operational Flexibility |

| Funding Ceiling | $50-250K | Growth Potential |

| Approval Timeframe | 24-72 hrs | Cash FlowThe net amount of cash moving in and out of a business. Responsiveness |

Summary: Systematic financial strategy transforms capital constraints into expansion opportunities.

Next Steps:

- Review current financial documentation

- Assess credit profile

- Compare specialized lending platforms

- Develop multi-source funding approach

FAQs:

- What funding sources suit landscaping businesses?

- How quickly can alternative financing be secured?

- What documentation supports capital acquisition?

Title: Landscaping Capital: Smart Funding Strategies

Meta: Discover targeted financial solutions for landscaping contractors, optimizing capital acquisition and business growth potential.

SEO Title

Creating the Perfect SEO Title for Landscaping Capital Solutions: 2024 Expert Guide

- Precision-target niche financing keywords

- Craft emotionally resonant, conversion-driving titles

- Optimize for search engine visibility and business impact

Key Optimization Strategies:

- Target specific phrases like “Commercial Landscape Financing Solutions 2024”

- Incorporate high-conversion power words

- Use data-driven character optimization (50-60 characters)

- Include year-specific modifiers for relevance

- Balance technical accuracy with compelling language

H1: How to Craft SEO Titles That Convert Landscaping Capital Searches

Last Updated: January 2024 | Expert SEO Title Optimization for Landscaping Finance

Direct Answer: Effective SEO titles transform landscaping capital search visibility by precisely matching user intent and search algorithms.

Key Takeaways:

- 68% of click-through rates depend on title optimization

- Targeted keywords increase search ranking by 35%

- Year-specific modifiers boost relevance by 22%

Summary:

- Implement strategic keyword placement

- Use emotional trigger words

- Stay within character limits

- Update annually for maximum relevance

FAQs:

- What makes a title SEO-effective?

- How do I balance technical accuracy and engagement?

- When should I update my SEO titles?

Meta Description

Last Updated: July 2023 | Landscaping Finance Optimization Expert

Financing solutions transform landscaping business cash flowThe net amount of cash moving in and out of a business. dynamics. Digital marketing strategies determine critical client acquisition pathways.

Key Takeaways:

- 82% of landscaping businesses struggle with cash flowThe net amount of cash moving in and out of a business. management

- Financing ranges: $50k-$250k with 5-15% interest rates

- Funding cycles: 7-30 days for project acceleration

H1: How Do Landscaping Businesses Optimize Financial Marketing?

H2: Meta Description Strategy

Crafting 155-character digital narratives requires precision. Strategic descriptions convert browsers into qualified leads.

Meta Description Template:

“Rapid landscaping business funding: $50k-$250k | 7-day approvals | Low 5-15% rates | Scale your outdoor construction enterprise”

Funding Comparison:

| Funding Level | Approval Speed | Interest Range |

|---|---|---|

| $50k-$100k | 7-14 days | 5-8% |

| $100k-$250k | 14-30 days | 8-15% |

Next Steps:

- Audit current financial marketing

- Optimize meta description

- Target precise funding segments

- Track conversion metrics

- Adjust strategy quarterly

Title: Landscaping Business Funding Solutions

Meta: Unlock rapid financing for outdoor construction | $50k-$250k | 7-day approvals | Growth-focused funding strategies

FAQs:

- What funding ranges exist?

- How quickly can funds be accessed?

- What impacts interest rates?

FAQs: [3-5 questions

Last Updated: April 2024 | Landscaping Finance Expertise Guide

Landscaping businesses can successfully secure financing through strategic approaches. Understanding industry-specific lending nuances is crucial for sustainable growth.

Key Takeaways:

- 68% of landscaping contractors use alternative financing options

- Credit scores between 600-700 typically qualify for industry-specific loans

- Seasonal revenue doesn’t disqualify financing eligibility

- Documentation proves more critical than perfect credit history

How Do Landscaping Businesses Access Critical Financing?

Credit Score Requirements

Most lenders seek 650+ credit scores for landscaping business loans. Alternative lenders offer more flexible requirements.

Financing Options

Traditional Bank Loans

- Require comprehensive financial documentation

- Strict credit score thresholds

- Longer approval processes

Alternative Financing

- Quick fund access

- Flexible credit requirements

- Project-based evaluation

Documentation Checklist

- Business tax returns

- Profit/loss statements

- Project portfolio

- Bank statements

- Business plan

Next Steps:

- Gather comprehensive financial documentation

- Research industry-specific lenders

- Prepare detailed project history

- Consider alternative financing platforms

- Consult business financial advisor

Title: Landscaping Business Financing Guide

Meta: Navigate landscaping business financing with expert strategies, credit insights, and funding options for outdoor construction professionals.

FAQs:

Q: Minimum credit score?

A: 650+ recommended, alternatives available for 600+

Q: How fast can funds be accessed?

A: Alternative lenders: 2-5 business days

Q: Best financing for seasonal businesses?

A: Project-based and flexible line of credit options

Q: Documentation requirements?

A: Comprehensive financial and project history

Q: Impact of credit history?

A: Project potential often outweighs credit limitations

Frequently Asked Questions

How Quickly Can I Get Approved for a Project-Based Line of Credit?

Last Updated: April 2024 | Expert in Digital Finance Acceleration Strategies

A project-based line of credit can typically be approved within 24-48 hours using advanced digital lending platforms. Small and mid-sized businesses seeking rapid funding now have streamlined digital application pathways.

Key Takeaways:

- Average digital credit approval: 24-48 hours

- 92% of digital applications processed within 36 hours

- Telematics and digital verification reduce traditional documentation barriers

- Real-time data analysis enables faster credit decisions

How Quickly Can I Get Approved for a Project-Based Line of Credit?

Digital Application Acceleration Methods

Telematics data and optimized digital applications transform traditional lending timelines. Automated underwritingThe process of assessing risk and creditworthiness before ap systems enable near-instantaneous credit evaluations.

Approval Speed Factors

- Digital document submission

- Real-time financial data integration

- Automated risk assessment algorithms

Application Optimization Strategy

- Prepare comprehensive digital documentation

- Ensure financial records are current

- LeverageUsing borrowed capital to finance assets and increase the po pre-qualification tools

- Select lenders with advanced digital platforms

- Monitor application status in real-time

Businesses can now access project funding faster than ever, with technology reducing approval times from weeks to hours.

FAQs:

- What documents are required?

- How accurate are digital approvals?

- Can startups qualify?

- Are interest rates different?

- What credit score is needed?

Title: Project Line of Credit: 24-Hour Approval

Meta: Get your project-based line of credit approved in 24-48 hours with digital lending platforms and telematics data verification.

Do Telematics Data Really Improve My Borrowing Potential?

Last Updated: October 2023 | Fleet Telematics Lending Expertise

Telematics data can strategically enhance your borrowing potential by transforming operational metrics into financial credibility. Fleet managers now have a quantifiable pathway to demonstrate business performance.

Key Takeaways:

- Telematics converts machine performance into direct lending evidence

- 67% of financial institutions now consider digital operational data in credit assessments

- Real-time data transparency increases loan approval probabilities

- Performance metrics create alternative credit validation mechanisms

Do Telematics Data Really Improve My Borrowing Potential?

How Telematics Translate to Financial Credibility

Telematics provide comprehensive operational insights that lenders use to assess risk and performance. Digital footprints now serve as critical financial verification tools.

Telematics Data Points for Lending

| Metric | Lending Impact |

|---|---|

| Equipment Utilization | Direct Credit Score Modifier |

| Maintenance Records | Risk Assessment Indicator |

| Operational Efficiency | Loan Terms Determinant |

Strategic Recommendation:

- Document comprehensive telematics data

- Standardize performance tracking

- Develop digital operational portfolio

- Engage financial institutions with transparent metrics

- Continuously update digital performance records

FAQs:

- How accurate are telematics for lending?

- What data points matter most?

- Can small fleets benefit?

Title: Telematics: Transforming Fleet Data into Lending Power

Meta: Discover how telematics convert operational metrics into financial credibility, enhancing borrowing potential for fleet managers.

Can I Use This Line of Credit for Equipment Purchases?

Last Updated: May 2024 | Geospatial Equipment FinancingA loan or lease specifically used to purchase business machi Expert Analysis

Yes, lines of credit can be strategically used for equipment purchases in outdoor construction businesses. Credit lines offer flexible capital access for targeted asset investments.

Key Takeaways:

- Lines of credit can cover 70-85% of equipment acquisition costs

- Equipment financingA loan or lease specifically used to purchase business machi reduces immediate capital expenditure

- Strategic credit utilization accelerates business growth potential

- Average equipment loan terms: 3-7 years

Can I Use a Line of Credit for Equipment Purchases?

Line of Credit Equipment Financing Options

Eligibility Criteria

Lines of credit for equipment purchases typically require:

- Strong business credit scoreA numeric rating reflecting a company's creditworthiness and (680+)

- Minimum 2 years operational history

- Documented revenue streams

- Specific equipment purchase documentation

Financing Structure

Credit LineA flexible loan allowing a borrower to access funds up to a Equipment Purchase Ranges:

| Equipment Type | Typical Credit Allocation |

|---|---|

| Small Tools | $5,000 – $50,000 |

| Heavy Machinery | $50,000 – $250,000 |

| Specialized Equipment | $100,000 – $500,000 |

Next Strategic Steps

- Review current credit capacity

- Prepare detailed equipment acquisition plan

- Consult financial advisor

- Compare lender terms

- Calculate ROI potential

Title: Equipment FinancingA loan or lease specifically used to purchase business machi via Business Credit Lines

Meta: Optimize your outdoor construction business growth through strategic equipment financingA loan or lease specifically used to purchase business machi using flexible line of credit options.

FAQs:

- What equipment qualifies?

- How fast can funds be accessed?

- Are there tax advantages?

- What documentation is required?

- How do interest rates compare?

What Minimum Revenue Qualifies for a 2026 Contractor Line?

Last Updated: January 2024 | Construction Finance Expert Network

Contractors need $120,000 minimum annual revenue to qualify for 2026 contractor lines. Smart lenders prioritize data transparency and business performance metrics for capital access.

Key Takeaways:

- $120,000 minimum annual revenue threshold

- 82% of lenders now use alternative data scoring

- Transparent financial documentation critical

- Performance metrics outweigh traditional credit metrics

What Minimum Revenue Qualifies for a 2026 Contractor Line?

Contractor Line Revenue Requirements

Minimum annual revenue of $120,000 is standard for most contractor financing lines. Performance consistency matters more than credit history.

Revenue Qualification Breakdown

| Revenue Tier | Qualification Status |

|---|---|

| <$120,000 | Likely Denied |

| $120,000-$250,000 | Moderate Approval |

| >$250,000 | High Approval Probability |

Next Steps

- Compile precise financial documentation

- Verify revenue consistency

- Prepare detailed business performance narrative

- Consider alternative lender networks

Title: 2026 Contractor Line: $120K Revenue Threshold

Meta: Discover minimum revenue requirements for contractor financing lines in 2026, with expert insights on lender qualification criteria.

FAQs:

- What revenue qualifies contractors?

- How do lenders assess financial health?

- Are traditional credit scores still important?

- What documentation is required?

How Does Weather Data Impact My Credit Limit?

Last Updated: March 2024 | Geospatial Risk Intelligence in Financial Technology

Weather data does not directly impact credit limits. Financial institutions use complex risk assessment models that consider multiple factors beyond environmental conditions.

Key Takeaways:

- Credit scoring relies on personal financial history

- Weather patterns have no statistically significant direct correlation to creditworthiness

- 97.3% of credit decisions use traditional financial metrics

H1: Can Weather Influence Credit Limits?

H2: Risk Assessment Fundamentals

Credit limits are determined by credit scores, income, payment history, and debt-to-income ratio. Weather data remains irrelevant in standard underwritingThe process of assessing risk and creditworthiness before ap processes.

H3: Data Sources for Credit Evaluation

- Credit reports

- Income verification

- Payment history

- Debt levels

- Employment stability

Summary: Credit limitThe maximum amount of money a lender will allow you to borro decisions stem from comprehensive financial profiles, not environmental factors.

Next Steps:

- Review personal credit report

- Maintain consistent payment history

- Reduce existing debt

- Increase income streams

Title: Weather’s Impact on Credit Limits

Meta: Explore how credit limits are calculated and why weather data does not influence financial risk assessment.

FAQs:

- What determines credit limits?

- How do lenders assess risk?

- Can external factors affect creditworthiness?