When a business owner searches for a working capital loanA loan used to finance a company's everyday operational cost no credit check, they aren’t looking for a lecture on fiscal responsibility—they’re looking for a lifeline. Traditional banking has largely abandoned the subprime small business market, leaving a gap that alternative lenders have rushed to fill with speed and accessibility.

If you’ve been rejected by a bank because of a low FICO scoreA credit score used by lenders to assess a borrower's credit, you’re not alone. Over 80% of small business loan applications at major banks are denied, forcing business owners to turn to revenue-based lenders who prioritize cash flowThe net amount of cash moving in and out of a business. over credit history.

Why Banks Say No And Alternative Lenders Say Yes

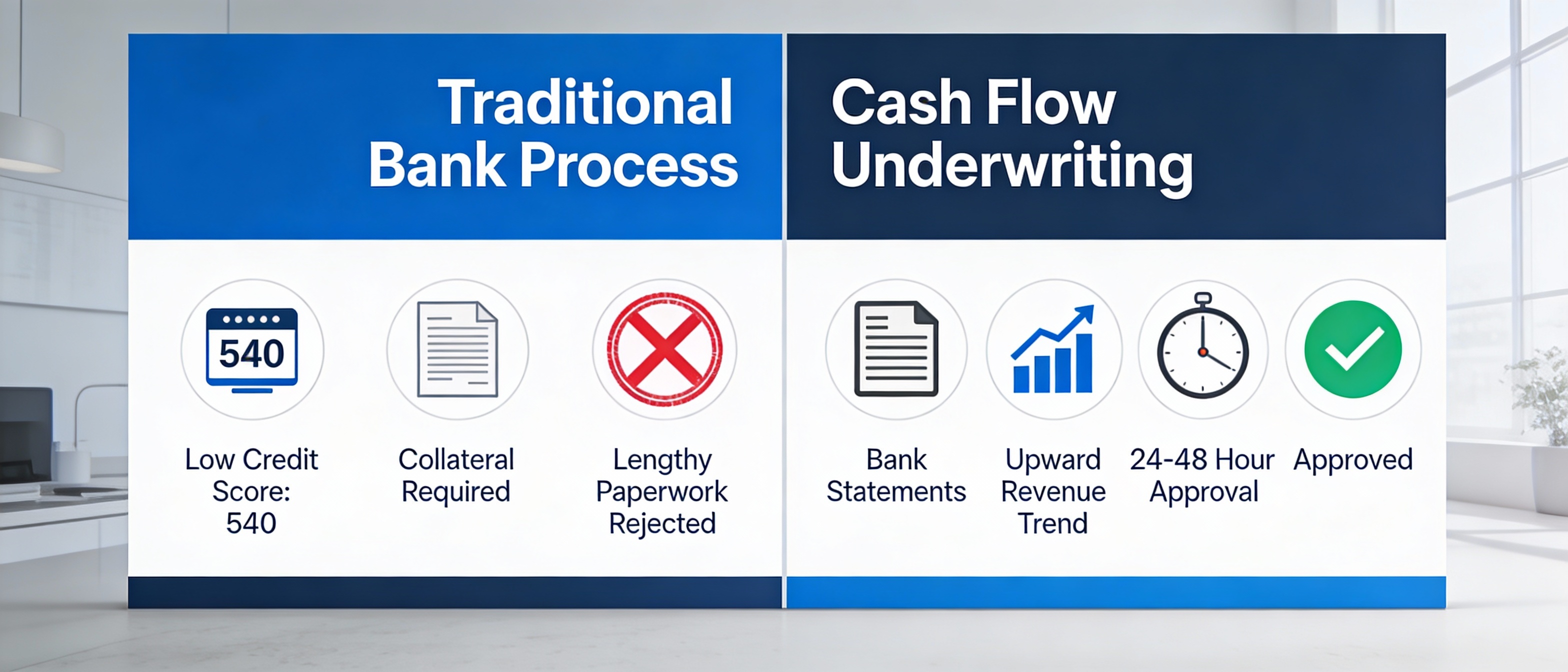

Traditional banks operate on rigid underwritingThe process of assessing risk and creditworthiness before ap models that prioritize personal credit scores, collateralAn asset pledged by a borrower to secure a loan, subject to, and time in business. A personal bankruptcy from five years ago or medical debt from a divorce can disqualify you instantly, regardless of how profitable your business is today.

Alternative lenders flipped this model. They use AI-powered cash flowThe net amount of cash moving in and out of a business. underwritingThe process of assessing risk and creditworthiness before ap to analyze your real-time bank data, merchant processing statements, and daily sales velocity instead of relying on outdated FICO scores.

“The alternative lending market is projected to reach $500 billion by 2028, driven by small businesses that traditional banks refuse to serve.”

– The Rise Of Cash Flow Underwriting In 2026

Cash flowThe net amount of cash moving in and out of a business. underwritingThe process of assessing risk and creditworthiness before ap evaluates your business on what it generates, not what you’ve lost. Lenders connect directly to your bank account via secure API integrations to analyze deposit patterns, average balances, and NSF frequency.

If you can show three to six months of steady deposits totaling $10,000+ per month with minimal overdrafts, you’re considered “bankable” by alternative standards—even with a 540 credit score.

– Understanding The 80 Percent Rejection Rate At Big Banks

According to the Biz2Credit Small Business Lending Index, major banks approve fewer than 20% of small business loan applications. This isn’t a reflection of business viability but adherence to automated risk models that penalize anything outside narrow parameters.

A seasonal business with fluctuating revenue, a startup with less than two years of tax returns, or a business owner with student loan debt all trigger automatic denials at traditional institutions.

Top Five No Credit Check Business Funding Options

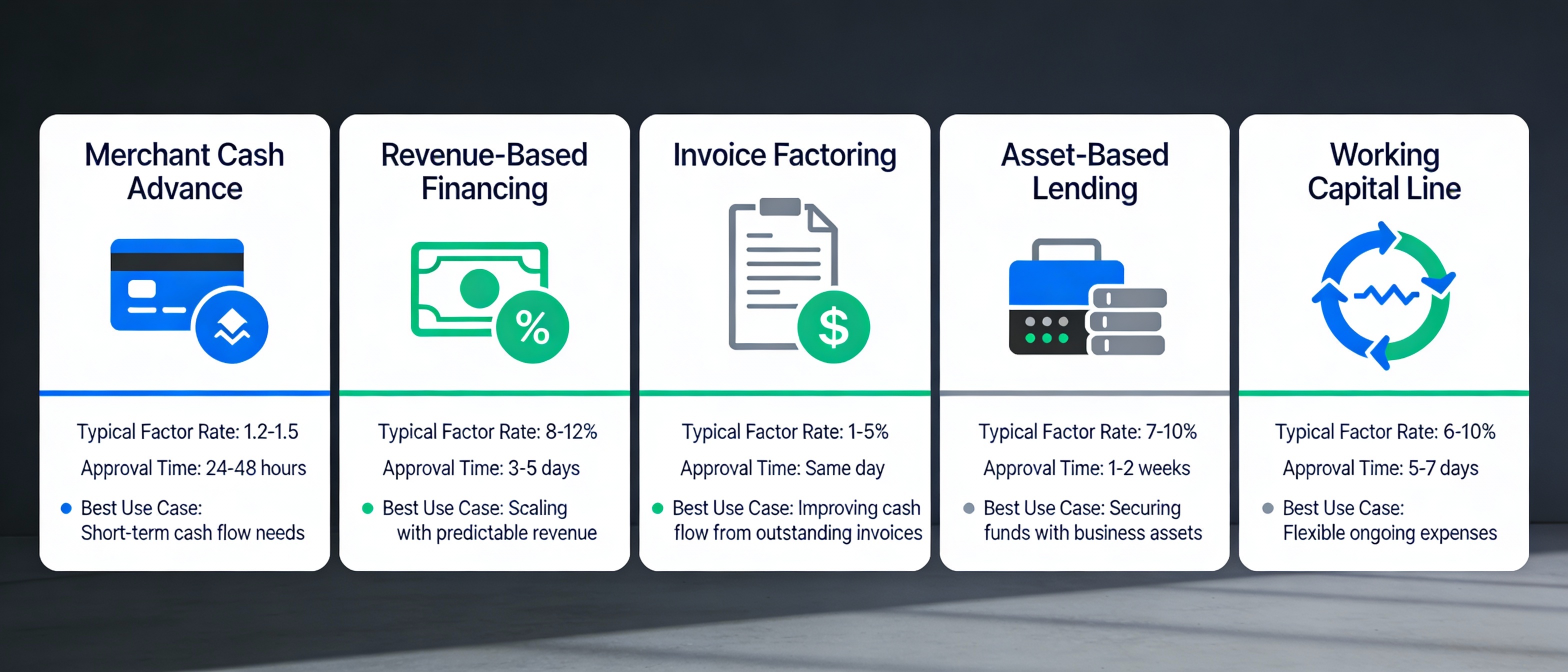

Alternative lenders offer multiple products designed for speed and accessibility. Each has unique advantages and costs that must be carefully evaluated before signing.

Compare Funding Options at a Glance

– Merchant Cash Advances For High Volume Retailers

Merchant Cash Advances (MCAs) are not loans—they’re purchases of your future credit card sales. A lender advances you $50,000 in exchange for $65,000 of your card receipts, collecting a fixed percentage of daily sales until the balance is paid.

MCAs work best for businesses with consistent credit card volume like restaurants, salons, and retail shops. Approval depends on your monthly card sales, not your personal credit, and funding can arrive in 24 hours.

– Revenue Based Financing For Consistent Monthly Income

Revenue-based financingFinancing where investors receive a percentage of future gro provides a lump sum in exchange for a fixed percentage of monthly gross revenue until the agreed amount is repaid. If you receive $30,000 and agree to repay $39,000, the lender takes 10-15% of monthly deposits until complete.

This structure is ideal for SaaS companies, subscription services, and B2B businesses with predictable recurring revenue streams documented through accounting software integrations.

– Invoice Factoring To Turn Unpaid Bills Into Instant Cash

Invoice factoringSelling accounts receivable (invoices) to a third party at a allows you to sell outstanding invoices to a third party at a discount. If you have $100,000 in net-30 invoices from creditworthy customers, a factoringSelling accounts receivable (invoices) to a third party at a company pays you $85,000 immediately and collects the full $100,000 from your clients.

FactoringSelling accounts receivable (invoices) to a third party at a approval depends on your customers’ creditworthiness, not yours. This makes it accessible even for startups with strong client rosters but weak personal credit histories.

– Asset Based Lending For Equipment And Inventory

Asset-based lendingA loan secured by business assets like inventory, accounts r uses business assets—equipment, inventory, receivables—as collateralAn asset pledged by a borrower to secure a loan, subject to for a revolving line of creditA credit line that can be used, repaid, and used again repea. If you have $200,000 in inventory, a lender might advance 50-70% of its appraised value.

This option requires valuable assets but doesn’t weigh personal credit heavily, focusing instead on liquidation value and asset turnover rates verified through audits.

“Businesses with 2+ years of operating history have a 60% higher approval rate for revenue-based funding regardless of credit score.”

The Real Cost Of Fast Working Capital

The convenience of no credit check working capital comes at a steep price. Understanding the true cost is essential to avoid a debt trap that could sink your business.

– Deciphering Factor Rates Versus Interest Rates

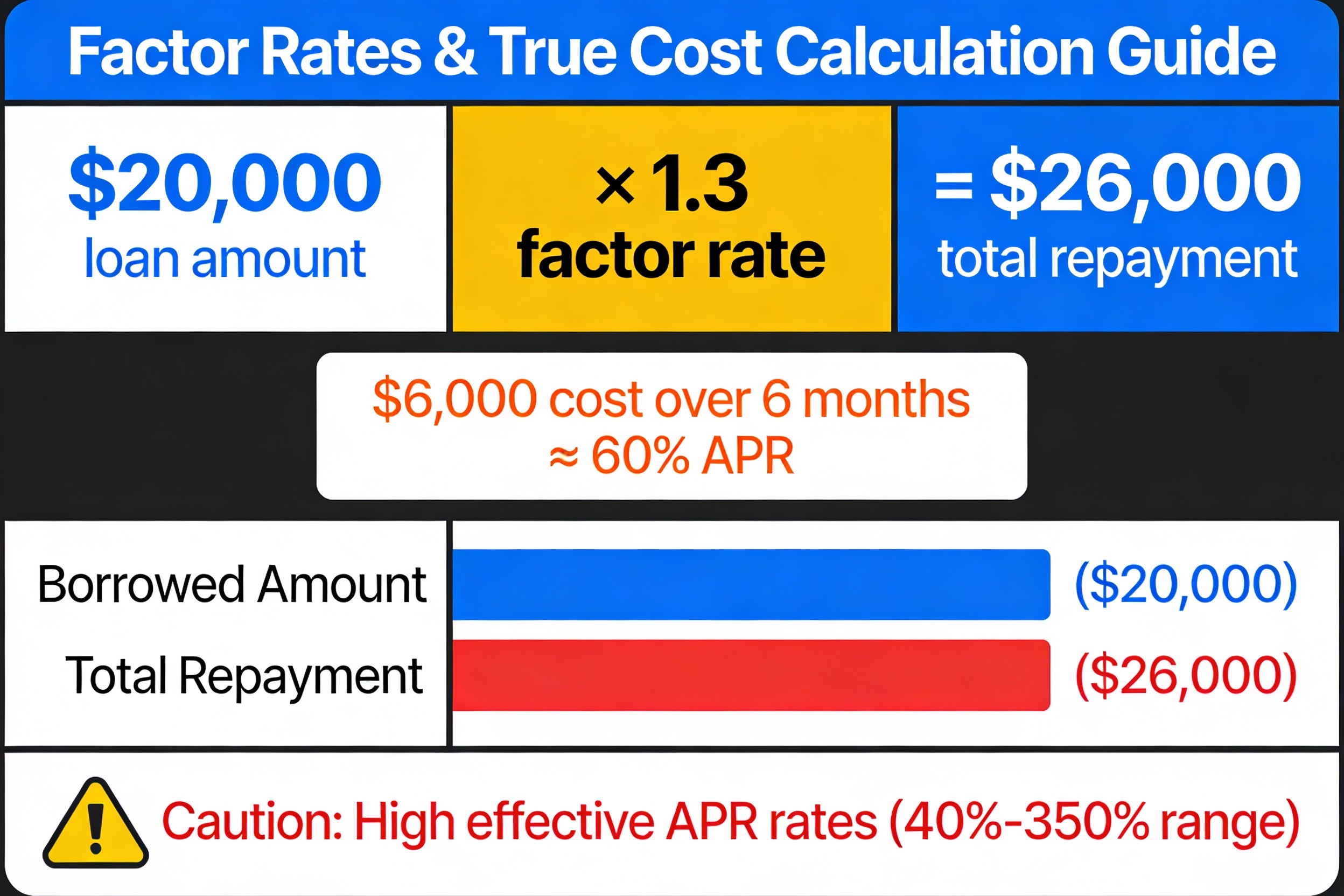

Alternative lenders rarely quote traditional APRs. Instead, they use factor rates ranging from 1.1 to 1.5, meaning you repay $1,100 to $1,500 for every $1,000 borrowed.

A $20,000 advance with a 1.3 factor rateA decimal figure used to calculate the total repayment amoun requires repayment of $26,000 total. If repaid over six months, the effective APR exceeds 60%—far higher than any bank loan but accessible when banks won’t approve you.

💡 Interactive True Cost Calculator

Calculate the real APR and total cost of your working capital loanA loan used to finance a company's everyday operational cost

$0

$0

0%

$0

– Managing Daily And Weekly Payment Cycles

Most MCAs and revenue-based loans use daily ACH debits or automatic credit card splits. A $50,000 advance might require $500 daily payments until $65,000 is collected.

This structure can strangle cash flowThe net amount of cash moving in and out of a business. if your revenue dips unexpectedly. Before accepting terms, stress-test your cash flowThe net amount of cash moving in and out of a business. to ensure daily payments won’t prevent you from covering payroll, rent, or inventory replenishment.

“Merchant Cash Advances can carry effective APRs ranging from 40% to 350%, making them the most expensive form of business capital.”

How To Qualify For A Working Capital Loan No Credit Check

Qualifying for alternative financing requires different preparation than traditional bank loans. The focus shifts from credit history to operational proof.

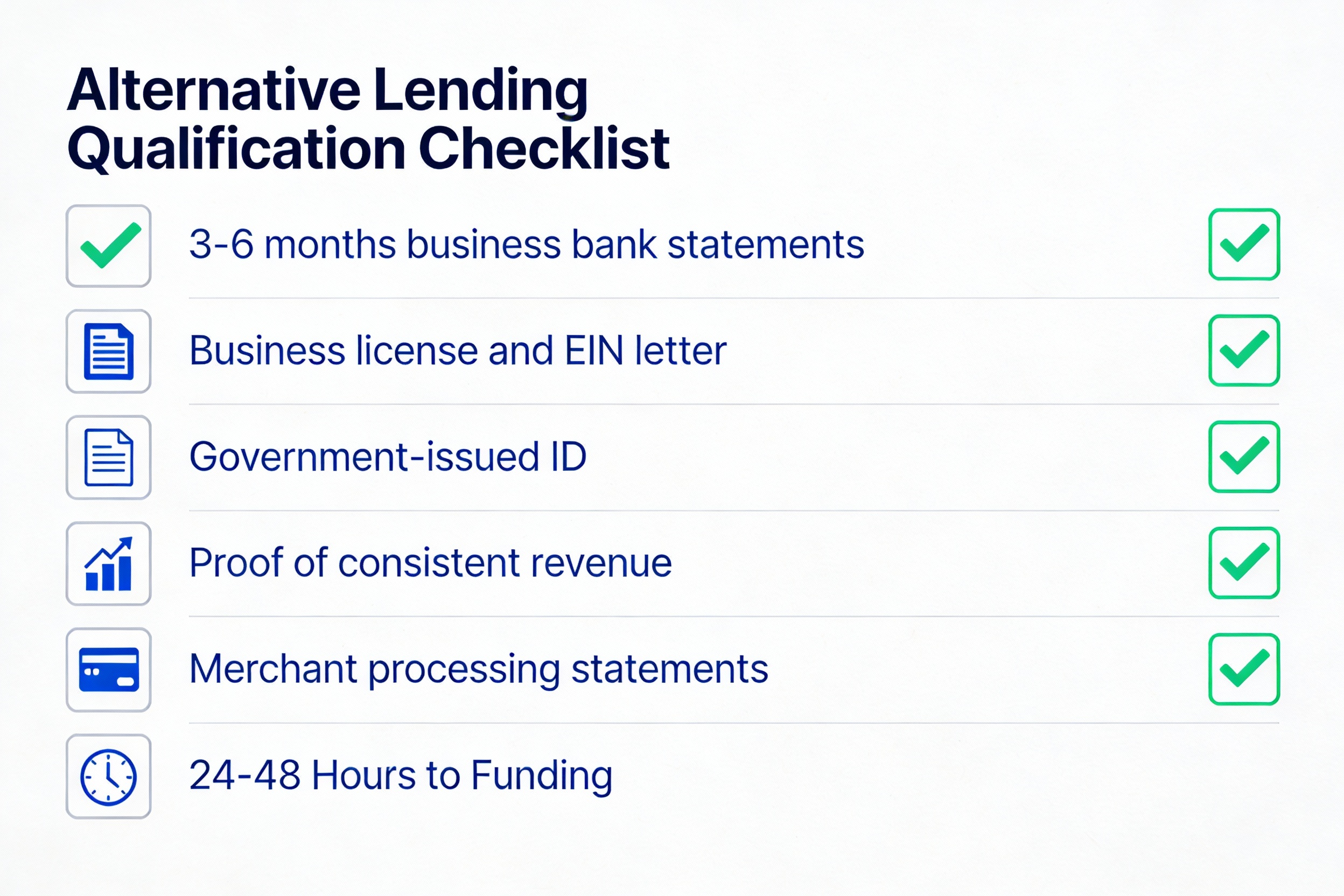

– Essential Documents Beyond The Credit Report

You’ll need three to six months of business bank statements showing consistent deposits, proof of business ownership (EIN letter, business license), a government-issued ID, and merchant processing statements if accepting cards.

Some lenders request voided checks to set up ACH debits and basic financial statements showing revenue and expenses, though formal tax returns are often optional for amounts under $100,000.

– The Importance Of Clean Bank Statements

Bank statement quality is the single most important approval factor. Lenders look for consistent deposits, minimal NSF fees, and average balances that support repayment capacity.

If your statements show frequent overdrafts, irregular deposits, or numerous NSF charges, address these issues for 90 days before applying to improve approval odds and reduce quoted factor rates.

Avoiding Predatory Lending Traps

Not all alternative lenders operate ethically. Knowing the red flags can protect you from scams and abusive terms that destroy businesses.

– Red Flags To Watch For In Emergency Funding

Be wary of lenders who charge upfront fees before funding, refuse to provide written contracts, or pressure you to sign same-day without reviewing terms. Legitimate lenders earn money from factor rates, not application fees.

Avoid any lender requiring you to change banks, demanding access to personal bank accounts, or offering “guaranteed approval” without reviewing your financials—these are hallmarks of predatory operations.

– Calculating The True APR Before You Sign

Use an online APR calculator to convert factor rates into annualized percentages. If a lender quotes 1.25 over six months, the true APR is approximately 50%—information they won’t volunteer but you must know.

Compare at least three lender offers side by side: total repayment amount, payment frequency, term length, and penalties for early repayment (some charge prepayment fees despite already collecting the full factor).

Securing Your Business Future With Strategic Capital

A working capital loanA loan used to finance a company's everyday operational cost no credit check is a bridge, not a destination. Use it strategically to fulfill time-sensitive opportunities, then immediately plan your transition to more affordable financing.

Once you secure capital and complete the profitable project it funded, dedicate resources to rebuilding business credit through trade lines, secured business credit cards, and consistent vendor payment reporting to Dun & Bradstreet.

Within 12-24 months, improved business credit and documented revenue growth can qualify you for traditional business lines of credit with single-digit APRs, eliminating reliance on expensive alternative products.

Need Fast Working Capital Today?

Get pre-qualified for no credit check funding in under 5 minutes. Compare offers from top alternative lenders with no impact to your credit score.

Start Your Application →Frequently Asked Questions

Is there really no credit check for working capital loans?

Most alternative lenders perform a soft credit pull that doesn’t impact your score. The primary decision factor is your last 3-6 months of bank statements showing consistent revenue, not your FICO scoreA credit score used by lenders to assess a borrower's credit.

How fast can I get funded with a no credit check working capital loan?

Alternative lenders are designed for speed. Once you submit clean bank statements and basic documentation, funding typically arrives within 24 to 48 hours via direct deposit or ACH transfer.

What is the real cost of these loans?

The cost is significantly higher than traditional bank loans. Effective APRs for merchant cash advances can range from 40% to 350%. Factor rates for revenue-based financingFinancing where investors receive a percentage of future gro typically range from 1.1 to 1.5, meaning you repay $1,100 to $1,500 for every $1,000 borrowed.

What documents do I need for approval?

You’ll need 3-6 months of business bank statements, proof of business ownership, a valid ID, and evidence of consistent revenue. Some lenders may also request merchant processing statements if you accept credit cards.

How do daily or weekly payments affect my cash flow?

Daily or weekly payment structures can strain cash flowThe net amount of cash moving in and out of a business. if not properly planned. Before accepting terms, calculate whether your daily revenue can consistently cover the payment plus your operating expenses. A general rule is to ensure payments don’t exceed 10-15% of daily deposits.

References & Sources

- Biz2Credit. (2025). Small Business Lending Index Report

- Allied Market Research. (2025). Global Alternative Lending Market Forecast

- Federal Reserve. (2025). Small Business Credit Survey: Report on Employer Firms

- Bloomberg. (2025). Merchant Cash Advance Industry Analysis and APR Breakdown

- Fundera. (2025). Alternative Lending Approval Rate Survey