Permanent fixed working capital is the long‑term capital your business needs to operate smoothly year‑round — regardless of seasonality, market cycles, or short‑term fluctuations. Whether you’re running a contracting business, managing rental properties, or scaling a service‑based company, this type of capital ensures you always have the financial “floor” required to keep operations stable.

Below is a complete breakdown of how permanent working capital works, how it differs from temporary working capital, and how businesses use it to stay funded, flexible, and growth‑ready.

Defining Permanent Or Fixed Working Capital For Growth

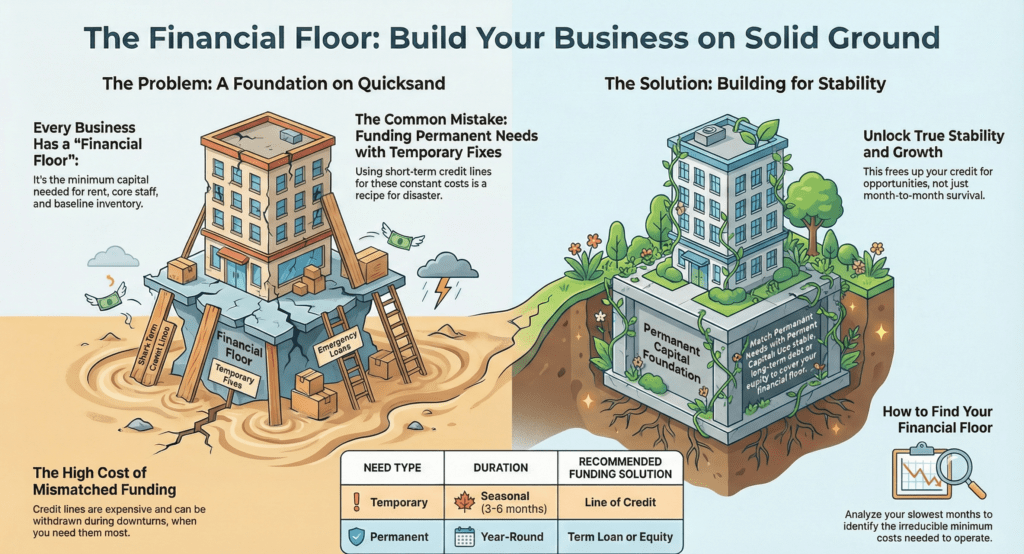

You’ve probably noticed that your business has a bare minimum it needs for survival, the rent that’s due whether you’re slammed or slow, the core team you can’t let go, the baseline inventory that keeps the lights functioning.

That irreducible minimum is your permanent working capital, and this is different from the temporary cash boosts you need during growth spikes or seasonal rushes. Learning to separate these two is what changes you from constantly scrambling for emergency credit to actually building a stable foundation that doesn’t crumble the moment sales dip. Proper funding structures help owners maintain operations, preventing common liquid failures that could otherwise derail your business. Growth often consumes cash reserves before revenues arrive, creating challenges in managing cash flowThe net amount of cash moving in and out of a business..

Permanent Working Capital vs. a Business Line of Credit

A business line of credit can be used to fund permanent working capital — but they are not the same thing.

| Feature | Permanent Working Capital | Business Line of Credit |

|---|---|---|

| Purpose | Maintain baseline operations | Flexible, on‑demand funding |

| Duration | Long‑term | Short‑term revolving |

| Stability | Predictable | Variable |

| Best For | Ongoing expenses | Seasonal or project‑based needs |

Why Permanent Working Capital Matters

Businesses that maintain adequate permanent working capital benefit from:

- Consistent cash flowThe net amount of cash moving in and out of a business.

- Operational stability

- Reduced financing stress

- Better vendor relationships

- More predictable growth planning

If you’re running multiple projects, managing inventory, or expanding into new markets, permanent working capital becomes the foundation that keeps everything running.

If you’d like to discuss how permanent working capital or a business line of credit could support your operations, you can speak directly with a funding specialist at:

The Irreducible Minimum Of Business Liquidity

Every business, no matter how successful, has a baseline number—the amount of cash and liquid assets that you need just for keeping the lights operational. This irreducible minimum is your permanent current assets: the inventory you can’t sell, the payroll you can’t skip, the rent that’s always due.

Think of it as your financial floor. You’re not talking about growth capital or seasonal spikes here. You’re identifying what stays constant even in your worst month.

That boutique retailer? They need $100k minimum, rain or shine. Without recognizing this floor, you’re fundamentally running blind, treating permanent needs like temporary problems. That’s where most businesses stumble.

Distinguishing Between Permanent And Temporary Capital Needs

Most business owners mix up their money problems, treating a temporary cash crunch the same way they’d handle a permanent drain in resources. Here’s the reality: they’re not the same beast.

Temporary capital needs spike during busy seasons, extra inventory for holiday sales, seasonal staffing costs, or a one-time equipment upgrade. These come and go.

Permanent or fixed working capital, though, is your baseline. It’s the irreducible minimum you require every single month: core staff salaries, rent, minimum inventory levels, and crucial operations.

| Need Type | Duration | Funding Solution | Cost | Flexibility |

|---|---|---|---|---|

| Temporary | Seasonal (3-6 months) | Line of credit | Higher interest | High |

| Permanent | Year-round | Term loan | Lower interest | Fixed |

| Growth | Project-based | Equity or grantNon-repayable funds given by an entity for a specific purpos | Variable | Medium |

| Emergency | Unexpected | Reserve fund | None | Low |

| Cyclical | Recurring pattern | Blended approach | Mixed | Moderate |

The distinction matters because you’ll fund them differently.

How Much Permanent Working Capital Do You Need?

Most businesses underestimate their baseline capital requirements. A simple rule of thumb:

- Stable businesses: 3–6 months of operating expenses

- Seasonal businesses: 6–12 months

- Growth‑stage businesses: 12+ months

Permanent working capital is often financed through:

- Business lines of credit

- Long‑term loans

- Revolving credit facilities

- Asset‑backed financing

For investors, this often means maintaining enough liquidityThe ease with which assets can be converted into cash. to cover:

- Carrying costs

- Renovation timelines

- Market delays

- Multi‑project overlap

The Role Of Core Assets In Your Financial Strategy

Your core assets—the minimum inventory you can’t operate without and the cash cushion that keeps the lights operating—are the real foundation of your financial strategy, not the extras you’ll add during growth spurts. You’ll find that pinpointing exactly what you need merely to survive a slow month is harder than it sounds, but this is the difference between utilizing expensive credit lines for emergencies and using them solely when you’re actually expanding.

Here’s the thing: if you’re managing a service business, you’re probably looking at a smaller fixed capital base than a retailer would need, which means your path towards that “financial floor” might be more rapid than you think. Keep in mind that trapped assets reduce bank balances despite still showing positive net incomeTotal revenue minus all expenses, taxes, and costs; the 'bot figures, which can impact how you view available financial resources. Alternative funding providers can help you access capital even if you have low personal scores, ensuring your core assets remain protected during tough financial periods.

When Permanent Working Capital Is Essential

You likely need permanent working capital if:

- Your business has ongoing, predictable expenses

- You manage inventory or supply chains

- You run multiple projects at once

- You’re expanding into new markets

- You want to reduce reliance on short‑term financing

Identifying The Minimum Inventory And Cash Requirements

Three things keep a business running during slow months: the inventory sitting in your shelves, the cash in your account, and the stubborn refusal to panic when sales dip.

Identifying your minimum inventory and cash requirements isn’t guesswork—it’s survival math. You need to pinpoint what your business absolutely needs in order to operate when revenue drops:

- The baseline stock you can’t go below without disappointing customers

- The payroll buffer covering your fundamental team members

- The utility and rent payments that don’t disappear in winter

- The safety cushion for unexpected repairs or emergencies

Once you’ve mapped these irreducible costs, you’ve found your financial floor. This isn’t about being conservative; it’s about being smart.

You’re building predictability into chaos, giving yourself the breathing room to innovate and grow instead of constantly scrambling.

Why Service Sectors Require Smaller Fixed Capital Bases

Now here’s where this becomes intriguing: not all enterprises bleed cash in the same manner.

Your service firm doesn’t require substantial inventory sitting in a warehouse, which signifies your permanent working capital needs are dramatically smaller than a retailer’s. You’re not financing physical stock—you’re financing personnel, tools, and minimal overheadOngoing operational expenses not tied directly to production.

| Business Type | Core Assets | Fixed Capital Need | Funding Method |

|---|---|---|---|

| Consulting | Staff & software | $15k–$30k | Short-term credit |

| Retail | Inventory & space | $75k–$150k | Term loan |

| IT Services | Equipment & talent | $20k–$40k | Line of credit |

| Manufacturing | Equipment & materials | $200k+ | Long-term debt |

| Freelance | Minimal | $5k–$10k | Personal savings |

This benefit means you’re building more rapidly with fewer resources. Your financial foundation is lower, so you’re not ensnared by permanent capital requirements.

Financing Permanent Or Fixed Working Capital Correctly

You’ve probably noticed that your credit lineA flexible loan allowing a borrower to access funds up to a feels like a safety net until the moment you really need it, then tightens just when your permanent costs won’t budge. Here’s the real issue: lines of credit are designed for temporary bumps in cash flowThe net amount of cash moving in and out of a business., not for the irreducible overheadOngoing operational expenses not tied directly to production that keeps your doors open month after month, which means you’re fundamentally gambling that lenders won’t pull the plug during an economic downturn. Recent trends show a significant rise in non-bank funding sources, providing alternative options beyond traditional lending.

Instead, you’ll want to fund your fixed working capital, the baseline inventory, core staff, and rent that never disappear, with long-term debt or equity, so you’re not caught in a liquidityThe ease with which assets can be converted into cash. trap when market conditions shift. Asset-backed funding, which uses collateralAn asset pledged by a borrower to secure a loan, subject to to secure loans, often provides more stability for permanent assets compared to non-collateral debt options.

The Importance Of Using Long Term Debt Or Equity

Because your permanent working capital isn’t going anywhere, the money that funds that shouldn’t either.

Here’s why long-term debt or equity beats short-term fixes:

- Stability – Your permanent needs get permanent solutions, not Band-Aids that expire when rates spike.

- Predictability – Fixed payments mean you’re not scrambling when credit lines vanish during market shifts.

- Growth Freedom – Your short-term credit stays available for actual opportunities, not survival.

- Lower Costs – Long-term working capital financing typically costs less than rolling expensive lines of credit.

You’re not just funding inventory and payroll. You’re building a fortress.

When you match permanent obligations with permanent capital, you stop playing financial roulette. Your business becomes predictable, resilient, and positioned to innovate rather than just survive the next downturn.

Permanent Working Capital

Long-term capital required to keep operations running year-round.

- Supports stable, ongoing operations

- Ideal for businesses with predictable demand

- Often tied to long-term financing

- Not ideal for seasonal spikes

- May require collateralAn asset pledged by a borrower to secure a loan, subject to or strong financials

Temporary Working Capital

Short-term capital used to cover seasonal or unexpected needs.

- Flexible and fast

- Ideal for seasonal businesses

- Often available through revolving credit

- Higher cost of capital

- Not suitable for long-term needs

Why Lines Of Credit Are Risky For Fixed Capital Needs

The credit lineA flexible loan allowing a borrower to access funds up to a trap is deceptively comfortable, until the situation isn’t. You’re relying upon a tool designed for temporary bumps, not permanent needs.

Here’s the problem: lines of credit are risky for fixed capital needs because they’re callable. A lender can yank your access when the economy shifts or your credit score dips, exactly when you need them most.

You’re also paying premium rates. Short-term borrowing costs more than long-term debt, so you’re bleeding money month after month on irreducible costs like rent and core staff. That’s backwards.

The real danger? You’re treating permanent expenses as temporary solutions. This keeps you trapped in the feast-famine cycle, constantly anxious about renewal dates and interest hikes. Your foundation shouldn’t be unstable. It’s time to anchor it with long-term financing instead.

Calculating Your Fixed Working Capital Floor

To find your financial floor, you’ll need to dig into your past balance sheets and identify the numbers that don’t budge, the inventory you can’t sell below, the staff you can’t let go, the rent that’s always due, because these are your true fixed costs.

Once you’ve identified what you actually need to keep the lights running during your slowest month, you can forecast what next year’s baseline requirements will look like and plan accordingly. That isn’t guesswork; that is the difference between funding survival with expensive short-term debt or building real stability with long-term capital.

Many entrepreneurs pay excessive interest rates because market knowledge remains low, so understanding current market rates can help you secure better financing options.

How Permanent Working Capital Supports Your Business

1. Establish Baseline Operating Needs

Identify the minimum capital required to keep operations running year-round.

2. Secure Long-Term Funding

Permanent working capital is typically financed through long-term credit facilities.

3. Maintain Operational Stability

Ensures you can cover payroll, inventory, and overheadOngoing operational expenses not tied directly to production without seasonal stress.

4. Support Expansion

Permanent capital frees up cash flowThe net amount of cash moving in and out of a business. so you can reinvest in growth.

Analyzing Historical Balance Sheets For Stability Trends

Looking back at your last three up until five years regarding financial statements is like holding up a mirror toward your business’s true rhythm, and that is the only reliable method for identifying your actual fixed working capital floor.

You’re hunting for patterns, not anomalies. Dig into your balance sheets and identify what stays constant, even during your slowest months.

Your net working capitalThe difference between a company's current assets and its cu tells the story, the gap between what you owe and what you own. Track these elements:

- Minimum cash balances across all seasons

- Baseline inventory levels that never drop below

- Accounts receivable that always exist

- Core payables you can’t avoid

This historical data becomes your blueprint for permanent funding.

Forecasting Base Requirements For The Coming Fiscal Year

Once you’ve identified your historical patterns, it’s time to translate those understandings into a forward-looking calculation, one that’ll become your fixed working capital floor for the year ahead. Look at your lowest revenue month from the past three years, then identify what you absolutely must spend to keep doors open: payroll, rent, core inventory.

That’s your capital requirements baseline. Now add a 15% buffer, because surprises happen. This number isn’t your average; it’s your floor.

You’re not guessing anymore; you’re building certainty. When you know exactly what you need, you can stop scrambling for emergency cash and start strategically utilizing capital toward growth instead.

Long Term Benefits Of A Permanent Capital Reserve

You’ve probably noticed that most business failures aren’t dramatic, they’re slow bleeds caused by the constant scramble to cover permanent costs with temporary fixes, and that’s where a capital reserve changes everything.

When you transition from emergency borrowing to strategic funding, you’re not just breathing easier; you’re actually building a business that can weather the valleys without selling off your future through expensive debt.

The real win? You’ll ultimately have the mental space to grow instead of spending every off-season just trying to survive the next one.

Survival Risks Linked To Improper Liquidity Management

When your business relies upon short-term credit to cover enduring costs, you’re fundamentally playing a high-stakes game where the house always wins, and you’re not the house. Without proper enduring capital, you’re exposed to real dangers that compound over time.

Consider these survival risks you’re facing:

- Credit lineA flexible loan allowing a borrower to access funds up to a collapse – Your lender pulls funding during downturns, leaving you stranded

- Escalating interest rates – Temporary debt becomes permanently expensive, crushing your margins

- CovenantA condition or restriction placed on a borrower by a lender violations – Missing debt requirements triggers defaultFailure to repay a debt according to the terms of the loan a, threatening your business license

- Missed growth opportunities – You’re too busy firefighting cash flowThe net amount of cash moving in and out of a business. to innovate

The math is brutal. You’re fundamentally paying premium rates for foundational needs while competitors who secured enduring capital move swiftly.

Your business becomes fragile, dependent on external conditions you can’t control. That’s not a strategy, that’s survival mode masquerading as business acumen.

Transitioning From Emergency Borrowing To Strategic Funding

The shift from constantly scrambling for quick cash toward building a real financial cushion doesn’t happen overnight, but this is absolutely worth the effort. You’re trading the chaos of emergency borrowing for the peace of strategic funding powered by permanent capital. Here’s what alters:

| Aspect | Emergency Mode | Strategic Mode |

|---|---|---|

| Funding Source | High-interest credit lines | Long-term loans |

| Decision Speed | Reactive, panicked | Planned, intentional |

| Interest Costs | 12–18% annually | 5–8% annually |

| Business Focus | Survival | Growth |

When you lock in permanent capital, you’re not just cutting costs—you’re reclaiming mental energy.

That $100k baseline you finance today through a term loan stays yours. You’ll stop treating your line of credit like a lifeline and start using it as innovation fuel instead.

To review your working capital needs or explore flexible funding options, you can reach a funding specialist at:

Frequently Asked Questions

How Do I Know if My Business Actually Needs Permanent Working Capital?

You’ve got permanent working capital needs if you’re covering baseline costs, rent, core staff, minimum inventory—even during your slowest month. If you’re constantly borrowing in order to survive downturns, you’re underfunded.

What’s the Difference Between Permanent Working Capital and a Business Emergency Fund?

Your emergency fund covers unexpected shocks; permanent working capital funds your irreducible baseline costs. You’re building one strategically, the other reactively. One’s structural, one’s protective.

Can I Use Equity Financing Instead of Debt for Fixed Working Capital?

You can absolutely use equity financingRaising capital by selling shares of ownership in the compan for fixed working capital, this is actually strategic. You’re trading ownership for permanent, low-cost capital that won’t evaporate during downturns. It’s ideal if you’re not debt-averse and want stability.

How Often Should I Recalculate My Permanent Working Capital Requirements?

You’ll want to recalculate quarterly, or whenever you’ve experienced significant revenue swings, inventory shifts, or staffing changes. This keeps your financial floor aligned with your developing business reality.

What Happens to Permanent Working Capital if My Business Scales Rapidly?

Your permanent working capital multiplies with swift scaling. You’ll need to recalculate inventory, receivables, and payroll reserves immediately. Underfunding that expanded floor creates a liquidityThe ease with which assets can be converted into cash. crisis that derails growth momentum more quickly than you anticipated.

What’s Your Working Capital Stability Score?

What’s Your Working Capital Stability Score?

Answer a few quick questions to see how stable your permanent working capital is — and where to improve.

- How to Calculate Your “Seasonal Draw Limit” to Avoid Over-Leveraging - February 21, 2026

- Understanding “Draw Periods” and “Repayment Cycles” in Seasonal Lending Agreements - February 3, 2026

- Case Study: How a [Type] Business Used a $100k Line of Credit to Scale for High Season - February 3, 2026