Last updated on December 30th, 2025 at 04:09 am

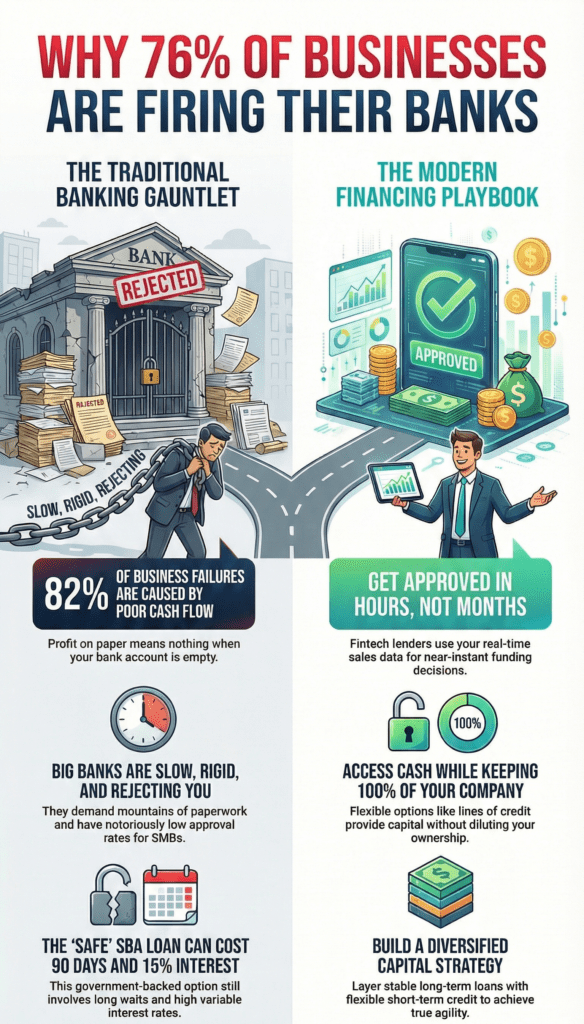

You’re ditching traditional banks because they’re slow, rigid, and rejecting small businesses at rates worse than a coin flip.

Big banks want mountains of paperwork and solid documentation, while fintech lenders approve you in moments using real-time sales data.

You’re not giving up ownership through equity; you’re keeping control with flexible debt options like revenue-based financingFinancing where investors receive a percentage of future gro and invoice factoringSelling accounts receivable (invoices) to a third party at a.

A diversified capital strategy layering short-term credit with longer-term loans gives you the cash flowThe net amount of cash moving in and out of a business. increase you actually need without the banking headaches.

There’s a smarter path forward.

Understanding The 2026 Working Capital Landscape

You’re watching your revenue climb while your bank account tells a different story—and you’re not alone. The harsh reality is that 82% of businesses don’t fail because they’re bad at their trade; they fail because cash flowThe net amount of cash moving in and out of a business. slips through their fingers like water, often quicker than growth can fill the bucket back up. Add in today’s skyrocketing operating costs, from inventory towards payroll regarding that warehouse space you need, and you’re facing a working capital squeeze that’d make even seasoned operators sweat. Growth often consumes cash reserves before revenues arrive, creating a critical cash flowThe net amount of cash moving in and out of a business. challenge that requires careful navigation. Fortunately, there are quick loan structures designed to bridge immediate liquidityThe ease with which assets can be converted into cash. deficits and keep operations running smoothly.

Why Cash Flow Mismanagement Causes Eighty Two Percent Of Failures

Cash flowThe net amount of cash moving in and out of a business. isn’t just a line item in your balance sheetA financial statement summarizing a company's assets, liabil, it’s the oxygen your business breathes, and when it runs out, everything stops.

You’re juggling invoices, payroll, and inventory simultaneously, but here’s the brutal truth: 82% of SMBs fail because they can’t control cash flowThe net amount of cash moving in and out of a business. management.

You might be profitable in paper while your bank account reads empty. That’s the cash flowThe net amount of cash moving in and out of a business. trap. Late customer payments, unexpected expenses, and seasonal slowdowns create a domino effect you didn’t anticipate.

You’re not necessarily a bad operator, you’re just caught off-guard. The difference between thriving and folding often comes down to one simple skill: knowing exactly where your money flows in and out, every single day.

The Impact Of Rising Operating Costs On Modern Liquidity

Every dollar that leaves your business today costs more than that it did last year, and that’s changing the entire game for how you manage working capital. Your suppliers want payment more quickly. Your employees demand competitive wages. Your utilities? They’re climbing steadily.

This squeeze means you can’t simply wait for invoices to land before covering your bills. You need operating expense funding that moves at your pace, not the bank’s.

That’s why savvy owners are building a liquidityThe ease with which assets can be converted into cash. safety net before they’re desperate. You’re not just managing cash flowThe net amount of cash moving in and out of a business. anymore; you’re orchestrating it. The businesses winning right now have diversified funding sources ready to absorb these rising costs without derailing growth. It’s strategic capital planning, not crisis management.

Traditional Banking And SBA Borrowing Options

You’ve probably noticed that big national banks treat your loan application like they are going through a black box, lots of paperwork, endless waiting, and often a polite rejection that leaves you wondering what went wrong. However, there are alternative funding providers that approve applicants despite low personal scores, offering additional options outside traditional banks.

Small banks and community lenders, in contrast, actually know their local market and are willing to take calculated risks regarding businesses like yours, which is why they’re approving around 52-54% of applications compared to the big guys’ much lower rates.

The SBA 7(a) loanA government-backed loan program designed to help small busi sounds promising with its government backing, but you’ll need to brace yourself for the current variable rates sitting between 11.5% and 15%—a cost you can stomach if you’re strategic about how you utilize that capital.

For businesses with financial challenges, there are also rapid funding options designed to provide quick access to capital despite past setbacks.

Navigating The SBA 7a Loan Process In A High Rate Environment

While traditional banks have tightened their lending standards, the SBA 7(a) loanA government-backed loan program designed to help small busi remains one among the most accessible government-backed borrowing options for mid-market businesses, though that’s not exactly a walk in the park these times. You’re looking at current rates between 11.5% and 15%, which stings, but here’s the silver lining: the SBA guarantees a chunk of your loan, making lenders more willing to say yes.

The process requires solid documentation—tax returns, financial statements, a detailed business plan—but you’ll appreciate the longer repayment terms and fixed rates. Sure, it takes 60-90 moments, but if you’ve got the runwayThe amount of time a company can operate before running out, an SBA 7(a) loanA government-backed loan program designed to help small busi provides the stability and lower cost that fintech alternatives simply can’t match. Think of it as the tortoise option in a race where speed matters.

Why Small Banks Offer Better Approval Rates Than National Giants

The 60-to-90-period waiting game for an SBA 7(a) loanA government-backed loan program designed to help small busi might feel like the safer path, but here’s what most business owners don’t realize: the bank you’re pitching matters just as much as the funding itself.

Small banks boast small bank approval rates hovering around 52-54%, while national giants operate with a fraction of that success. Why? Community lenders actually know their market.

They’re willing to dig into your story, not just your credit score. They move more quickly, often closing within 30-45 periods, and they understand that your local business fills a real gap.

While big banks apply one-size-fits-all rules, smaller institutions have flexibility built into their lending models. You’re not a loan number; you’re an investment in your community’s future.

The Rise Of Fintech And Alternative Lending

When you’re tired with waiting ninety periods for a bank decision, fintech lenders and alternative platforms are stepping in with pre-approved capital that hits your account in periods, not quarters, by tapping real-time data from your payment processors and sales channels.

You’re no longer locked into choosing between a rigid traditional loan or nothing; instead, you can layer flexible lines of credit atop longer-term financing to give yourself the breathing room to seize opportunities without constantly sweating the cash flowThe net amount of cash moving in and out of a business. math. Establishing a baseline liquidityThe ease with which assets can be converted into cash. level helps ensure that you maintain access to funds and achieve year-round stability.

Think of embedded lending as your financial safety net that actually catches you, since it’s designed to move as quickly as your business does.

Proper funding structures help owners maintain operations, preventing common liquidityThe ease with which assets can be converted into cash. failures that can derail business growth.

Leveraging Embedded Lending For Rapid Cash Access

Your payment processor already knows more about your business than your bank ever will, and that’s exactly why embedded lending is becoming the quickest route for cash when you need assistance most.

Embedded lending works in this manner: platforms you are already utilizing, your payment processor, accounting software, or e-commerce dashboard, analyze your real-time transaction data and offer pre-approved capital within hours, not weeks. No lengthy applications. No credit committee meetings that lead nowhere.

You are tapping into a system that comprehends your actual revenue patterns, seasonal fluctuations, and customer behavior. The approval occurs automatically because the lender’s risk assessment is based on concrete numbers, not instincts.

You receive liquidityThe ease with which assets can be converted into cash. precisely when opportunities arise, whether that is restocking inventory or covering unexpected expenses. It is capital designed for how you actually operate.

How Lines Of Credit Provide Flexible Operating Insurance

Because cash emergencies don’t announce themselves weeks in advance, lines of credit have become the operating insurance that today’s SMBs can’t afford to skip. Unlike traditional loans, business credit lines let you borrow only what you need, when you need it—no more, no less. You’re not paying interest for money sitting idle in your account.

Here’s why they’re revolutionary:

- Flexibility: Draw funds for payroll gaps, seasonal dips, or surprise opportunities

- Speed: Access capital in periods, not months of bank bureaucracy

- Cost control: Interest accrues only on what you actually use

- Credit building: Responsible usage strengthens your financial profile

- Peace of mind: You’ve got a safety net ready before crisis hits

Think of this as financial breathing room.

Strategic Comparison Of Debt Versus Equity

When you’re deciding whether to borrow or give up equity, you’re really asking yourself one question: do you want to keep control over your company or save money upfront?

Debt lets you keep 100% ownership and know exactly what you owe, but equity deals can feel like you’re paying forever through diluted profits—except the investor gets a portion of every win you make.

The trick is running the numbers regarding your specific situation, because the “cheapest” option in writing might actually drain your wallet or your authority in ways that matter more.

Additionally, understanding the difference between asset-backed funding and non-collateral debt can help you choose a borrowing option that best aligns with your business needs.

Protecting Your Ownership With Non Dilutive Capital

At some point in your growth expedition, you’ll face a fork in the road: do you borrow money or sell a segment for your business?

Here’s the truth: non-dilutive financing keeps you in the driver’s seat. When you borrow, you’re renting money. When you sell equity, you’re handing over permanent control and future profits.

Consider these non-dilutive options:

- SBA loans – Government-backed, lower rates, long repayment terms

- Revenue-based financingFinancing where investors receive a percentage of future gro – Repay only when you’re profitable

- Merchant cash advances – Quick access tied to your sales volume

- Invoice factoringSelling accounts receivable (invoices) to a third party at a – Convert receivables into immediate cash

- Line of credit – Flexible borrowing for opportunistic moments

The math is simple: keeping 100% ownership while paying interest beats surrendering equity every time. You’re building your empire, not funding someone else’s investment portfolio.

Analyzing The Cost Of Capital For Different Loan Structures

The price tag regarding capital comes in two flavors, and they’re wildly different. Debt keeps your ownership intact but demands monthly payments—typically 11-15% annually for fintech options versus 8-12% for bank loans. Equity, meanwhile, dilutes your stake forever but requires zero repayment.

Here’s the real math: a $100k debt at 12% costs you roughly $12k yearly, but you’re done in five years.

Equity giving away 10% of your company? That’s permanent. Your cost of capital decision hinges on timing and growth path. If you’re scaling rapidly and confident in profitability, debt’s predictable burden wins.

If you’re betting on explosive growth, equity’s flexibility might justify the dilutionThe reduction in ownership percentage of existing shareholde. Choose strategically—this choice compounds for decades.

Qualifying For Working Capital In A Tight Market

You’re probably wondering why lenders suddenly care about documents you’ve been casually tossing in a folder, well, in today’s tight market, your paperwork is basically your financial report card, and it directly impacts the rates you’ll qualify for.

The good news? You can actually control two big levers: getting your vital documents organized, think tax returns, bank statements, and profit-and-loss reports, and enhancing your debt service coverage ratio, which shows lenders you’ve got enough cash flowThe net amount of cash moving in and out of a business. to handle payments without breaking a sweat.

Together, these moves convert you from a risky bet into an attractive borrower.

Essential Documents For A Successful Funding Application

When lenders look at your application in 2025, they’re not just scanning your business plan: they’re hunting for proof that you can handle their money responsibly. Your documentation is your credibility currency, particularly when competing for financial term loans and alternative funding.

Here’s what separates approvals from rejections:

- Last 2 years of tax returns (personal and business combined)

- Bank statements showing 3 to 6 months of activity (proves cash flowThe net amount of cash moving in and out of a business. patterns)

- Profit and loss statements (demonstrates operational efficiency)

- Accounts receivable aging report (reveals customer payment reliability)

- Detailed business plan with financial projections (shows you’ve thought ahead)

Lenders aren’t being paranoid. They’re protecting themselves. You’re fundamentally saying, “Trust me with your capital,” so give them concrete reasons to believe you.

Clean, organized documentation signals you’re serious, professional, and worth their risk.

Improving Your Debt Service Coverage Ratio For Better Rates

Your debt service coverage ratio (DSCR)A metric measuring a company's ability to use its operating, basically the relationship between what you earn and what you owe, is the single metric that determines whether lenders see you as a safe bet or a gamble in 2025’s tightened credit environment.

Here’s the reality: you’ll need a DSCR of at least 1.25 to compete for decent rates. That means your annual profit must cover your debt payments and then some.

Enhancing this ratio requires strategic thinking. You’ve got two levers: increase profitability or reduce debt obligations.

The debt vs equity conversation matters here: taking on equity dilutes ownership, but it strengthens your DSCR instantly. Nevertheless, if you’re protecting your stake, focus on aggressive expense reduction and revenue acceleration.

Even a 10% profit bump reshuffles the math markedly, making you suddenly bankable.

Implementing A Diversified Capital Strategy

You’ve probably noticed that relying upon a single funding source is like putting all your inventory in one warehouse, risky and inflexible.

The real power comes from stacking different types of capital: a solid long-term SBA loan gives you stable, predictable payments for equipment or expansion, while a shorter-term line of credit lets you grab those opportunistic moments without waiting three months for approval.

When you’re also watching your cash conversion cycle, tracking how quickly you turn inventory into sales into actual money in your pocket, you’ll identify exactly when and where to utilize each tool, turning what feels like a juggling act into a calculated strategy.

Balancing Long Term Term Loans With Short Term Credit

Because most businesses face both predictable expenses and surprise opportunities, relying regarding a single funding source is like showing up at a gunfight with one bullet.

You’ll want to layer your working capital and borrowing options strategically. Think regarding long-term loans as your foundation: they’re stable, affordable, and perfect for equipment or real estate.

Short-term credit is your flexibility play for seasonal dips or sudden inventory deals.

Here is the winning combination:

- SBA loans for steady, low-rate capital

- Lines of credit for unpredictable cash gaps

- Invoice financingBorrowing money against outstanding invoices to improve imme when customers slow-pay

- Embedded lending through your payment processor

- Trade creditAn arrangement to buy goods or services now and pay the supp from suppliers you trust

This mix lets you stay agile without overpaying for money you don’t constantly need. You’re not just borrowing anymore: you’re designing your capital stack like a true strategist.

Monitoring Your Net Operating Cycle For Maximum Efficiency

How much money’s actually sitting idle in your business right now? That’s your net operating cycle talking, and it’s costing you real opportunities.

By monitoring how long cash gets stuck between paying suppliers and collecting from customers, you’ll identify inefficiencies that drain your growth potential.

The trick? Track your inventory turnover, receivables, and payables like a hawk. When you’ve got that data locked down, you’ll know exactly how much revolving capital you actually need versus what you’re wasting. Tightening that cycle by even 10 periods can free up thousands.

That’s where your diversified capital strategy clicks into place. With real numbers, you’ll borrow smarter, taking only what moves the needle, not what looks safe on a spreadsheet.

Frequently Asked Questions

How Do I Know When to Use Debt Versus Bootstrapping for Business Growth?

You’ll use debt when you’ve identified a time-sensitive opportunity with predictable returns exceeding your borrowing costs. Bootstrap when you’re building foundational systems or lack clear revenue visibility in order to service repayment obligations confidently.

What Hidden Fees Should I Watch for in Alternative Lending Agreements?

You’ll want to scrutinize origination fees, prepayment penalties, hidden servicing charges, and variable rate escalators. Check if they’re bundling insurance or payment processing fees. Compare APR versus stated interest rate—that’s where fintech lenders bury real costs.

Can I Combine Multiple Funding Sources Into One Cohesive Capital Strategy?

You can absolutely stack funding sources—combine a low-rate SBA loan for stability with fintech lines for flexibility. Layer in trade creditAn arrangement to buy goods or services now and pay the supp and invoice financingBorrowing money against outstanding invoices to improve imme to create a diversified capital stack that adjusts to your growth cycles.

How Does Borrowing Impact My Business Valuation for Future Investors or Exits?

You’re looking at a delicate balance: strategic debt positions you attractively to acquirers by demonstrating utilization capacity, yet excessive utilization signals risk. Investors value your debt-to-equity ratioA ratio comparing a company's total liabilities to its share and cash flowThe net amount of cash moving in and out of a business. stability most heavily during valuation.

What Red Flags Indicate a Lender Is Predatory Rather Than Legitimate?

You’ll identify predatory lenders when they demand upfront fees, guarantee approval regardless of creditworthiness, obscure terms in fine print, or charge rates exceeding 25% APR without justification. Legitimate lenders transparently disclose all costs upfront.

- How to Calculate Your “Seasonal Draw Limit” to Avoid Over-Leveraging - February 21, 2026

- Understanding “Draw Periods” and “Repayment Cycles” in Seasonal Lending Agreements - February 3, 2026

- Case Study: How a [Type] Business Used a $100k Line of Credit to Scale for High Season - February 3, 2026