Revenue growth means nothing when your bank account remains empty at month’s end. Operating working capital turnover measures the velocity at which your operational dollars convert from inventory to receivables and finally back into cash—a critical efficiency metric that separates thriving businesses from those perpetually chasing liquidityThe ease with which assets can be converted into cash..

The difference between paper profits and actual purchasing power lies in how effectively you manage the capital trapped in your operational cycle. Companies that optimize this metric unlock hidden cash reserves without securing additional financing, funding growth from internal resources rather than expensive external debt.

Understanding The Core Concept Of Working Capital Turnover

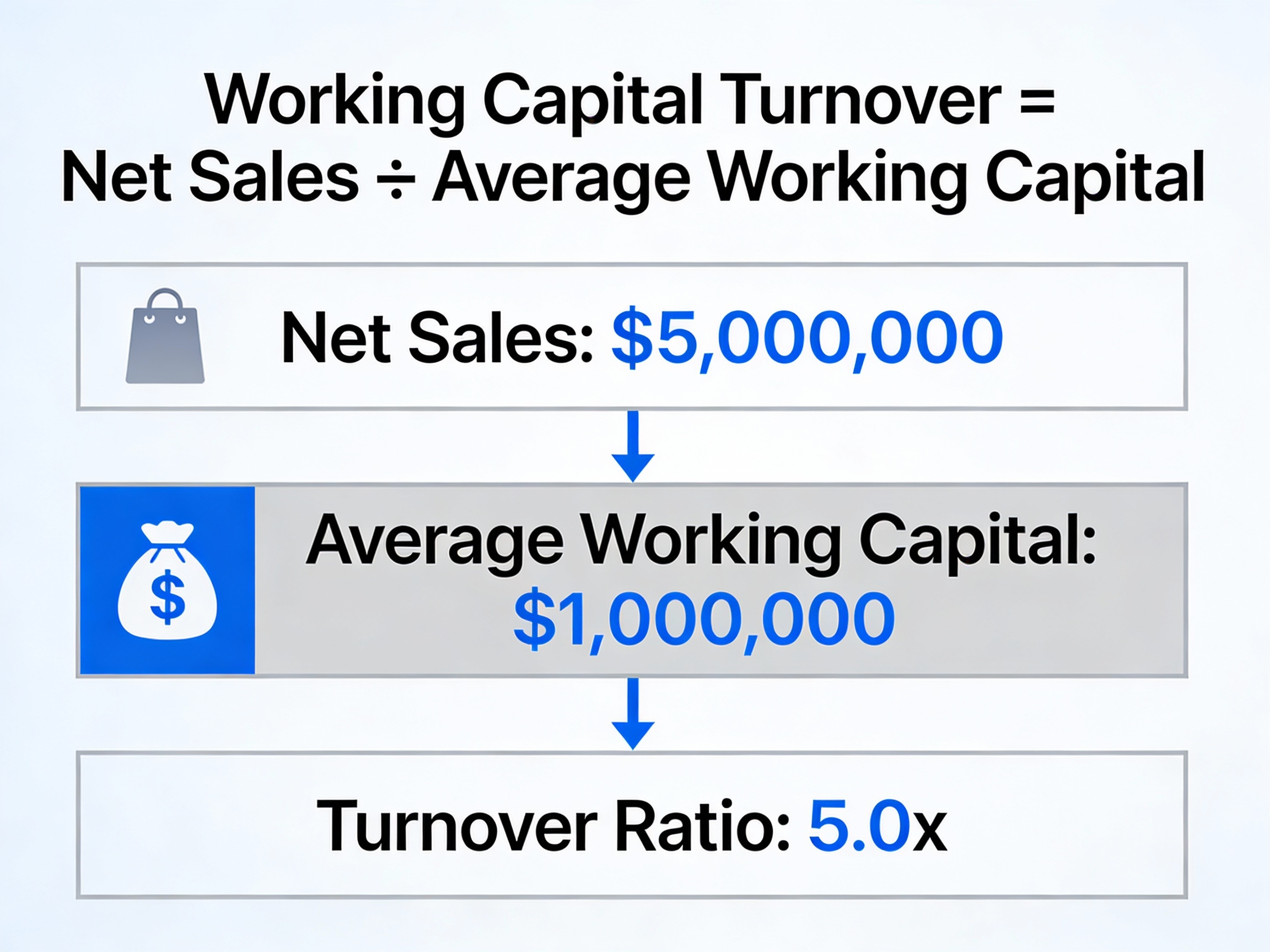

Working capital turnover quantifies how many dollars of revenue your business generates for every dollar invested in working capital. The standard formula divides net sales by average working capital, revealing whether your short-term assets are pulling their weight or sitting idle.

“Working capital turnover is one of the most revealing metrics for operational efficiency. It shows not just how much you’re selling, but how intelligently you’re deploying every dollar of capital.”

A ratio of 5.0, for example, means your business cycles through its working capital five times annually, generating five dollars in sales for every dollar of working capital deployed. Higher ratios indicate superior efficiency in converting operational assets into revenue, though context matters significantly across different industries and business models.

– How To Calculate The Operating Working Capital Turnover Ratio

The calculation begins with determining your net sales from the income statement for a specific period. Next, calculate working capital at both the beginning and end of that period by subtracting current liabilities from current assets.

Average working capital is derived by adding beginning and ending working capital, then dividing by two to smooth seasonal fluctuations. The formula is: Working Capital Turnover = Net Sales ÷ Average Working Capital.

Consider a business with annual net sales of $5,000,000 and average working capital of $1,000,000. The working capital turnover ratio equals 5.0x, indicating the company generated five dollars in revenue for each dollar of working capital deployed during the year.

– The Difference Between Total Working Capital And Operating Working Capital

Operating working capital focuses exclusively on assets and liabilities directly tied to business operations. This refined calculation excludes non-operating items like short-term debt, marketable securities, and dividendA portion of company earnings distributed to shareholders. payables that don’t drive core revenue generation.

Operating working capital typically comprises accounts receivable plus inventory minus accounts payable. This narrower definition provides a clearer picture of the capital efficiency in your business engine, removing financial engineering and focusing purely on operational velocity.

The operating formula becomes: Operating Working Capital = Operating Current Assets − Operating Current Liabilities. This distinction matters because it isolates the cash tied up specifically in your value creation cycle rather than mixing in treasury management decisions.

Why Efficiency Ratios Drive Enterprise Valuation

Capital efficiency directly correlates with enterprise value because it demonstrates management’s ability to extract maximum output from minimum input. Businesses that cycle working capital rapidly require less external financing, reducing cost of capital and improving return on invested capital—two factors heavily weighted in valuation multiples.

Investors and acquirers prioritize companies that can self-fund growth through operational excellence rather than constant capital raises. A strong turnover ratio signals operational discipline, pricing power, and effective resource allocation—all indicators of sustainable competitive advantage.

– Releasing Hidden Cash From Your Balance Sheet

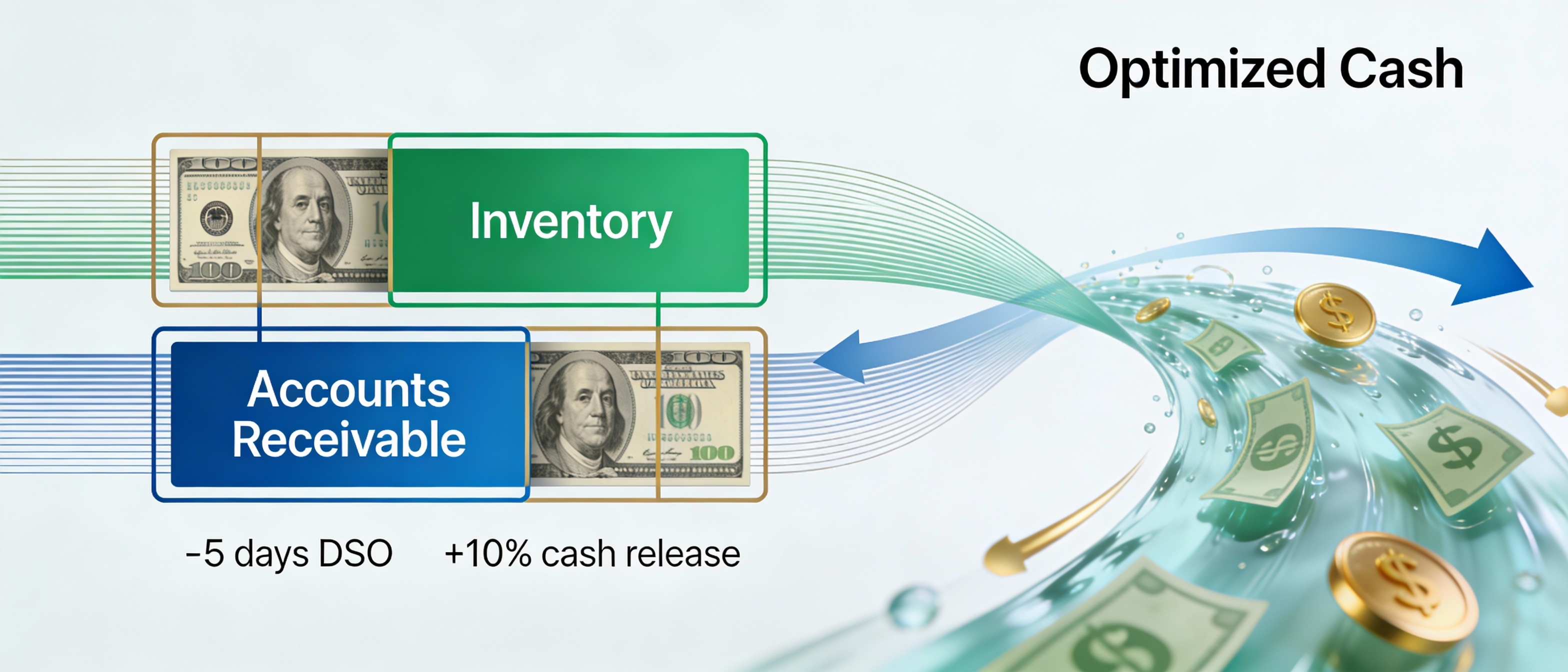

Working capital optimization functions as an internal line of credit without interest charges or covenantA condition or restriction placed on a borrower by a lender restrictions. By accelerating collections by just five days, a company with $10 million in annual receivables releases approximately $137,000 in cash—money that was already earned but trapped in the billing cycle.

“The average company can unlock between 5-10% of annual revenue in hidden working capital through systematic optimization of the cash conversion cycle.”

Similarly, reducing inventory days outstanding by 10% in a business carrying $2 million in stock frees up $200,000 that can be redeployed into growth initiatives, debt reduction, or operational buffer. These improvements compound over time, creating a self-reinforcing cycle of efficiency and liquidityThe ease with which assets can be converted into cash..

– The Real Cost Of A Slow Cash Conversion Cycle

The cash conversion cycle measures the number of days between paying suppliers and collecting from customers. Extended cycles force businesses to finance operations through debt or equity, incurring explicit costs in interest payments and implicit costs in ownership dilutionThe reduction in ownership percentage of existing shareholde.

A 90-day cash conversion cycle means you must finance three months of operations before seeing a dollar of cash return. For a business with $1 million in monthly operating expenses, this translates to permanently maintaining $3 million in working capital—capital that earns nothing while waiting to cycle through the business.

Industry benchmarks vary dramatically: food and beverage companies average 20-50 days, while pharmaceutical firms may extend to 100-150 days due to regulatory requirements and development timelines. Understanding your industry context prevents misguided optimization efforts that could damage operations.

Analyzing The Components Of The Turnover Engine

Three operational levers control working capital velocity: accounts receivable collection speed, inventory turnover rate, and accounts payable extension. Each component requires distinct strategies, but optimal performance emerges from synchronized management across all three dimensions.

– Optimizing Accounts Receivable To Accelerate Inflows

Days Sales Outstanding (DSO)The average number of days it takes for a company to collect measures the average time required to collect payment after a sale. Lower DSO directly improves cash conversion and reduces the capital requirement to sustain operations.

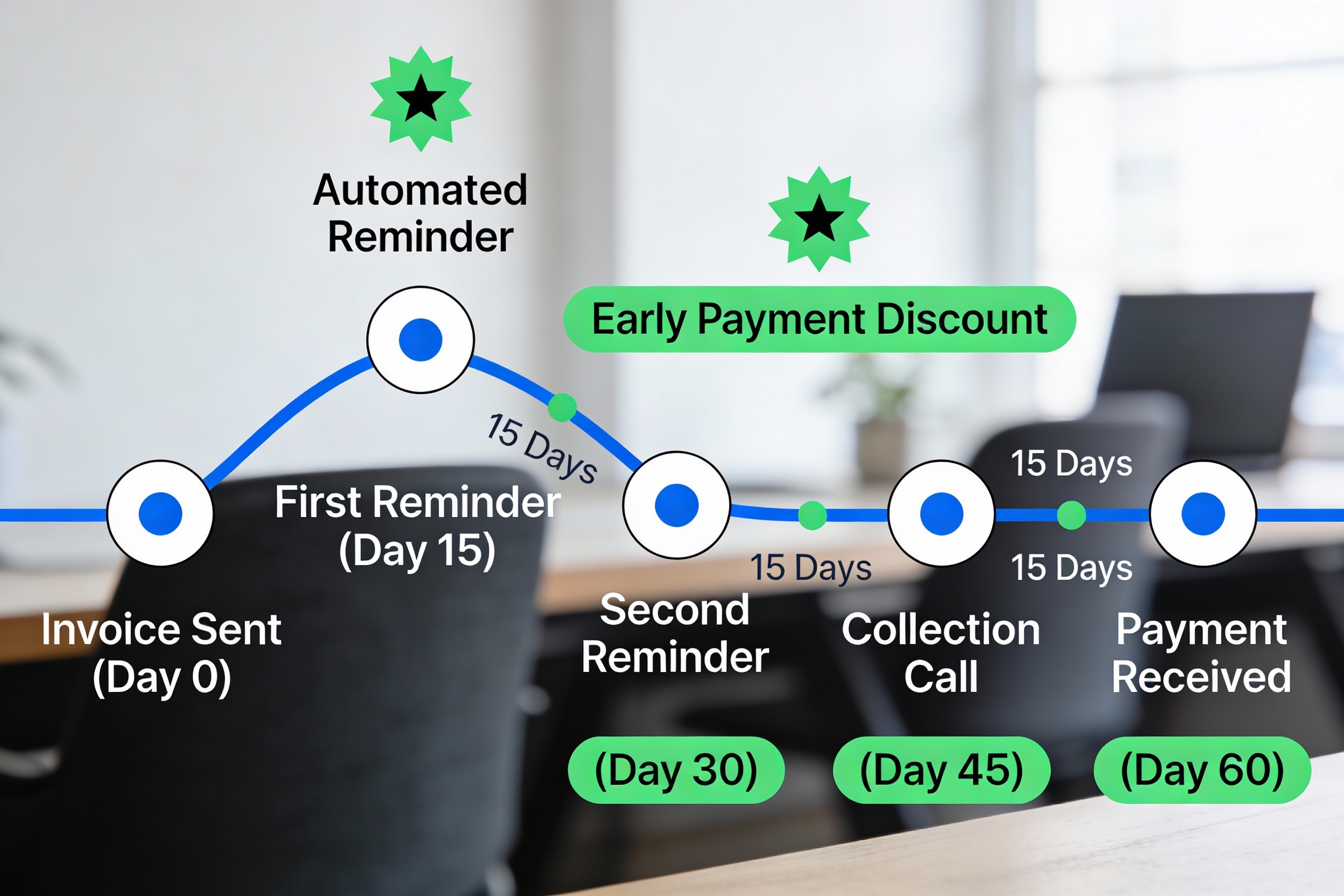

Practical optimization strategies include implementing automated invoicing systems that send bills within 24 hours of delivery, offering early payment discounts of 1-2% for settlement within 10 days, and establishing credit policies with clear payment terms communicated before engagement. Digital payment platforms reduce friction and accelerate collection by enabling one-click settlement.

For businesses with significant B2B sales, conducting quarterly credit reviews of major accounts prevents deteriorating payment patterns from becoming embedded problems. Segmenting customers by payment behavior allows you to adjust credit terms and collection intensity appropriately.

– Inventory Management Strategies For Higher Velocity

Days Inventory Outstanding (DIO) tracks how long products sit before sale. Excess inventory represents cash imprisoned on warehouse shelves, generating storage costs rather than returns.

“Every day your inventory sits unsold is a day your cash sits unproductive. The goal isn’t zero inventory—it’s optimal inventory that balances availability with capital efficiency.”

Demand forecasting systems powered by historical sales data and market signals reduce overstock situations while maintaining adequate safety stock. Just-in-time inventory methodologies minimize holding periods, though they require reliable supplier relationships and operational precision.

SKU rationalization—eliminating slow-moving products that generate minimal revenue but consume significant working capital—often yields immediate improvements. Products turning less than twice annually should face rigorous justification for continued inventory investment.

– Managing Accounts Payable Without Damaging Supplier Trust

Days Payables Outstanding (DPO) measures how long you take to pay suppliers. Extending DPO improves your cash position but must be balanced against supplier relationship preservation and potential early payment discount opportunities.

Strategic payables management involves negotiating payment terms that align with your cash cycle rather than arbitrarily delaying payments. Many suppliers offer 2/10 net 30 terms—a 2% discount for payment within 10 days—which represents an annualized return exceeding 36% if you have the cash available.

Centralizing payables through a procurement system enables you to capture early payment discounts where economically advantageous while extending terms on commoditized purchases where relationship dynamics matter less. Dynamic discounting programs allow flexible optimization based on current cash position.

Benchmarking Your Operational Performance

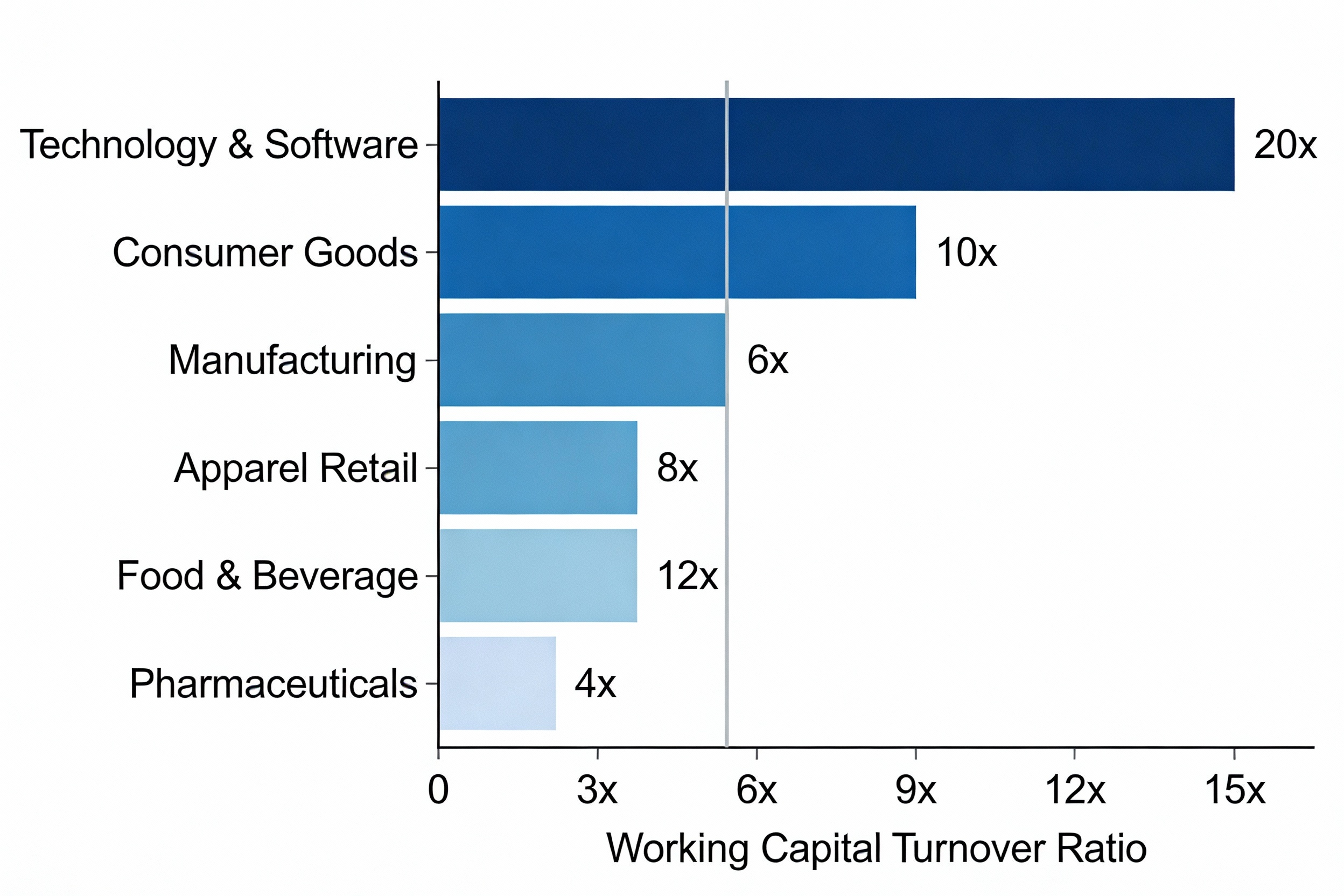

Absolute turnover ratios mean little without industry context. A ratio of 3.0x may indicate exceptional efficiency in capital-intensive manufacturing but signal operational weakness in professional services with minimal working capital requirements.

– Industry Standards For Turnover Ratios In 2026

Manufacturing firms typically maintain cash conversion cycles between 50-100 days due to raw material procurement, production lead times, and finished goods inventory requirements. Their working capital turnover ratios generally range from 4-8x depending on product complexity and customization levels.

Consumer goods companies achieve shorter cycles of 40-70 days through fast-moving products and favorable supplier payment terms, translating to turnover ratios of 6-12x. Apparel retailers operate in a 50-90 day range, though fast fashion models push toward the lower end through rapid inventory turns.

Technology and software businesses often achieve negative working capital—collecting from customers before paying suppliers and employees—resulting in exceptionally high or even negative turnover denominators that distort traditional ratio interpretation. Service businesses with minimal inventory may show ratios exceeding 20x.

– Red Flags Indicating A Liquidity Crisis

Deteriorating turnover ratios over consecutive periods signal operational breakdown even when top-line revenue grows. A declining ratio means you require more working capital to generate each dollar of sales—the opposite of scaling efficiency.

Warning signs include DSO increasing by more than 10% quarter-over-quarter, which suggests collection problems or customer credit quality deterioration. Inventory building faster than sales growth indicates demand forecasting failures or obsolescence issues requiring immediate intervention.

Cash conversion cycles extending beyond 90 days in industries with typical 45-60 day cycles indicate severe operational inefficiency or potential insolvencyA state where a borrower cannot pay debts as they become due risk. Businesses in this position often resort to expensive financing just to fund basic operations, creating a debt spiral that erodes profitability.

Practical Steps To Improve Your Turnover Efficiency

Sustainable improvement requires systematic intervention across people, processes, and technology. Ad hoc efforts yield temporary gains that revert under operational pressure without structural change.

– Implementing Automated Collection Systems

Automated accounts receivable platforms send payment reminders at predetermined intervals, escalating tone and urgency based on days past due. These systems remove the emotional discomfort of collection calls while ensuring consistent follow-up that human teams often deprioritize.

Integration with accounting systems enables real-time visibility into outstanding invoices, allowing finance teams to focus intervention efforts on high-value accounts rather than chasing small balances manually. Customer portals providing self-service access to invoices and payment history reduce inquiry volume while accelerating payment processing.

– Using Real Time Data For Lean Inventory Control

Cloud-based inventory management systems provide live visibility into stock levels, sales velocity, and reorder points across multiple locations. This transparency enables data-driven purchasing decisions rather than intuition-based ordering that typically results in overstocking.

Demand sensing algorithms analyze historical patterns, seasonality factors, and external market signals to generate accurate forecasts that minimize both stockouts and excess inventory. ABC classification systems prioritize management attention on high-value items that represent the majority of inventory investment while automating reordering for low-value commodities.

Vendor-managed inventory arrangements shift holding responsibility to suppliers who maintain consignment stock at your location, converting fixed inventory costs into variable expenses paid only upon consumption. This model dramatically reduces working capital requirements while ensuring product availability.

The Strategic Advantage Of Self Funded Growth

Businesses that master working capital turnover create a sustainable competitive moat through capital efficiency. They can underprice competitors while maintaining superior margins, invest in innovation without diluting ownership, and weather economic downturns with built-in liquidityThe ease with which assets can be converted into cash. buffers.

The compounding effect of efficiency improvements generates returns far exceeding their initial investment. A 10% reduction in cash conversion cycle might free up $500,000 in a mid-sized business—capital that can fund a new product line, geographic expansion, or strategic acquisition without touching external capital markets.

Financial independence translates to strategic flexibility. When opportunity emerges, efficient operators can move immediately while competitors scramble to secure financing. For businesses that do need external capital, understanding these metrics improves access to working capital solutions and short-term working capital loans on more favorable terms.

Working capital optimization represents the intersection of operational excellence and financial strategy. Whether you’re managing permanent fixed working capital needs or addressing the fundamental need for working capital, treating cash velocity as a core performance metric alongside revenue and margin transforms businesses from capital consumers into capital generators—a fundamental shift that redefines growth potential and enterprise value.

Frequently Asked Questions

What is a good operating working capital turnover ratio?

A good operating working capital turnover ratio varies by industry. Generally, ratios between 4-8x are considered healthy for manufacturing, while consumer goods companies may achieve 6-12x. Technology and service businesses often exceed 20x. Context matters more than absolute numbers—compare your ratio to industry benchmarks and track trends over time.

How does operating working capital differ from total working capital?

Operating working capital focuses exclusively on assets and liabilities directly tied to business operations (accounts receivable + inventory – accounts payable), excluding non-operating items like short-term debt, marketable securities, and dividendA portion of company earnings distributed to shareholders. payables. This provides a clearer picture of capital efficiency in your core business operations.

Can a working capital turnover ratio be too high?

Yes, an excessively high ratio may indicate you’re under-stocking inventory, which could lead to stockouts and lost sales, or implementing overly strict credit policies that damage customer relationships. The goal is optimization, not maximization—balance efficiency with operational effectiveness.

How can I improve my working capital turnover ratio?

Improve your ratio by accelerating accounts receivable collection through automated invoicing and payment reminders, optimizing inventory levels using demand forecasting and SKU rationalization, and strategically managing accounts payable by negotiating better terms and capturing early payment discounts where beneficial.

What is the cash conversion cycle and how does it relate to working capital turnover?

The cash conversion cycle measures the number of days between paying suppliers and collecting from customers. It directly impacts working capital turnover—shorter cycles mean you need less working capital to generate the same revenue, resulting in higher turnover ratios and better capital efficiency.

Related Articles You May Find Helpful

References & Sources

- Float Financial. (2025). Calculate Working Capital Turnover for Business Success

- Stripe Resources. (2025). Working Capital Formulas: A Guide for Businesses

- Flexiloans. (2025). How to Calculate Working Capital Turnover Ratio

- GTreasury. (2025). Working Capital Metrics

- Ramp. (2025). Cash Conversion Cycle: Formula, Examples & Benchmarks

- VJM Global. (2025). How to Calculate Operating Working Capital

- CFO Perspective. (2025). How to Measure and Monitor Your Working Capital

- MetricHQ. (2025). Cash Conversion Cycle (CCC)