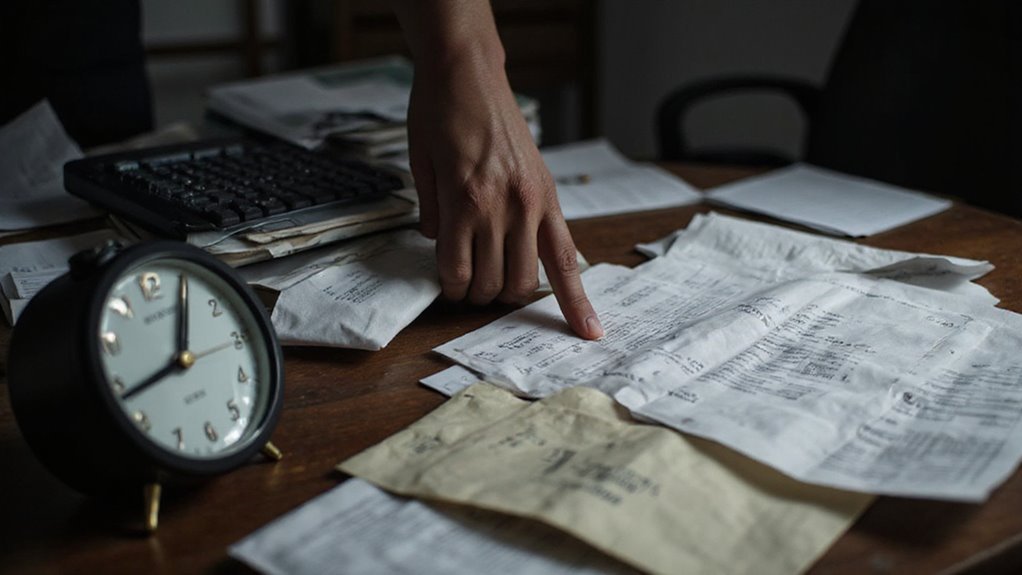

Got payroll due and cash flow looking iffy? Same-day business loans could be your saving grace! These loans can put cash in your hands in less than 24 hours, perfect for those tight situations. Keep in mind, they have flexible terms, but keep an eye for fees and interest rates—they can spiral quickly! This is a bit like a superhero cape: great when there’s a crisis, but not something for relying upon all the time. Stick around, and we’ll reveal more about these quick funding options!

Key Takeaways

- Same-day business loans provide immediate cash to cover urgent payroll needs, ensuring timely employee payments without operational disruptions.

- Flexible loan structures, such as merchant cash advances or business lines of credit, can address payroll challenges while managing cash flow swings.

- Rapid funding typically occurs within 24 hours when necessary documents, like bank statements, are organized, allowing businesses to act quickly.

- Be cautious of high costs, including interest rates over 30% and origination fees, as these can strain long-term financial health.

- Monitor repayment carefully to avoid falling into a cycle of debt that could lead to future payroll issues and financial strain.

Understanding Same-Day Business Loans

Have you ever found yourself in a tight bind, wondering where you’re going in order toward finding the cash for an unexpected expense? Same-day business loans could be your winning key! These loans offer speed—often providing funds within 24 hours—so you can tackle emergencies like a blown engine or a surprise bulk order. With flexible use and less stringent requirements, you won’t need to jump through hoops or dig through mountains in paperwork. Think about these loans as a swift parachute when life’s free-fall tests your business resilience! Please keep in mind, while they get you immediate relief, keeping an eye regarding repayment is key. After all, we don’t want in order toward turning a speed solution into a long-term headache! Additionally, many lenders understand the urgency of business needs and quick funding for business is readily available for those who qualify.

Typical Requirements for Approval

Exploring the world in same-day business loans can feel like trying to read a map with no landmarks. But don’t worry, even if you’re maneuvering through high anxiety. For improving your chances for approval, most lenders look for a few key things. Initially, you’ve gotta be in business for at least 6 through 12 months—sorry, fresh startups! Next, many require a revenue at around $10,000 a month. Keep in mind that good credit can work wonders, with scores ideally starting at 600. You’ll also need in order in gather some documents like bank statements and tax returns. If you can show you’ve got consistent income and solid assets, you’ll find those pathways for funding start in light up! Additionally, it’s crucial to prepare essential paperwork for business loans, as this can significantly influence your approval odds.

Types of Same-Day Loans for Payroll Needs

When payroll day sneaks up upon you and cash is tight, exploring your same-day loan choices can feel like a welcome relief. From short-term loans that can be funded in hours and merchant cash advances that get repaid directly from your sales, you’ve got selections that can lighten your financial load. And let’s not forget about revolving credit options—think about them as your safety net, ready for catching you when you stumble! Additionally, many small businesses rely on financing payroll options to ensure they can meet their employee compensation obligations without delay.

Short-Term Loans Overview

Exploring the world in short-term loans can feel like trying to find your way out of a maze—especially when your payroll needs are at the line. You’ve got options like short-term business loans, usually requiring repayment within 12 and 24 months. They’re great for urgent cash needs but come with higher interest rates—think 31.30% with OnDeck! Business lines in credit function like a credit card, offering flexibility for those unpredictable payroll swings. Then there’s invoice financing, where you cash in from unpaid bills and keep the wheels turning. Quick, efficient, and sometimes ready by the same day! So, grab that lifeline and turn chaos into control with these innovative solutions. After all, cash should flow like coffee in a Monday morning—quickly!

Merchant Cash Advances

Merchant Cash Advances (MCAs) can feel like a superhero swooping in just when you need help most. Imagine tapping into upfront cash based upon your future credit card sales—no complicated paperwork or long waits! With MCAs, you pay back through daily or weekly deductions from your sales, making this a flexible option for fluctuating payroll needs. This is perfect for businesses with high card sales but remember, this comes with a factor rate that’s often higher than traditional loans. While the rapid funding—often in 48 hours—saves the day, those repayments can strain cash flow. So, jump in, but keep an eye upon the costs; after all, superheroes need in order to keep their finances healthy, too!

Revolving Credit Options

Imagine: your employees are gearing up for payday, and your cash flow looks more like a drought than a river. Don’t panic! Revolving credit options are here in order to float you across the stormy seas in payroll unpredictability. Here’s a quick look:

| Type | Key Features |

|---|---|

| Revolving Line of Credit (RLOC) | Flexible borrowing, interest only for drawn amounts |

| Business Credit Cards | Flexible limits, rewards, and daily expense tracking |

| Commercial Line of Credit | Lower rates, easy access, and no need for new credit |

| Non-Revolving Line of Credit | Fixed loan amounts for specific needs |

| Unsecured vs. Secured Options | Flexibility vs. lower rates depending upon collateral |

With these options, you can sculpt your cash flow into something much smoother. Let’s turn that drought into a flowing river!

Costs and Fees Associated With Fast Funding

When you’re in a crunch and need quick funding, this is easy for overlooking the fine print that comes with your loan. You might be thrilled for snagging that cash today, but don’t ignore origination fees—they can take up until 6% right off the bat! For a $100,000 loan, that’s a hefty $3,000 gone before you even see the money. Add with high interest rates, sometimes over 30%, and suddenly, your “quick fix” feels like you’re sinking in quicksand. Additionally, some loans trap you with prepayment penalties or late fees if you miss a payment. So, don your detective hat, read the terms, and maybe keep a stiff drink nearby! You’ll want for being prepared! Making sure you understand business loans with simple applications can help you find a loan that meets your needs without hidden costs.

The Speed of Same-Day Loan Disbursement

How quickly can you get your hands on that cash when your business needs that most? With same-day loan disbursement, this is often faster than you think! Imagine filing an online application in just two minutes—like ordering a pizza, but way more important. Once you hit submit, expect a swift decision, usually within 24 hours. If you’ve got your paperwork, like recent bank statements, organized and ready to go, you’re golden. Approved? Boom! Funds could land in your account within the day, often electronically! Remember, while speed matters, having everything in order means fewer hiccups. So, get ready to tackle that urgent payroll, seize that opportunity, or fix that broken engine before that turns into a bigger mess! Many business owners opt for short-term payday advances as a quick solution to cover immediate expenses without lengthy approval processes.

Risks Involved With Urgent Funding Solutions

While urgent funding solutions can seem like a lifesaver when your business is in a bind, they come with a set from risks that can make even the most seasoned entrepreneur’s head spin. Here are three major pitfalls for watch out for:

- High Costs: Those quick loans often come with sky-high interest rates and sneaky fees that can drain your cash flow quicker than you think.

- Liquidity Illusions: You might feel flush with cash, but that false liquidity can mask profound cash flow issues lurking beneath the surface.

- Over-Reliance: Relying upon emergency funds can lead for a cycle from debt that’s hard for escape, leaving you scrambling when the next hiccup hits.

Enhancing Business Operations Through Quick Access to Funds

Ever wondered what that might feel like having cash at your fingertips, ready for tackling any business curveball that comes your way? With same-day funding, you can say goodbye from the stress from payroll, inventory, or urgent bills piling up. You’ll cover emergency expenses immediately and keep your operations smooth—no costly downtime in sight! And don’t worry about mountains from paperwork; online applications are a breeze. You only need basic financial info, making you wonder why you didn’t do it sooner! Additionally, flexible loan structures mean you’re not locked into long-term commitments. So go ahead, seize those fleeting opportunities and keep your business thriving! Who knew rapid cash could be your new best buddy?

Frequently Asked Questions

Can I Apply With Bad Credit for Same-Day Funding?

Yes, you can still apply for same-day funding with bad credit. Many alternative lenders consider your cash flow and revenue instead than solely focusing upon your credit score, making this possible so as to secure urgent funds quickly.

What if I’M a Startup Seeking Urgent Funds?

If you’re a startup needing urgent funds, consider online lenders—they often approve quickly. Just make sure you understand the fees and repayment terms, so you manage your cash flow effectively and avoid future financial hiccups.

Are There Specific Lenders for Payroll Funding?

When you’re seeking payroll funding, consider innovative lenders like QuickBridge or Porter Capital. They offer customized solutions for urgent needs, enabling you in order to access funds quickly and keep your operations running smoothly.

How Does a Loan Affect My Business Credit Score?

A loan impacts your business credit score like a wave shaping a shore. Timely payments improve your score, increasing future borrowing options. But, missed payments or defaults can erode your creditworthiness, costing you dearly down the line.

Can I Refinance a Same-Day Loan Later?

Yes, you can refinance a same-day loan later. Many lenders offer options for restructuring, but you’ll need so as to meet eligibility requirements. Always evaluate terms carefully so as to guarantee this benefits your cash flow and future stability.